Transitioning to a new monetary system

News

|

Posted 19/04/2018

|

7431

Cryptos continue to appear to be top of mind for IMF (International Monetary Fund) Chief Christine Lagarde with her last 2 blog posts having been dedicated to cryptocurrencies.

Let’s take a look at the two main benefits highlighted by Lagarde in her blog.

Fast and inexpensive financial transactions

As anyone who has transacted with a cryptocurrency knows, transfers are usually extremely fast and relatively inexpensive (except of course when BTC reached capacity late last year and both transaction times and transfer fees increased). When you make a payment it is pretty much instantaneous and most certainly same day. The receiver of the payment certainly does not need to wait until the next business day to see the funds in their account or wallet which is still most often the case here in Australia with domestic internet banking transfers. Could cryptos and the potential disruption they represent to the banking monopoly be the reason for the new Pay ID system which has been introduced this year?

Overseas transfers is where the real magic of cryptos comes into play and Lagarde makes mention of this as well, “some payment services now make overseas transfers in a matter of hours, not days”. The use of cryptocurrencies truly makes for a borderless world without draconian intermediaries imposing hefty fees and time constraints. International trade and global expansion will become more affordable and within reach of many more businesses as mainstream adoption of cryptocurrencies continues.

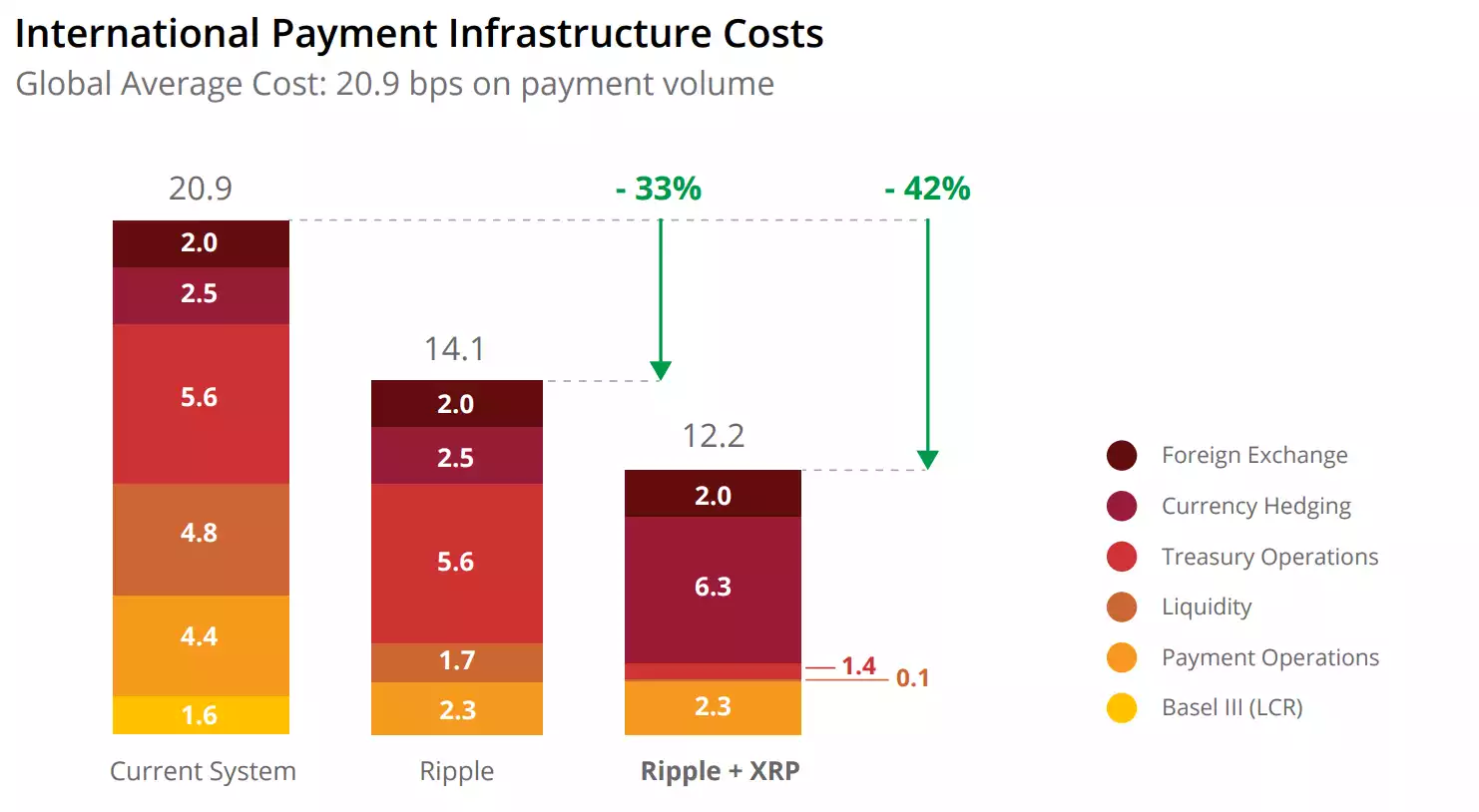

Looking at the leader in the space, Ripple, and you can see the benefits are not just time but also cost:

A better balance for the financial ecosystem

Christine Lagarde’s next major benefit highlighted in her blog relates to the potential of cryptocurrencies bringing about a balance in the financial landscape. While Lagarde does not believe the fintech revolution will completely eliminate the need for trusted intermediaries such as brokers and banks, she does highlight, ‘there is hope, however, that decentralised applications spurred by crypto-assets will lead to a diversification of the financial landscape, a better balance between centralised and decentralised service providers, and a financial ecosystem that is more efficient and potentially more robust in resisting threats.’

Competition in the financial arena will certainly provide a more level playing field and is definitely not a bad outcome for the whole of the financial system especially given the findings of the Royal Commission into Banking that is currently underway.

As Christine Lagarde, IMF Chief quite aptly states, ‘Just as a few technologies that emerged from the dot-com era have transformed our lives, the crypto-assets that survive could have a significant impact on how we save, invest and pay our bills.’

Revolutions of any kind are not without fear, uncertainty, doubt and a certain level of turmoil, and this current Financial Revolution and transition of our monetary system that we are living through is no exception.

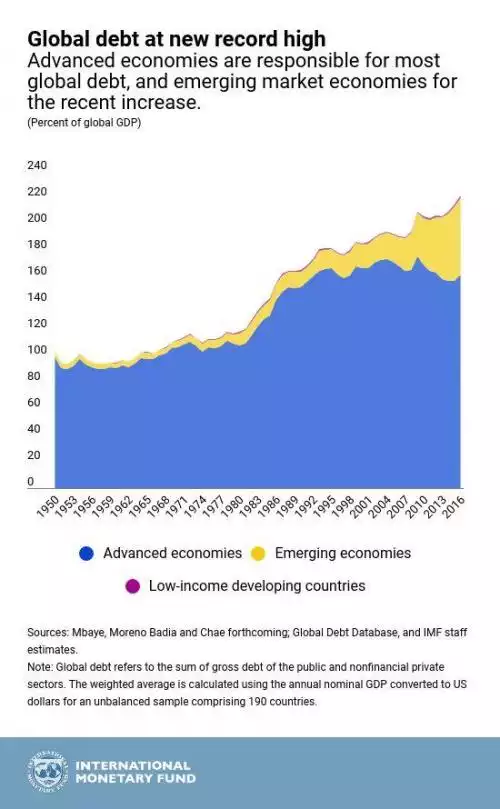

Topically, the IMF also just yesterday released a new report on their mounting concerns on global debt. Public plus private debt, as a percentage of GDP are now higher than the peak triggering the GFC and the cost of servicing that public debt alone has doubled in just the last 10 years to be 20% of taxes! The graph below shows this public plus private global debt is now at 225%. Is it any wonder more people are looking to store their wealth outside this credit based monetary system….