US loses $1.2 trillion in a good year!

News

|

Posted 01/03/2018

|

8144

Following on from yesterday’s report where the new chair of the US Fed warned of the unsustainable levels of US debt, we today discuss the whopping $1.2 trillion loss the US Treasury Secretary has publically reported in their official Financial Report for the 2017 financial year.

For context, that loss of $1.2 trillion is larger than the size of the entire Australian economy!

What is absolutely outstanding about this figure is that for all intents and purposes 2017 was in fact a good year. There wasn’t a recession, a major war, nor a financial crisis and indeed the Fed was talking up the economic growth and raising rates. Yet despite that, the land of the endless money printing machine still managed to have a NET LOSS for the year.

No wonder the new Fed chair is saying that the US Debt levels are unsustainable. If there is a loss of these proportions in a good year, what on earth are the losses going to be like when the ‘everything bubble’ bursts and we have the inevitable bad year/s? Let’s acknowledge too that Governments have a proven track record of making more bullish assumptions than what normally transpires.

The overall picture gets even more interesting though as you move through the financial report (summary below). Taking a look at the US’s actual net worth, it is an unbelievably dismal MINUS $20.4 trillion. As you know, to calculate net worth, just the same as if we were to calculate our own net worth, we take all the assets that we own such as our house, car, bullion etc then subtract liabilities such as our mortgage, car loan and credit card debt. The resulting figure is our net worth.

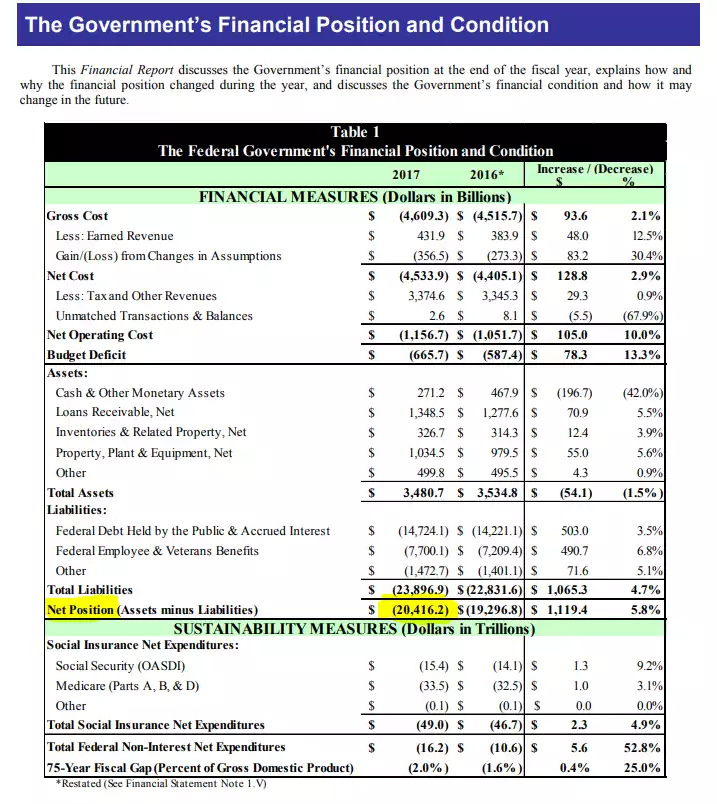

It is exactly the same principle to calculate the net worth of a business or in this case the US Government. As per below, which is “The Federal Government’s Financial Position and Condition”, an extract from the US 2017FY Financial Report, you can see that even with the US holding assets to the value of $3.4 trillion, their liabilities are over 6X that value, at the sum of $23.8 trillion. With the difference being a negative net worth for the US of MINUS $20.4 trillion. You can also see from the report that this figure has grown worse from the 2016 financial year – in fact the US government’s net worth has gone backwards by 5.8%.

Now let’s get to the ‘Sustainability Measures’. You may recall an article we penned earlier last year about ‘Unfunded Liabilities’. That $49 trillion is the present value of future and very real liabilities of social welfare and Medicare. So, the combined position of the USA is nearly $70 trillion in the red or around $580,000 per US tax payer. That $70 trillion is at odds with the $105 trillion in that article (and now $112 trillion http://usdebtclock.org/) but on either account it is simply shocking.

It is truly remarkable that these results are not making headlines in the mainstream media.

We recommend you go back and read that previous article (here) but if you don’t have time let us repeat this one quote from the Austrian economist Ludwig von Mises

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”