When debt wins

News

|

Posted 27/06/2014

|

3281

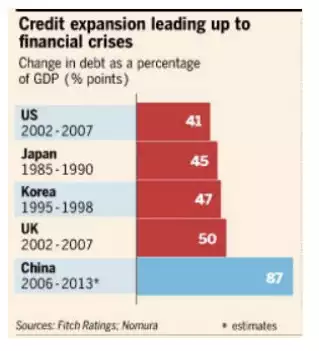

The graph below illustrates the extent to which debt blew out in the countries largely responsible for the last few crashes…and then the extent of what China has racked up of late. Standard & Poor’s latest research has China now as having the world’s highest amount of corporate debt but with cashflows that don’t support it and make it the most risky. Just as Japan seemed unstoppable in the late 80’s everyone seems to think China can keep posting 7+% GDP figures infinitum. (though Japan is winning the world race of total debt to GDP at the moment so stay tuned on that one too….). The problem this time will be the ever increasing inter-connectedness of the global economy and how catastrophic a Chinese collapse would be on the world (and especially Australia). Vern Gowdie puts it well:

“So who’s going to hit the wall of reality first — Japan, China, the US or one of the Euro basket cases? No one knows. But what we do know is that no country, company or individual in the history of money has ever been able to accumulate debt indefinitely. There has always been and there will always be a day of reckoning. This is the bitter reality that faces us after three sweet decades of debt indulgence.”