US Debt Ceiling or Debt Target?

News

|

Posted 24/03/2017

|

8474

With very little press or fanfare, on Wednesday, the temporary suspension of the debt ceiling negotiated by Obama just 16 months ago ended. No one probably thought it possible they could add $1.4 trillion in just that time but they did and now the US government is unable to go into any more debt until the debt ceiling is raised. The so called “emergency measures” accounting tricks can buy them some months but already, the U.S. Treasury has less cash on hand than Apple or Google.

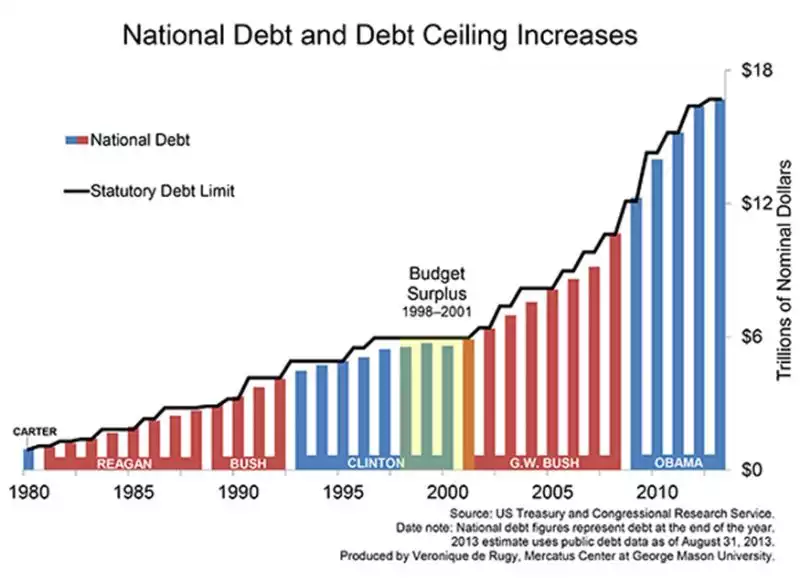

Trump’s first budget, for all its headline grabbing cuts, included big increases in defence and still presents a deficit and hence more debt. That’s not a new thing however… the US has run continual deficits since 1969. The graph below shows the lead up to the now famous 2013 debt ceiling fiasco that saw government employees go unpaid, offices shut down and credit agencies downgrade the biggest economy in the world. That graph indicates that Clinton delivered a surplus but there is debate this was courtesy of some clever accounting shuffling and was still in deficit in real, conventional terms. Either way it is a small blip on what has been a staggering story of borrowing today at the expense of future generations, future generations that will at some stage wear the day of reckoning.

From Bloomberg:

“Euphoria has been pervasive in the stock market since the election. But investors seem to be overlooking the risk of a U.S. government default resulting from a failure by Congress to raise the debt ceiling. The possibility is greater than anyone seems to realize, even with a supposedly unified government.

In particular, the markets seem to be ignoring two vital numbers, which together could have profound consequences for global markets: 218 and $189 billion. In order to raise or suspend the debt ceiling, 218 votes are needed in the House of Representatives. The Treasury’s cash balance will need to last until this happens, or the U.S. will default.

The opening cash balance this month was $189 billion, and Treasury is burning an average of $2 billion per day – with the ability to issue new debt. Net redemptions of existing debt not held by the government are running north of $100 billion a month. Treasury Secretary Steven Mnuchin has acknowledged the coming deadline, encouraging Congress last week to raise the limit immediately.”

After the argy bargy we saw last night with the far right Freedom Caucus over the healthcare bill, that 218 votes is by no means a done deal. Republicans control 237 seats in the house and the Freedom Caucus numbers 29, that leaves 208 for the mathematically challenged…

In 2013 the government had to decide on paying interest on their enormous debt pile or their workers. With credit ratings at stake they chose the former. That interest bill is far bigger now with around $3.6 trillion MORE debt since 2013.

Trump’s love of tweets means we can be reminded of his position in the 2013 debt ceiling debate when he tweeted “I cannot believe the Republicans are extending the debt ceiling — I am a Republican & I am embarrassed!” It will be interesting to see his reconciliation of that in a couple of months time when his government runs out of money…

Everyone seems to love Obama. He was charismatic to be sure, but he also accumulated a staggering amount of debt delivering record level deficits buying such popularity. I have no doubt I would be enormously popular with my friends if I borrowed heaps and lavished them with goodies. I would however leave my kids with a debt bill that may well see them homeless on the streets. In its very essence this is what governments are doing to us all now. But don’t expect it to stop until it’s out of their control.

I read once “The debt ceiling should be called the debt target, and they hit it every single time.”