The Pension “Weapon of Mass Destruction”

News

|

Posted 31/07/2019

|

11864

Precious metals and cryptocurrencies are allowable assets in a Self Managed Super Fund and recent data is highlighting some of the key reason for having one over a managed fund.

A recent study by the Association of Superannuation Funds of Australia found that there continues to be a very significant gap between the $640,000 considered to afford a comfortable retirement and what is currently being achieved through super savings. For individuals aged 60 to 64 the median balance increased to $154,453 for males and $122,848 for females.

Australia stands out in the world at having a compulsory super scheme (currently at 9.5%) that currently sees an incredible balance of $2.8 trillion. For context $2.8 trillion is bigger than our GDP and indeed the GDP of all but 7 countries in the world. But it is still not enough and we still have 70% of retirees relying on a full government pension, and that’s only down 10% from the 80% of the mid 90’s when compulsory super started. Throw in an aging population that is projected to see the number of retirees to workers grow from the current 23% to 30% and you can well see the fiscal problem before the government. Importantly, that is without any economic shock to the system. That is why we are seeing the debate at present about increasing that 9.5% to 12%.

We have written extensively in the past about the unfunded liabilities that are pension obligations in the US not counted in their already massive $22 trillion government debt figure. A recent report from the American Legislative Exchange Council estimated it at nearly $6 trillion! That is $6 trillion of very real obligations that are simply not put on the balance sheet. Congress however is now considering a new bill called the Rehabilitation for Multiemployer Pensions Act that would see the US tax payer bail out their own pension funds. What can possibly go wrong….Lance Roberts posits:

“The real crisis comes when there is a ‘run on pensions.’ With a large number of pensioners already eligible for their pension, the next decline in the markets will likely spur the ‘fear’ that benefits will be lost entirely. The combined run on the system, which is grossly underfunded, at a time when asset prices are declining will cause a debacle of mass proportions. It will require a massive government bailout to resolve it.”

Topically on the eve of the US Federal Reserve meeting we are reminded just how much rests on their actions.

“This is why Central Banks globally are terrified of a global downturn. The pension crisis IS the “weapon of mass destruction” to the global financial system, and it has started ticking.”

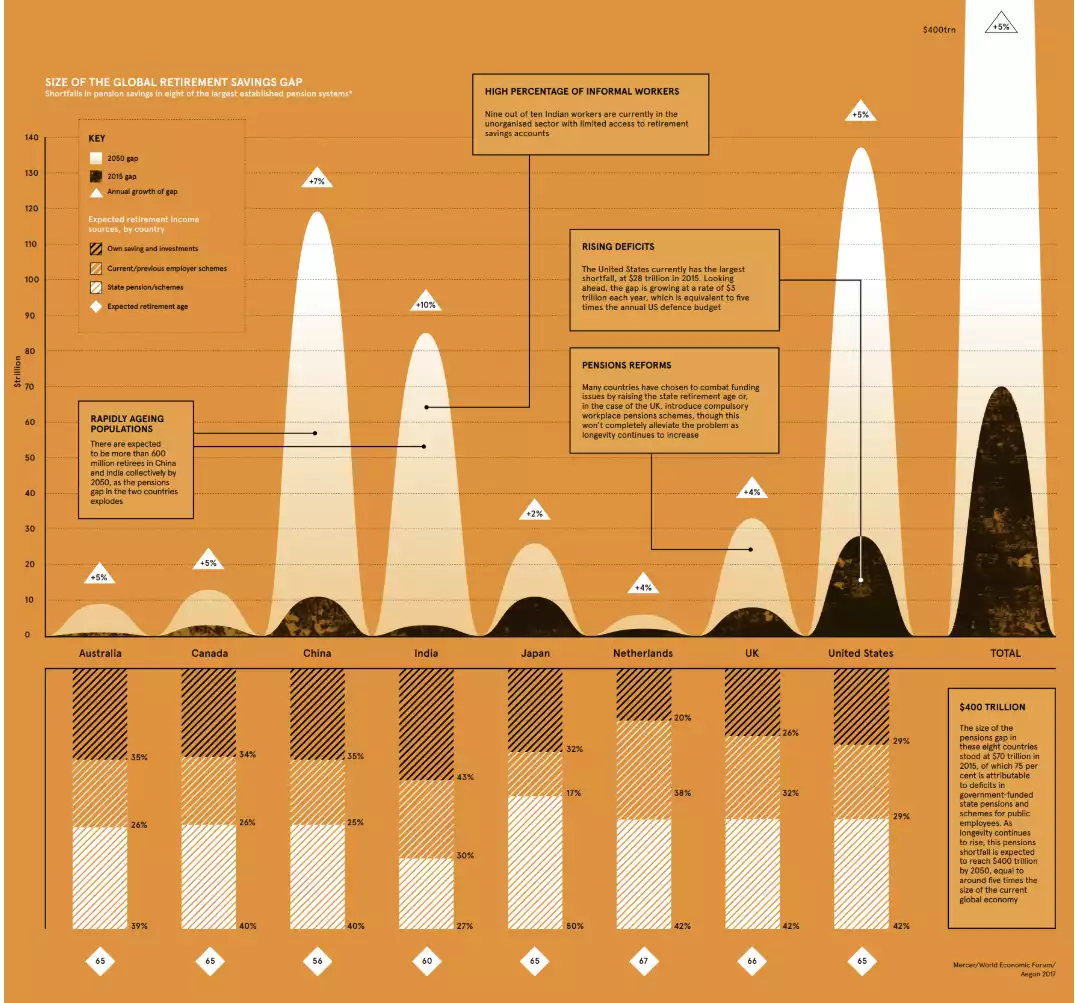

As he says, this is not just a US or Australian problem, but a global one. From Visual Capitalist:

“According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies…

The WEF says the deficit is growing by $28 billion every 24 hours – and if nothing is done to slow the growth rate, the deficit will reach $400 trillion by 2050, or about five times the size of the global economy today.”

All of the above talks to there not being enough funds in pension funds to meet obligations but the other elephant in the room is governments being so desperate for money that they essentially confiscate these funds or, indeed, your super. We discussed the precedents of exactly that in Argentina, Portugal, Hungary, Bolivia, Ireland, Poland and most recently in Greece. You can read that article here. Indeed we later reported on an example of the Queensland government ‘borrowing’ from state pension funds…

Data just out from APRA showed that SMSF’s outperformed retail and industry super funds for the first time in 2016-17 but this kind of misses the point. It is well established that retail and industry super funds are very heavy equities and will stay that way right up until the crash happens. It’s what they do. It’s why we all saw distressing images of distraught retirees after the GFC who had just lost half their life’s savings. An SMSF can, on the other hand, easily establish a more balance portfolio including defensive or uncorrelated assets such as gold and silver bullion. If you think all the numbers above are bad, imagine what they look like after a major (or even minor) economic shock.

There is arguably no more important time since you had the ability to take control of your super to do so than now.

The following is Lance Robert’s conclusion on the US side of this but it is just as applicable to Australia:

“The combined issues of debt, deflation, and demographics will continue to push the U.S. closer to the “point of no return.”

As the aging population grows becoming a net drag on “savings,” the dependency on the “social welfare net” will continue to expand. The “pension problem” is only the tip of the iceberg.

It’s an unsolvable problem.

It will happen.

It will devastate many Americans.

It is just a function of time.

“Demography, however, is destiny for entitlements, so arithmetic will do the meddling.” – George Will

But here is the real question that needs to be answered:

“Who is going to buy all the debt?””