Tick Tock The Leverage Clock

News

|

Posted 11/11/2016

|

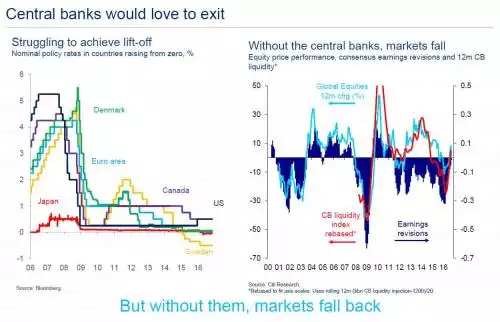

7240

Sharemarkets surged higher again last night. Optimism rules on Trump promises of fiscal stimulus. The world has lived under central bank created monetary stimulus since the GFC with terrible results so let’s rejoice this new approach!…. Fiscal stimulus is fancy speak for spending lots of government money on things like infrastructure and, say, big walls etc. The problem is the US already has massive deficits and this new big spend is going to coincide with lower tax income on promised broad based tax cuts. As we discussed in today’s Weekly Wrap this ordinarily sees inflation and rates rise and Ray Dalio, the head of the world’s largest hedge fund and twice Forbes’ 100 most influential people, says it will be this mix of even higher debt and higher rates that will cause the financial crash.

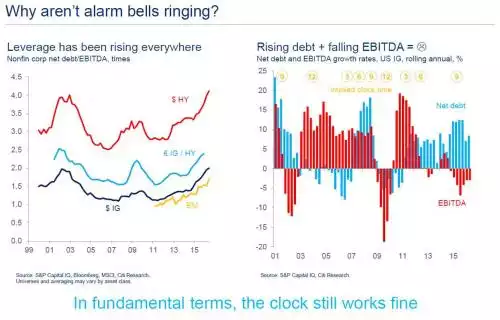

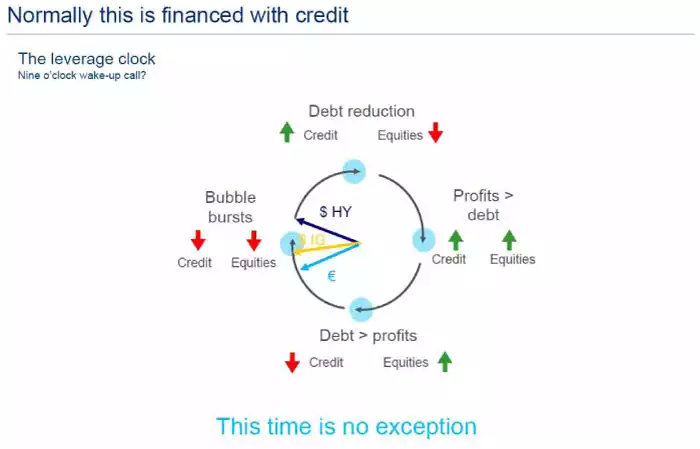

That monetary stimulus to date has already set up a scary situation. CitiBank just released a report showing the effects.

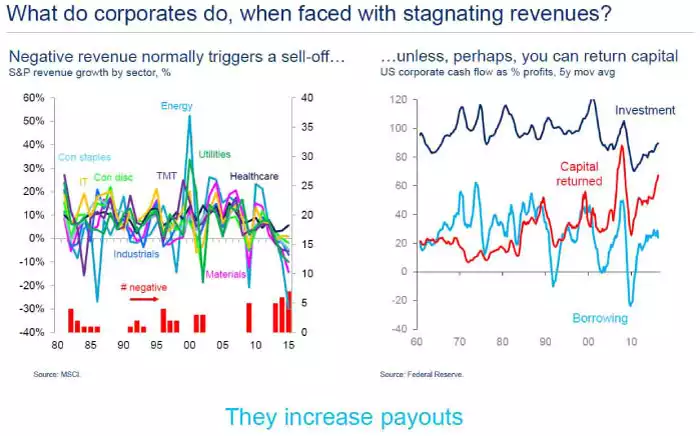

To date companies have propped up their shares through share buy backs or paying dividends to improve yields (when the bank and gold gives you nothing) by borrowing at these record low interest rates to do so. The 2 charts below paint a very clear picture when you consider the timing of the last financial crashes. i.e. they are borrowing more to avoid a crash that would have, and previously has, happened on fundamentals: