US Shares v Gold

News

|

Posted 03/06/2015

|

5270

Lets compare very succinctly the stark difference between what’s going on in the world’s largest sharemarket to the world’s largest gold markets:

Goldman Sach's chief equity strategist, David Kostin had this to say to clients this week - "by almost any measure, US equity valuations look expensive. The typical stock in the S&P 500 trades at 18.1x forward earnings, ranking at the 98th percentile of historical valuation since 1976. For the overall index, the aggregate forward P/E multiple equals 17.2x, a rise of 63% since September 2011, compared with the median expansion of 48% during 9 previous P/E expansion cycles. Financial metrics such as EV/EBITDA, EV/Sales, and P/B also suggest that US stocks have stretched valuations. With tightening on the horizon, the P/E expansion phase of the current bull market is behind us."

These sentiments take on greater weight when last week Nobel prize winner Robert Shiller, and co author of the now universally accept Shiller Index, said that in his opinion, unlike 1929 (pre Great Depression), this time everything - stocks, bonds and housing - was overvalued as all assets were in bubble like conditions after all the stimulus since the GFC.

Throw in as well that margin debt on these shares just hit a new all time high of $507 billion or 50% higher than the last bubble peak reached JUST before the GFC.

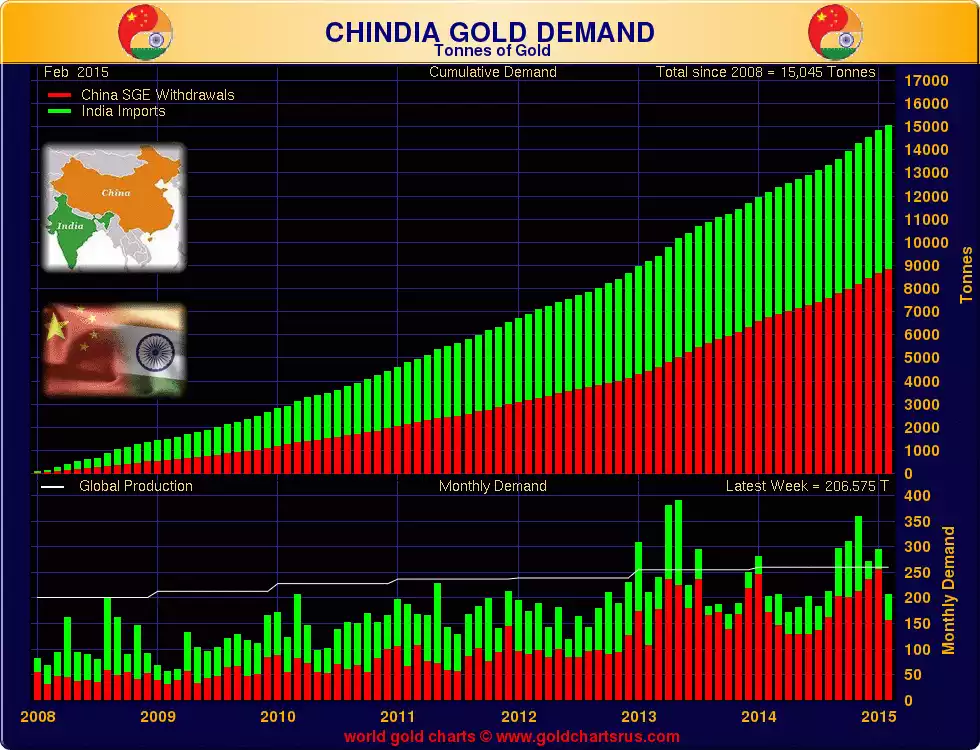

Now compare that to what the world’s 2 most populous countries are doing in the graph below and, critically, note the white/grey line in the bottom section to see of late on average they are consuming basically ALL of global production.

Which of these 2 markets looks to be better value?