US Twin Deficit Hits 25% of GDP!

News

|

Posted 07/05/2021

|

6528

The following charts from Crescat paint a salient reminder of the trap the US Fed find themselves in. Real inflation is coming but deficit spending is at an all time high and can’t handle higher rates.

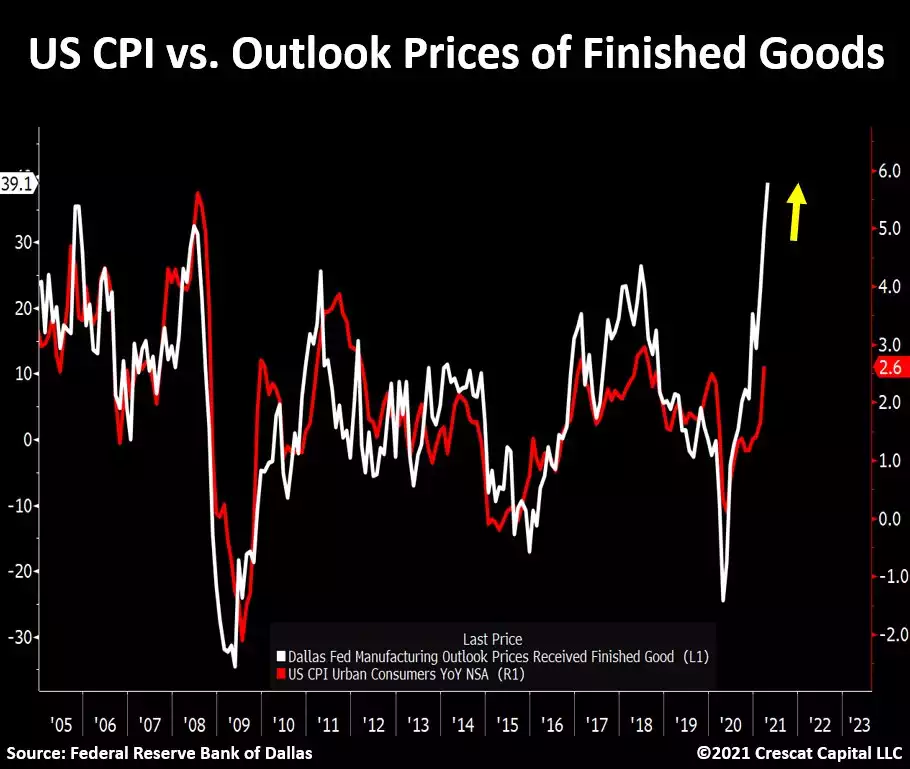

The recent Dallas Fed Manufacturing Survey highlighted the real inflationary pressures at the coal face. The first chart below shows the outlook for prices of received finished goods which just surged to an all time high in April shown in white. The official CPI chart up to March is then overlaid in red and shows a much hotter than expected CPI print is likely before us.

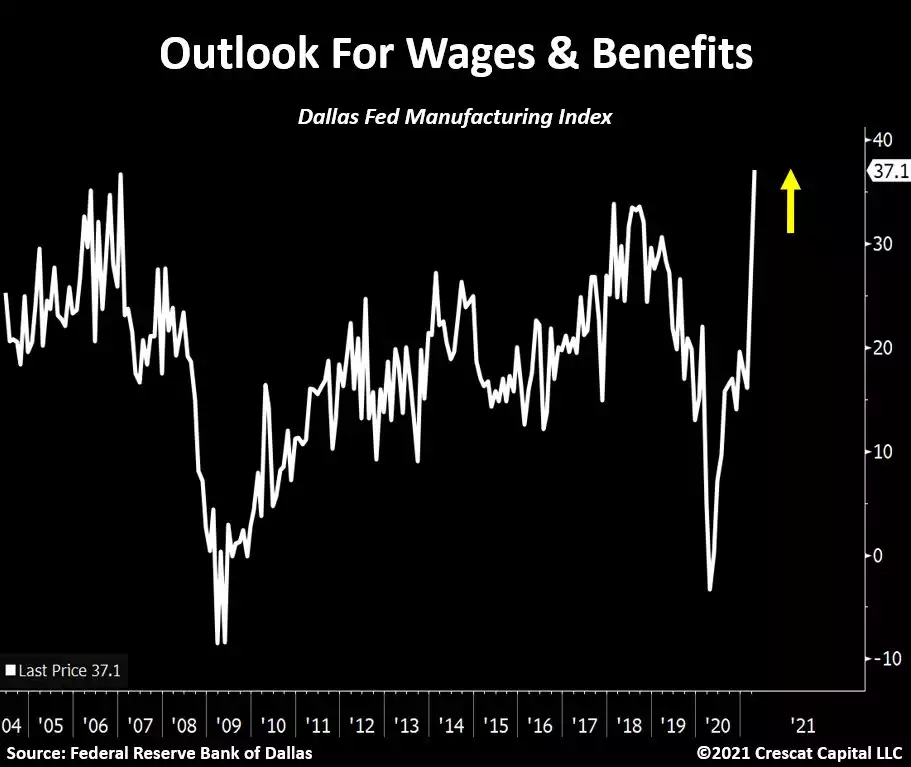

Paradoxically, when last night we saw US jobless numbers swell to 8m higher than pre COVID, the report talks to the largest 2 month increase in wages outlook in history. Why? This maybe talks again to the K shaped recovery where COVID affected industries continue to struggle but sectors in the reflation arena are going gangbusters off cheap debt.

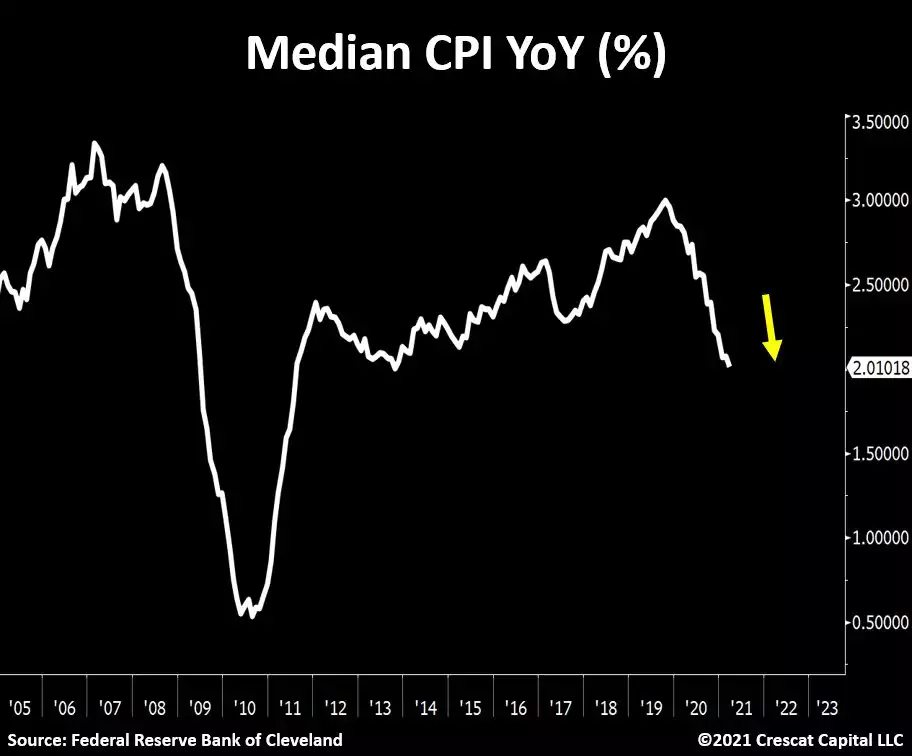

The Fed knows the system can’t handle higher rates. Just yesterday we wrote of the market panic on Janet Yellen even hinting at rises in rates. The easiest way to maintain calm and control is to reinforce ‘everything is awesome’ and ‘nothing to see here’. Below is the Fed’s own calculation of inflation sitting at a 7 year low… Clearly no need to be raising rates, huh?

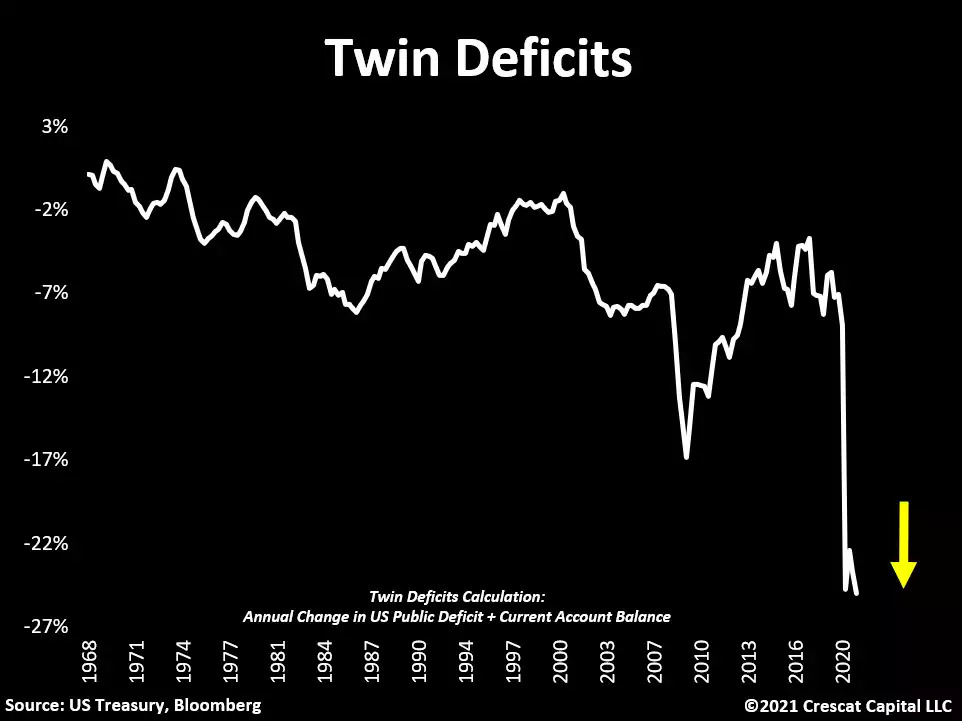

And to highlight the sheer magnitude of what is before the Fed to control, the chart below maps the so called ‘twin deficits’ of the US public deficit (funding Biden’s stimulus packages on top of the perpetual deficits for social and medical welfare etc) and the Current Account Deficit. The latter just 2 days ago hit an all time record high of $74.4 billion in March, worse then last month’s all time record of $71.1 billion.

And so the US is amassing more and more debt to keep the ship going (whilst sinking it deeper and deeper with debt) and buying $70-odd billion more than she sells every month. As the author Otavio Costa tweeted to the above chart:

“How in the world can the Fed reverse its monetary policy when the US twin deficit is 25% of GDP.......”

Indeed. Reality eventually always catches up.