Too Big To Fail

News

|

Posted 06/08/2014

|

5055

TBTF – the acronym at the heart of the systemic risk of global economic meltdown. In the week that saw Portugal’s central bank take control of the failed Banco Espirito Santo’s assets and deposit-taking operations with a “loan” (bail out) of $6.6 billion we now see US regulators reject their big bank’s “Living Wills”. Living Wills are supposed demonstrate how any one of them can fail without bringing down broad economic failure or the need for tax payer funded bail outs as we saw in the GFC and again this week in Portugal. In response to examining 11 banks with assets over $250b each, via the Wall Street Journal the FDIC said “Despite the thousands of pages of material these firms submitted, the plans provide no credible or clear path through bankruptcy that doesn't require unrealistic assumptions and direct or indirect public support,”. The FDIC has given these banks until July 2015 to improve their plans.

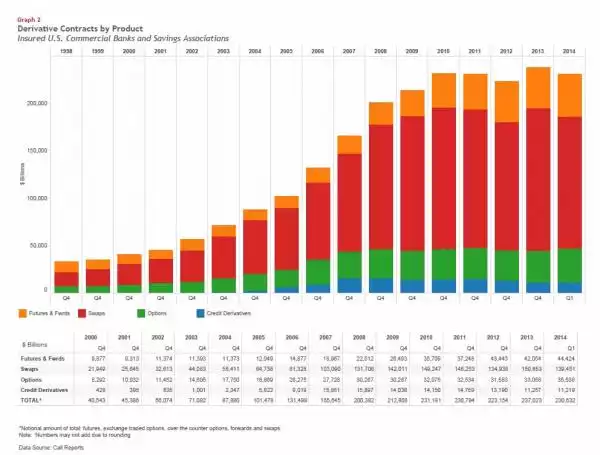

What makes this particularly scary are the following 2 graphs courtesy of Zero Hedge. The first shows no less than $230 trillion in derivatives exposure by the banks. The second shows just 4 hold $213t of that! No “Living Will” or bail-in will cover the domino effect just one of these failing will cause.

Think we are immune in Australia? If you are wondering how the major banks are offering these new cheap 5 year fixed rates when our cash rate is unchanged, you may be surprised (shocked/scared) to know it is through accessing cheap funds from overseas banks. We are as linked into this mess as anyone…