The State of Crypto Adoption

News

|

Posted 16/06/2020

|

25905

Last night Crypto.com released a research report into the state of adoption for the crypto market. Here are some of the findings, giving expert insight into the progression of the market into mass adoption.

Crypto faces 5 adoption barriers, namely:

- Unclear use cases;

- Lack of use options;

- Fees/speed;

- Ease of use;

- Negative stigma;

To set the tone on where the current user base of crypto sits, here are a few survey results and an outline on the current ecosystem:

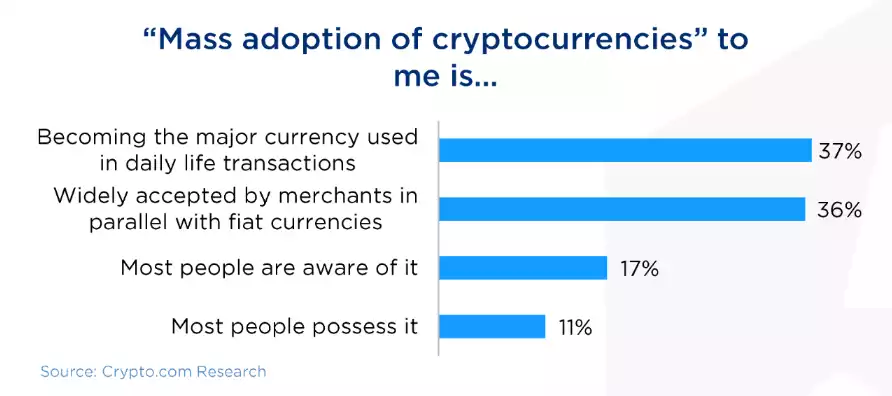

Crypto.com surveyed its users and found that most respondents believed that “Mass adoption of cryptocurrencies” means that it should be in some way used as a currency for daily transactions. The results of their survey are below:

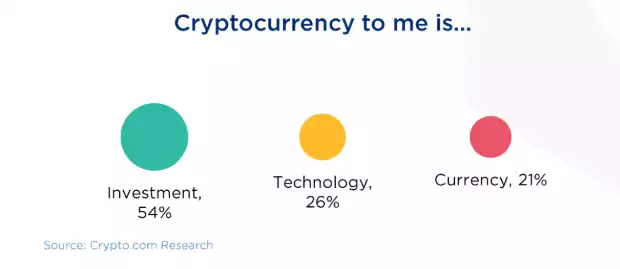

At the same time, the research found that most respondents view crypto as an investment first and as a currency last:

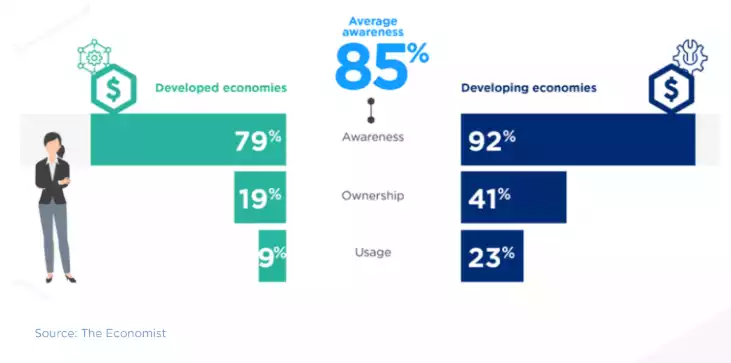

The research also suggests that only 16% of people are using crypto, although 85% are aware of it.

All the data from the survey suggests to the experts that crypto has not yet reached mass adoption if we consider it as currency. So how many people own crypto and how many people actually use it for payments?

The report suggests that there are roughly 66 million cryptocurrency owners. Only 36% of respondents in Crypto.com’s survey report having ever used crypto for buying goods or services – suggesting less than 24 million users use their crypto as a currency.

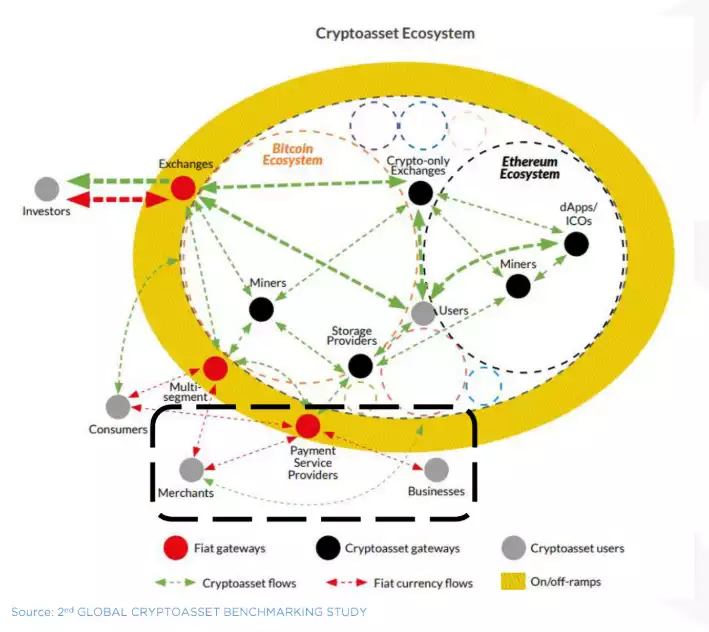

The low usage of crypto as payment is partially attributed to the limited acceptance of crypto as a payment currency as of now. That being said, many crypto service providers have built and are building payment solutions to help free up the crypto payment ecosystem to increase crypto's standing as a medium of exchange – all to drive mass adoption. As soon as the ecosystem is easier for the general population, the quicker adoption will rise. Here is a broader view of the current ecosystem:

The future will see further refinement of this ecosystem. The main constraint is the on/off-ramps. Once this becomes easier, adoption will soon follow – likely at an exponential rate. With that covered, let's look into the market's adoption barriers.

Unclear use cases

While there is still a lot of confusion from the general public, crypto.com believe that this problem may become less prominent when people become more educated on crypto. The use cases for different cryptocurrencies are very clear:

- Bitcoin: Store of Value, decentralised currency

- Ethereum: Programmable money

- XRP: Global remittance

etc

In general, the use cases are there and are strong. This will not be a hard adoption barrier. The key to solving this barrier is through more education and as the space is simplified for the masses, the notion of “unclear use cases” will decrease.

Lack of use options

Lack of use options is the equivalent to saying that there are too few merchants that accept crypto. Although the list of merchants accepting crypto is growing, it still only contributes to a very small proportion worldwide. As said in the report:

"Merchant acquisition is hard, requiring payment platforms to reach out to businesses one by one. The situation is especially tough for crypto when considering technology integration costs, a relatively small user base and market size."

This will be a significant barrier to overcome because although merchant integration can be done easily by providing addresses, it still takes effort and costs for merchants to update existing systems. However, in future, as more come on board, to remain competitive, merchants will have to jump on board. Remember that Ainslie accepts crypto payments for any bullion or other crypto in an easy transparent manner.

Fees / Speed

For bitcoin, one may need to wait 60 minutes (6 blocks) until a transaction can be confirmed. Even 1 block can take anywhere between 5-30 minutes. For small transactions such as buying a cup of coffee, this kind of delay just is not realistic.

Transaction fees are another issue. Bitcoin's transaction fee is independent of volume – meaning that no matter how much the transaction is ($5 for a coffee or $500,000 for a house) the user can expect to pay around $1 US to facilitate the transfer. This is why the market has slowly been shifting away from Bitcoin as being a “merchant payment solution” and more to a store of value.

There are many crypto projects trying to solve this problem but there is a scalability trilemma.

Ease of use

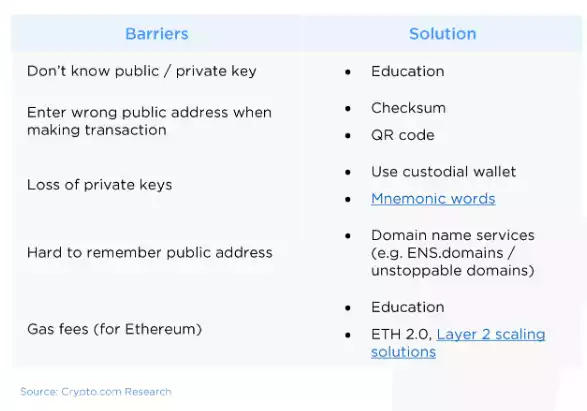

While crypto veterans may not feel it, stepping into crypto is a very very daunting task. Here is a list of common barriers that beginners face, as identified by Crypto.com’s report:

This barrier can be easily solved by focussing on designing a beginner-friendly user interface and providing education. Again Ainslie make all this simple for any user, providing a human to human means of trading crypto with traditional payment options.

Negative Stigma

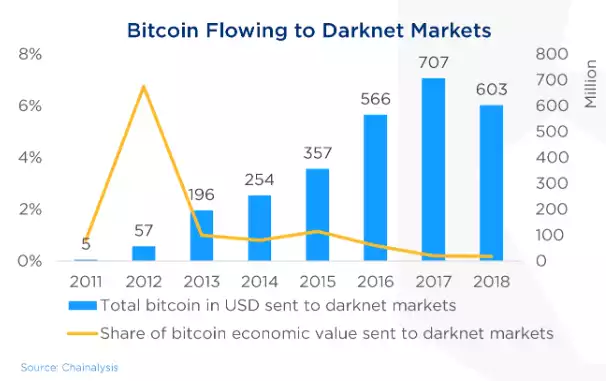

Bitcoin in its early days was closely tied to illegal transactions. One famous example is the first modern darknet market – Silk Road. The crypto market has come a long way since the early days, however. Data suggests that the percentage of bitcoin used in the darknet has declined significantly to near nothing since the early days.

The more mature crypto market will gradually change the public’s perception. As reputable partnerships are formed, the crypto space’s credibility will increase. This barrier will break down slowly but will not be a big hurdle in the future.

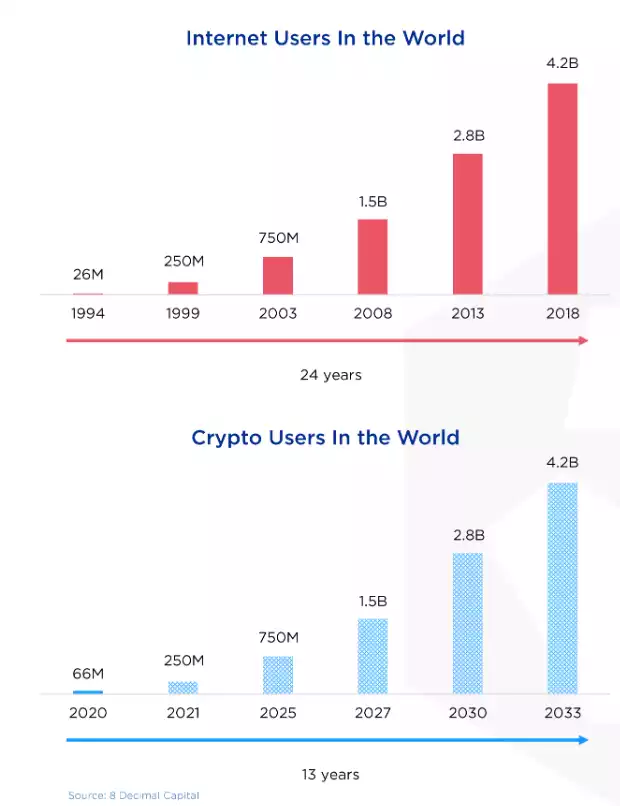

To conclude, we should not forget that cryptocurrencies and blockchain technology is still an emerging technology that has only around 12 years of history. The adoption of crypto technology has been likened to the internet in 1994.

The barriers that are currently in the market will be solved and mass adoption will shortly follow. Big tech offering crypto and CBDC’s will also further accelerate crypto’s path to mass adoption. The market has come a long way even in the last year. Who knows what the market will look like in a year – let alone 10 years? While having the barrier’s discussed today, all data and trend show that crypto is still on track for exponential grown and eventually mass adoption. We just have the opportunity now to invest before mainstream understanding. History doesn’t give many such opportunities.