What Headwinds Crypto Faces

News

|

Posted 22/02/2022

|

6255

Bitcoin markets have continued to struggle, with prices trading down from the weekly high of $44,659 US, and closing below the psychological $40k support level. Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.

As the prevailing downtrend deepens, the probability of a more sustained bear market can also be expected to increase, as recency bias and the magnitude of investor losses weighs on sentiment. The longer that investors are underwater on their position and the further they fall into an unrealised loss, the more likely those held coins will be spent and sold.

One of the distinct signals of bearish Bitcoin markets is a lack of on-chain activity. This can be identified using tools such as Active Addresses/Entities as a proxy for users, or via block space demand metrics such as Transaction Counts, and On-chain Fees spent as users bid for inclusion in the next block.

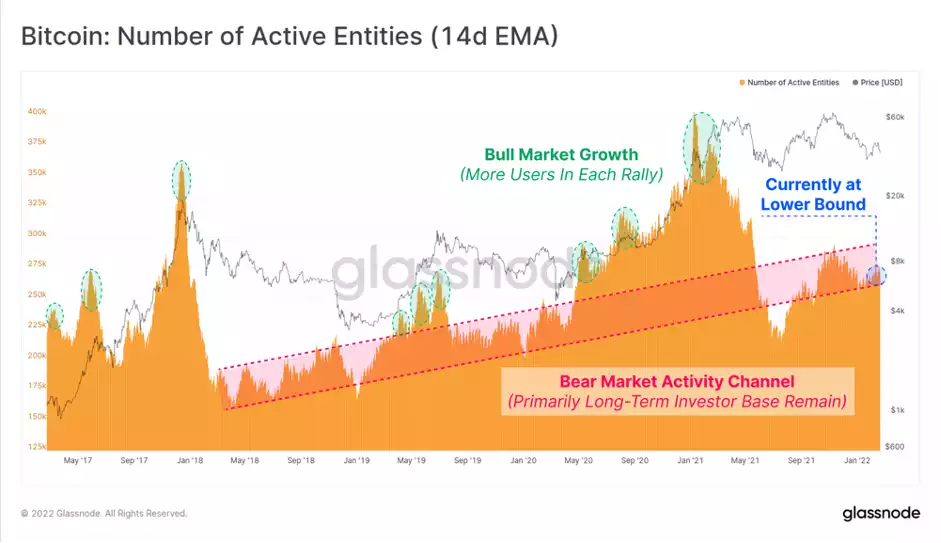

The chart below presents the number of Active Entities using the Bitcoin network over the last 5 years

- Bull markets can be identified as periods of growing demand from users, typically with an increasing number of active entities during each subsequent bullish impulse (net user growth).

- Bear markets are characterised as periods of relatively low network activity, and diminished interest from retail marked out in the red channel below. The lower bound of this channel has historically increased in a near-linear fashion, suggesting that the pool of dependable Bitcoin users (the HODLers) is still growing over the long term.

This week however the degree of on-chain activity is languishing at the lower bound of the bear market channel, which can hardly be interpreted as a signal of increased interest and demand for the asset.

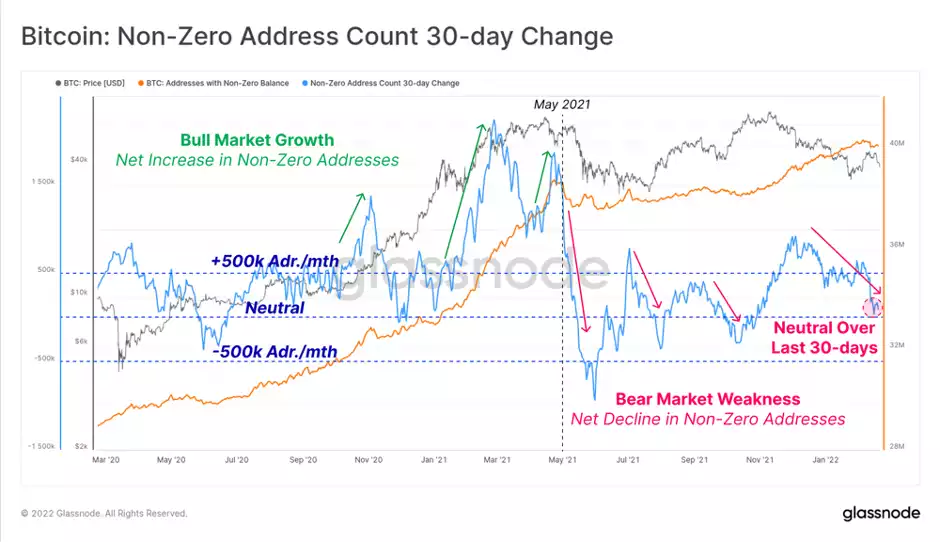

Supporting this observation is the 30-day change in non-zero balance addresses. Periods of high demand and supply accumulation are usually accompanied by an increase in UTXO creation, and growth in non-zero address counts (and vice-versa).

Whilst the macro trend in non-zero balance address creation is upwards, over the last 30-days, there has been a softening of the trend. This is the result of some investors emptying their address balances completely. Over the last month, around 219k addresses (0.54% of the total) have been emptied.

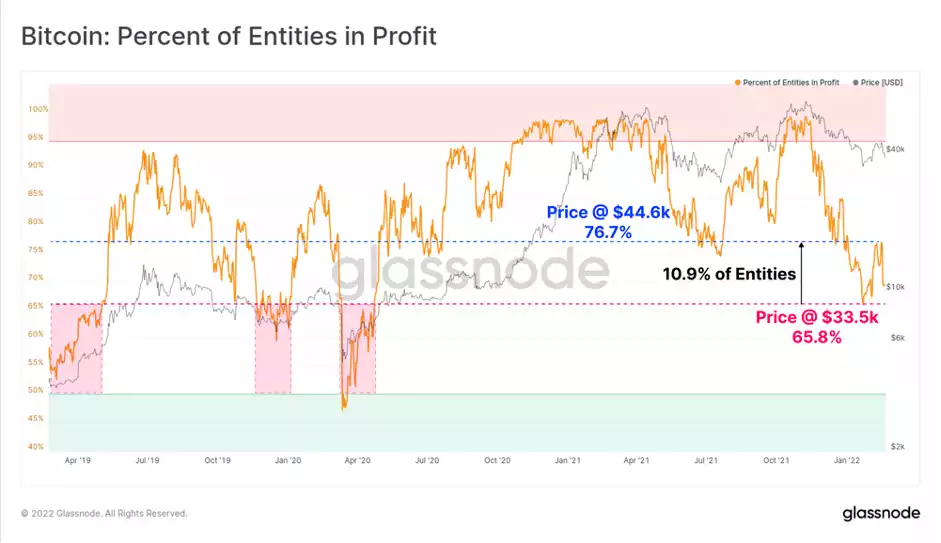

A probable cause for this spending behaviour is associated with the financial cost and psychological pain of holding an underwater investment. We can see in the chart below that the proportion of on-chain entities in profit is oscillating between 65.78% and 76.7% of the network.

The flip side of this observation is that more than a quarter of all network entities are now underwater in their position. Furthermore, approximately 10.9% of the network has a cost basis between $33.5k and $44.6k, with many of them purchasing in recent weeks. If the market fails to establish a sustainable uptrend, these users are statistically the most likely to become yet another source of sell-side pressure, especially if price trades below their cost basis.

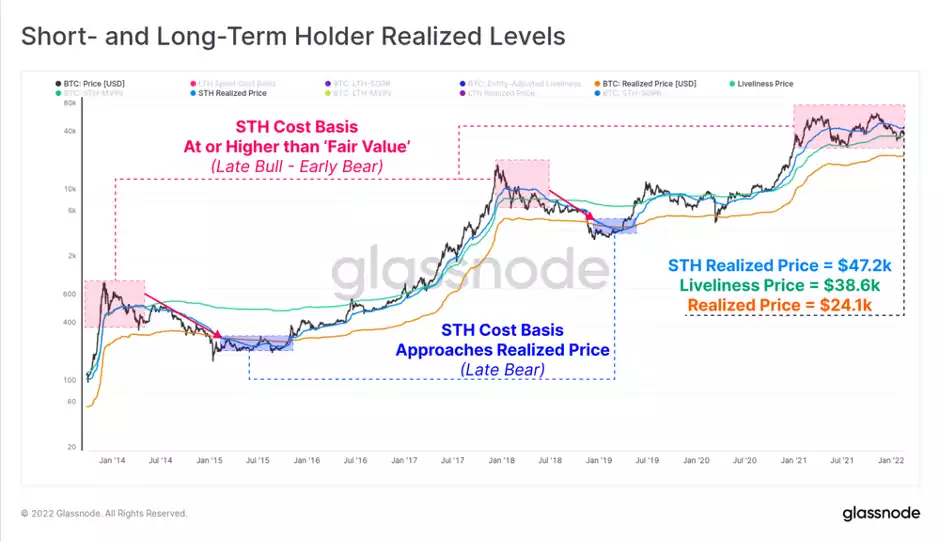

As a gauge of just how underwater Short-Term Holders are, we can calculate the STH Realised Price (aggregate cost basis) by dividing the price by the STH-MVRV Ratio (result in blue). This indicates that STHs have an average on-chain cost basis of $47.2k, which equates to an average unrealised loss of -19.3%.

Furthermore, the STH realised price is currently trading above the Liveliness Price ($38.6k) which reflects an estimate of 'HODLer Fair Value'. In both the 2013-14, and 2018 bear markets, when STHs hold coins well above this fair value estimate, it has signalled that the bearish trend has some time left in it to reestablish a price floor.

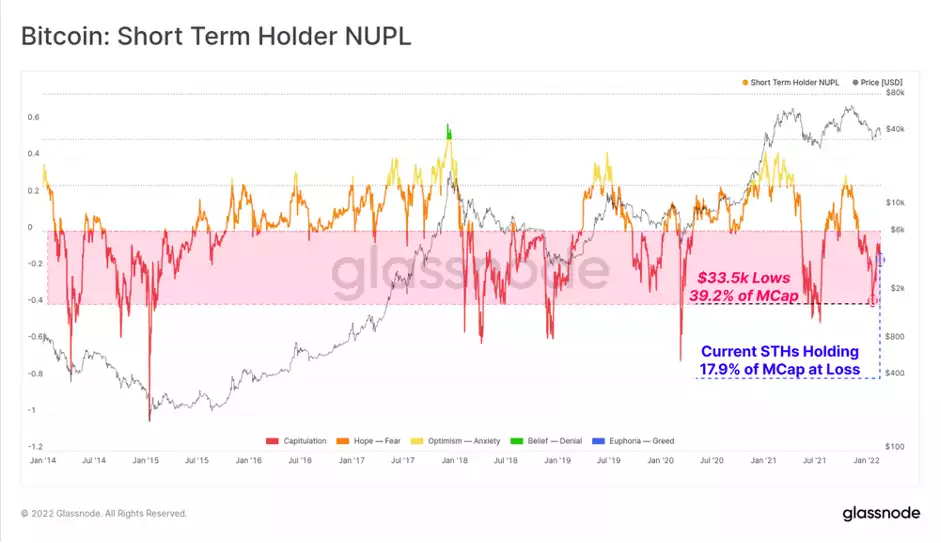

The STH-NUPL metric presents the magnitude of losses held by these Short-Term holders in proportion to the Bitcoin Market Cap. Here we can see that STHs have been underwater, in aggregate, since 4-Dec-2021. The total unrealised losses held by STHs is currently equal to 17.9% of Bitcoin's Market Cap.

At the recent price lows of $33.5k, STH-NUPL reached -39.2%, a level of extremely poor supply profitability, and a level that is rarely exceeded outside the deepest of selloffs during bear markets. STHs have held coins at a loss for over 2 months now, which could be argued to be a sign of resilience but should equally be considered a probable source of overhead resistance.

Overall, the Bitcoin market has numerous bearish headwinds in play, ranging from very weak on-chain activity (a proxy for demand) to large volumes of supply held at a loss (potential sell-side). With a total of 4.70M BTC currently underwater, and 54.5% of it held by STHs who are statistically more likely to spend it, the bulls certainly have their work cut out for them.

However, despite the prevailing drawdown that has been in play for over three months, the underlying supply dynamics remain markedly more constructive than previous bears. Bitcoin investors appear far more likely to hold on for dear life (HODL) and use derivatives to hedge risk, rather than selling spot to reduce exposure.