The Great Australian Scream – Essential Reading

News

|

Posted 14/07/2023

|

16206

Occasionally you come across a presentation so compelling, so critical for everyone to read and understand that it needs repeating here verbatim. At the Sydney Morning Herald’s Sydney 2050 Summit, Matt Barrie, CEO & Chair of Freelancer gave an opening address that literally left the room shellshocked at completion. Not a short read but one everyone NEEDS to take the time to do so.

Alternatively you can watch the YouTube video of the presentation here.

From Matt Barrie:

Sydney is the greatest city in the world. We’ve got it all- the harbour, the people, the beauty.

In 2000 Sydney was electric in the lead up to the Olympics, emerging as an international city. Spectacularly well executed, Samaranch proclaimed them “The Best Games Ever”.

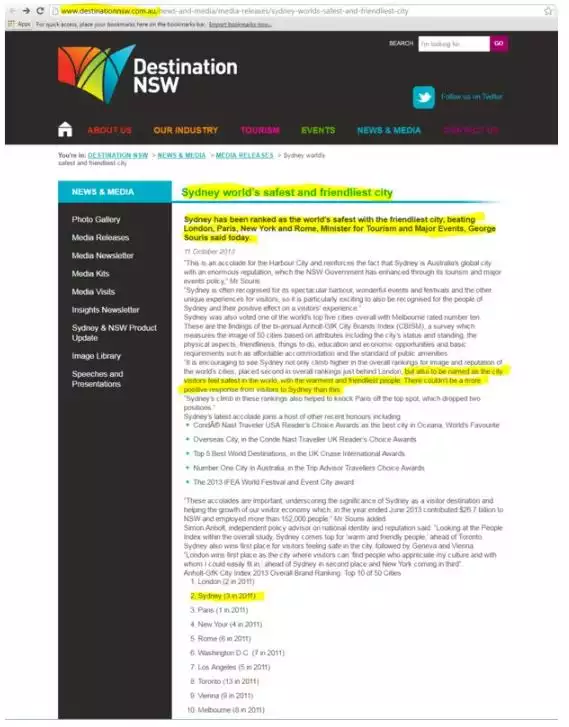

By 2007, Sydney was named the world’s best city in the City Brands Index for culture, people, international status, and to visit, work and live. Condé Nast ranked us the world’s #1.

In 2011, Condé Nast ranked us again #1, TripAdvisor second best. We won Cruise Destination of the Year. US Travel & Leisure ranked us fifth and then eighth in 2012.

In 2013, we ranked third in the City Brands Index, and the world’s most popular destination for international students.

From 2010 to 2016 Sydney was ranked the world’s best festival and event city by the International Festivals Association.

World’s best city for festivals and events seven years in a row.

Boy did we stuff it up.

Sydney today has a class action by festival goers over strip-searches by police. Strip searches that have increased 20 times in ten years. At one point, police were strip-searching people at the train station on their way home from work. The New South Wales government argued that the searches, which sometimes involved removing tampons, were reasonable.

People being strip searched at the train station on the way home from work

Source: Daily Mail

Honestly, what are we doing?

Today it’s the only city in the world where it’s normalised to be at a pub and have a parade of police with sniffer dogs march in. Or a mining conference.

Sniffer dogs at an international mining conference in Sydney. Source: Twitter

Tyler Brûlé, the Editor of Monocle, which publishes an annual list of the world’s most liveable cities, lamented that due to the nanny state, “Australia was on the verge of becoming the world’s dumbest nation.”

Last year, Sydney was ranked the third worst in the world for making friends by Time Out, the second worst nightlife in the Global Liveability Rankings, the sixth worst airport for cancellations and ninth for delay and the second least affordable city in the world.

When it was first proposed to deliver this keynote I baulked at the idea. Sydney is a city of maximum frustration.

Leaving work at 9pm that Tuesday, I aimed for a meal on Victoria Street in the Cross, a great eat street of Sydney. ‘Sorry, kitchen’s closed!’ echoed from every single venue.

Depressingly it looked like Betty’s Burgers. “Sorry, kitchen’s closed!”. At 9:11pm.

I tweeted “What does it take to find a restaurant open after 9pm in Sydney?”.

The responses came in fast: “a taxi driver”, “kebab or maccas”, “an alarm clock so you can head out earlier”, “affordable wages”, “delusion”, “a miracle”, “a sledgehammer”, “a plane ticket”, and what I thought was the most correct answer, “a time machine back 15–20 years”.

I thought, Jesus Christ, they’ve stuffed up this city! How bad will they stuff it in 20 more?

Maybe I should do that keynote after all.

I mean.. Why can’t you get a meal in Sydney after 9pm anymore?

Source: TimeOut Magazine

Let’s look at rent, which for a restaurant in Sydney, is around $12,500 per square metre per year. In Manhattan, the world’s most popular tourist destination, it’s under $10,000. In Los Angeles, it’s even cheaper.

Unbelievably, Australia also has the highest casual wage in the world at $21.38 per hour.

What to actually pay is baffling. We have 122 pay guides, and it’s not easy to figure out which to use. The one missing is the one for the poor sod in Canberra that puts them all together.

We have an “Asphalt Industry Award” for anyone in “road making and the manufacture or preparation, applying, laying or fixing of bitumen emulsion, asphalt emulsion, bitumen or asphalt preparations, hot pre-mixed asphalt, cold paved asphalt and mastic asphalt”.

There’s one for Premixed Concrete, different from the one for Concrete Products. There’s one for the Cemetery Industry different from the Funeral Industry. There’s one for the Sugar Industry different from the Salt Industry.

Source: Fair Work

They call these ‘modern awards’, what’s modern about this?

For a restaurant you’d think maybe the Hospitality Award applies. No, that’s for hotels, motels, saloons, bars, caterers, casinos, nightclubs.. and restaurants but only in hotels.

It’s also not the Fast Food Award.

The correct one is the Restaurant Award, which applies to catering by a restaurant but not catering as a business, cafes, tea rooms, roadhouses and nightclubs that are not in hotels.

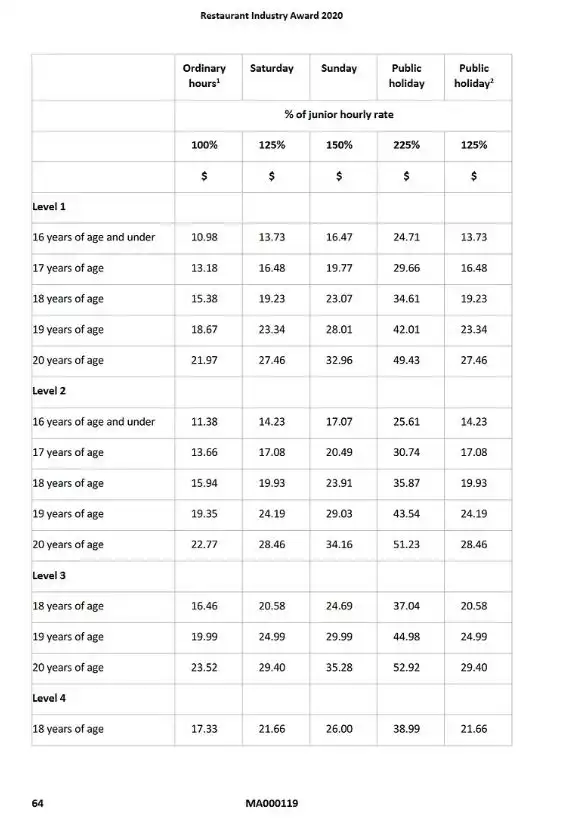

91 pages of confusing tables for which you need a ouija board: Level 1, 2, 3, grades 4, 5, 6.

I couldn’t find the pay table for the poor sod that maintains the pay tables. Source: Fair Work

What’s the difference between a Level 1 Food and Beverage Attendant Grade 2 and a Level 1 Grade 3? The first serves food and beverages, handles cash and provides customer service, while the second provides advanced food and beverage or specialist advice.

There’s tables depending on the time of day, type of day and whether it’s a holiday. There’s tables for adults, tables for 16 years or under. More for 17, 18, 19 and heaven forbid 20 year olds. Then all the sundries like $1.93/day if you bring your own cheese grater.

If you want to negotiate a salary there’s An employer’s guide to annualised wage arrangements in the hospitality and restaurant industries from Fairwork, which says you actually can’t and still have to pay overtime and penalty rates.

The ‘penalty’ rates differ depending on time of day, phases of the moon, and are a mess. In the Hospitality Award, the evening is 7pm to midnight but in the Restaurant Award 10pm-12am.

If you get any of this wrong, you’re a wage thief!

I’ll tell you a ‘penalty’, and that’s not being able to get a meal because the restaurant’s shut.

They don’t open past 9pm in Sydney, because as the demand for a meal is dropping, wages go up and you need an actuary and an eye of newt to figure out the pay. So last call’s at nine, so they can close at 10pm, when the complexity rockets up.

On the flip side, $21.38 an hour for 38 hours a week takes home $709.44. Compared with the average weekly rent of $783, leaves negative $74.

The restaurant is trapped between astronomically high rent, labour costs and bureaucracy. On the flipside, despite the highest casual wages in the world, its workers can’t afford to live.

How did we get here?

Peter Thiel says that “the entire modern political order is predicated on easy and relentless growth.. [but] most of our political leaders are not engineers or scientists and do not listen to engineers and scientists”.

One only has to look at the occupations of the Federal Ministry:

Policy Advisor

Solicitor

Solicitor

Policy Advisor

Community Worker

Union Organiser

Union Organiser

Political advisor

Healthcare Consultant

Aboriginal Affairs Administrator

Union Organiser

need I go on…

Australia’s quite the ‘lucky country’; our top four exports are raw materials that we extract out of the ground and stick on a boat: iron ore, coal, gas and gold. You can’t get easier than that. Raw materials for which we are price takers not price makers. Lucky again because they keep going up, despite not engineering them into more complex, higher margin products.

Indeed, Harvard ranks us 91st in the world for economic complexity, a measure of how unique and sophisticated our industry is, behind Kazakhstan, Guatemala and Laos.

Source: Harvard Atlas of Economic Complexity

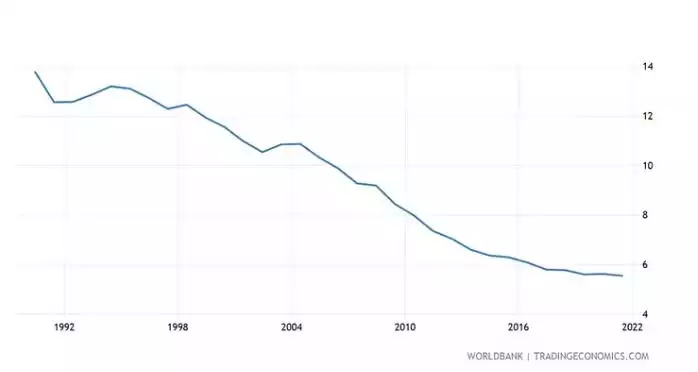

It’s fallen 40 places since 1995, a year when Australia made things like cars, for which we’re still taxed $1.5 billion a year, to protect an industry that no longer exists.

Australia’ manufacturing’s share of GDP is 5.5%, on par with a tax haven like Luxembourg, but worse than Botswana, which sells diamonds and where you can see cheetahs.

Source: Trading Economics

Our high tech exports of US$6.3b are 1/150th of China’s, and 1/26th of South Korea’s, a country with GDP on par with our own.

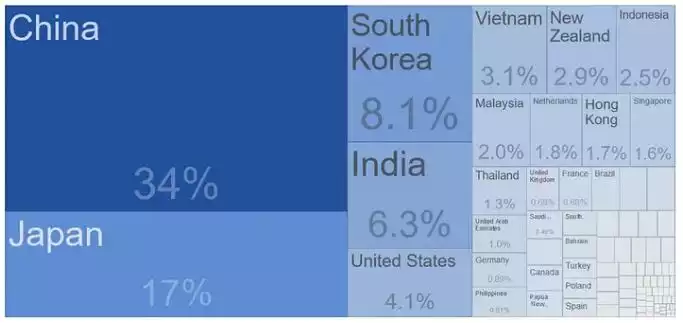

Those four commodities: dirt, dead trees, gas from dead trees and gold, along with 34% of everything we produce, we put on a boat to China- a country we are now totally dependent upon, and that we have totally pissed off. In return we take 2% of theirs.

Source: Trading Economics

Our fifth biggest export is “educational related travel services”, or a visa factory at our local university, vocational, “business” or English college. The educational quality at the latter is worse than you’d get binge watching cat videos on Tiktok.

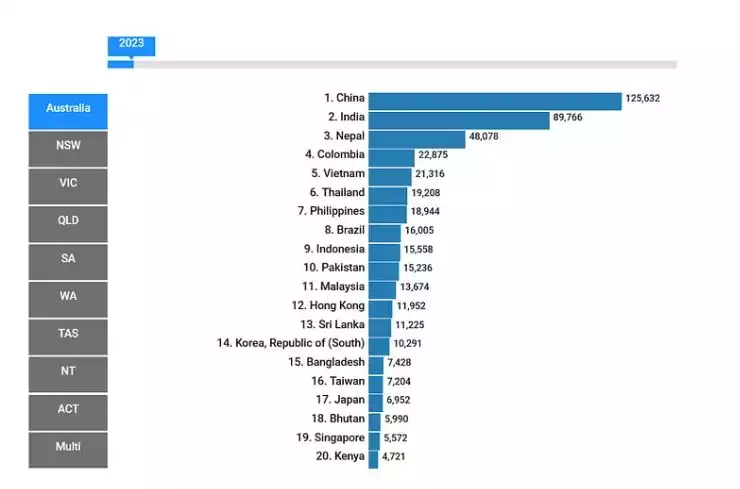

There are 620,000 “students” in Australia, equivalent to the populations of Canberra, Darwin and Alice Springs. 45% are studying higher education, 25% vocations and 17% English. Almost 40% are in NSW. By 2025 there’ll be 940,000 and Sydney will host a Canberra.

[6/2/23 CORRECTION — thanks Abul Rizvi — the Australian 573,000 number was an earlier stock number of students in the country]

If that also sounds weird, in 2022 392,657 student visas were issued by Australia. The United States issued 416,405, a country with 13x the population and around 4,000 universities with degree granting secondary education. Australia has 43.

The near record numbers are despite a 40% drop in Chinese students since 2019, the year Australia took the lead in the origin of covid inquiry, a question that remains to this day, along with Where’s Waldo?, one of the greatest unanswerable mysteries of the world.

The overwhelming majority are from emerging markets, India surging with 16% and Nepal at 9%. Colombia, Vietnam, Thailand, Philippines, Brazil, Indonesia and Pakistan are next.

Source: Department of Education

Now students from India are some of the brightest in the world. IIT has the world’s toughest entrance exam, where 1.2 million students compete for 10,000 places.

But there’s a few clues to what is actually going on.

Australia recently signed up to the Mechanism for Mutual Recognition of Qualifications as part of the Indian Free Trade Agreement. This agreement requires Australia to recognise all official Indian educational qualifications.

Like Australia, education in India is booming, at US$117 billion per year. Education is the lubricant of upwards mobility, but like Australia, it’s turning into a business that provides that by payment, rather than achievement.

A Bloomberg article Worthless Degrees Are Creating an Unemployable Generation in India quoted a former secretary for school education, that of the “16,000 colleges handing out bachelor’s qualifications for teachers, a large number existed only in name”.

“Calling such so-called degrees as being worthless would be by far an understatement,” said a former Dean at Delhi University.

Another clue is Morrison removing the 20 hour per week work cap. The result was a flood of Indian applications- so high, Home Affairs had to reject 94% for vocational training. Nepalese applications had to be cut from 85% to 7%. Employment is now limited to 24 hours per week.

According to the Home Affairs Minister, we created ‘an underclass of low-paid and exploited workers, leaving international students in limbo and failing to meet the current and future economic challenges faced by the nation’. In the same breath, O’Neil announced all these workers can be permanent residents, a statement that does not logically follow.

This is the big, uncomfortable secret about Australia’s ‘easy, relentless’ growth.

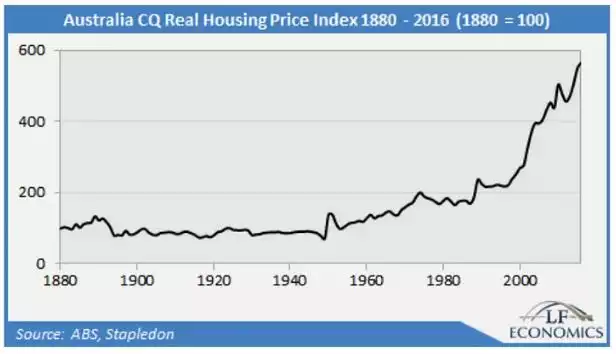

The ‘easy, relentless growth’ politicians have chosen to take is to blow a property bubble on a scale like no other, one that has driven Australian houses up 8,570% (86x!) over 61 years.

Demographia publishes a global housing affordability survey, the measure being the median price of a house to the median household income. If the median house price to the median household income is 3x or less, housing is affordable, 3x to 4x moderately unaffordable, 4x to 5x seriously unaffordable, 5x or more severely unaffordable.

Sydney today is 13.3 times: the second most expensive in the world.

London is 7.0 times and New York is 7.1.

Source: Demographia International Housing Affordability Survey 2023

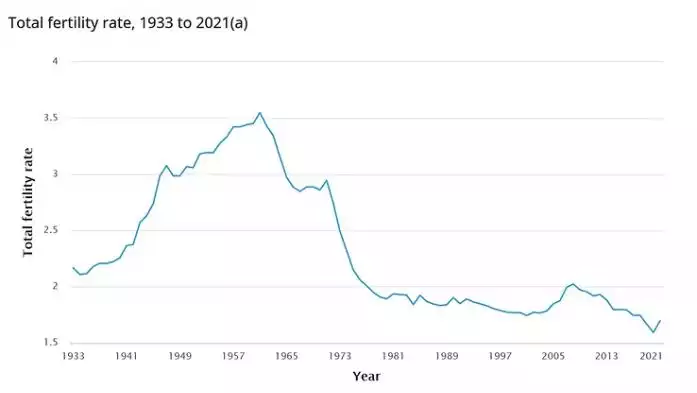

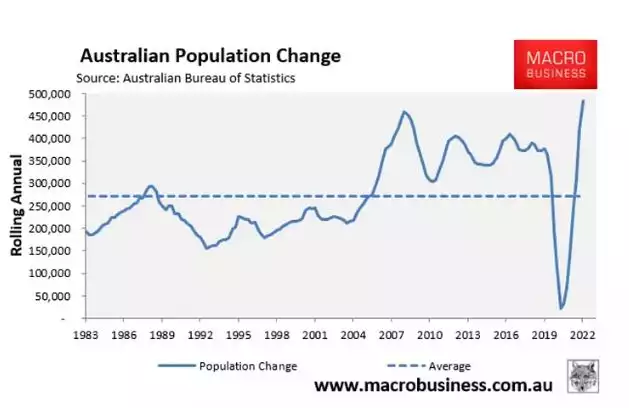

It’s not because Australia is making more people. Every woman must have 2.1 kids to maintain the population. Australia is 1.6 and dropping and hasn’t been above 2.1 since 1975.

Source: Australian Bureau of Statistics

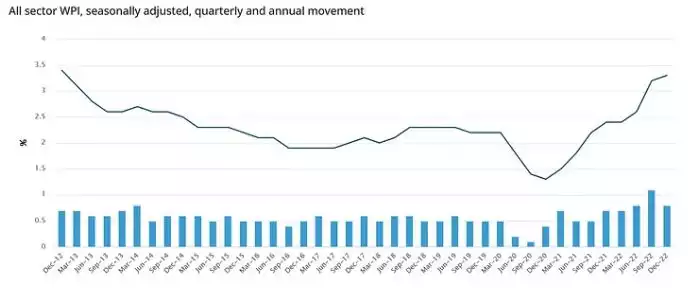

House prices are also not driven by wage growth, which for the last decade has been below 2.5% per annum, barely above inflation, not going anywhere. Now with inflation at 7% and wage growth at 3.3%, Australians are experiencing the largest decline in real wages ever. Our buying power in the last year went back to December 2008. House prices didn’t.

Source: Wage Price Index, Australian Bureau of Statistics

Source: Consumer Price Index, Australian Bureau of Statistics

The average Sydney house is now $1.2m and the average wage is $94k, making it mathematically impossible for the average person to buy the average house.

If you borrowed it today from the Commonwealth Bank, at a 6.18%, your repayments would be $7,200 a month, every month, for 30 years. The monthly post tax income for $94k is $5,900, leaving you out of pocket $1,300 a month for 30 years, assuming you don’t eat.

In fact, on that wage, the Commonwealth Bank will only lend you $514k, and only if you lie.

Right now, 62% of household income (two people) is needed to service a mortgage in Sydney. Back in the 80s, when rates were 17%, it only took 44%.

For a modest budget, you could rent a place in Eagle Vale, 56 kilometres from Sydney, for $130 a week, $520 in bond and two weeks’ rent in advance. Bring your own ‘small shed or tent’ for their backyard, ‘open to discussing ‘power, water, Wi-Fi, toilets and showers’.

Source: Facebook

In January a student from China found a tent useful for privacy, because for $300 a week she had to pitch one in a share-house living room.

Source: ABC

The City of Sydney is putting ads on bus stops for “how to grow your own food if you rent”.

Source: A boring dystopia, Reddit

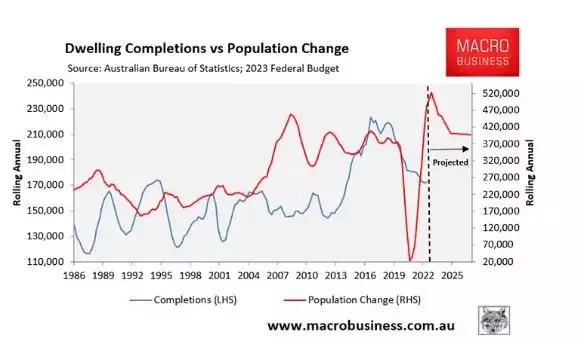

To solve this, the Federal Government announced a grand plan to build one million homes by 2029. At the same time it took in 400,000 people net. At this pace by 2029, we’ll be building 1 million homes for 3 million new immigrants, a million of which will come to Sydney.

Sobering when the Grattan Institute forecast that lifting by 40,000 would lift rents 5%.

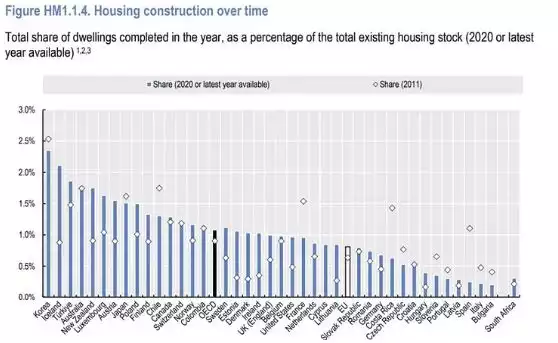

We could build more homes, but we have the fourth highest construction rate in the OECD.

Source: OECD Affordable Housing Database

The Rider Levett Bucknall Crane Index tracks cranes worldwide, of which there are 868 in Australia: 365 in Sydney and 189 in Melbourne. There are 10 operating in New York, 17 in San Francisco and 14 in Chicago.

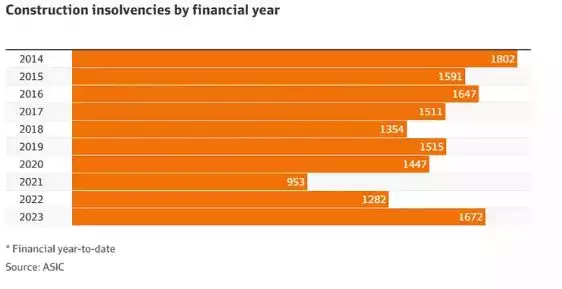

Construction is now the top sector going bust. This financial year 1700 construction companies have entered administration, up 83%, due to inflation.

Source: Macrobusiness, ASIC

“It’s the grimmest I’ve ever seen in 45-odd years,” said the Chairman of builder Tamawood. The Association of Professional Builders says “it will get worse”. Bank loans for building are at a 15 year low, down 31%, now requiring a 17–32% return on investment.

Leaked documents found NSW will build 36,000 homes a year for the next five years, when it needs 62,800, a shortfall the Planning Minister says is “greater than we thought”.

Source: Macrobusiness

At the same time RBA Governor Lowe gaslit the Australian public saying that you were the problem, “The price of land is high… because of the choices we made of a society where to live, how to tax housing and how to invest in transport”. The same Bubble O’Phil that said rates would stay at 0.1% until 2024.

But of course it’s not true. It’s not your fault. This crisis is engineered. It is by design.

A “deliberate design feature of our economic architecture”, quoting a former Finance Minister.

The US uses quantitative easing to drive ‘easy, relentless’ growth.

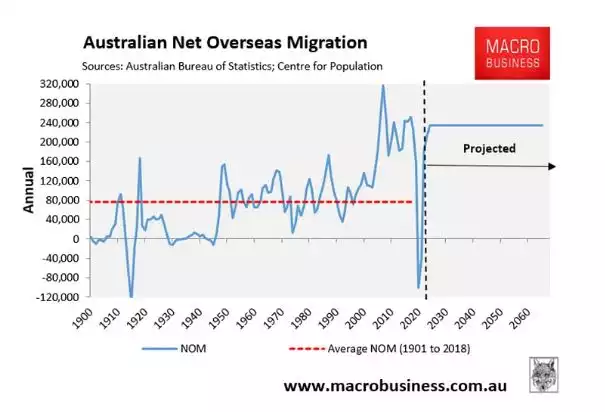

Australia uses quantitative peopling.

In the year to March, Australia grew by a record of 523,000, following which Albanese added 500 staff and $42m to clear a 600,000 visa backlog.

This is not about ‘growth’ but inflating demand for housing. It’s not about the ‘economy’ but inflating GDP. But population growth does not increase GDP per capita.

Minister O’Neil said ‘Our country faces genuine and significant challenges providing safe affordable housing for Australians. These problems are not caused by migrants’. I guess she thinks the Canberra-sized armada each year are all nicely in tents in someone’s backyard.

So high is immigration that Migration Agent is listed on the Skilled Occupation List and Brickworks, the largest brick manufacturer in Australia, is demanding that we bring in more migrants as bricklayers.. to build houses for migrants.

Source: Home Affairs

NSW bears the brunt, importing people on an industrial scale. Before covid, 730,000 a year to replace 450,000 leaving to net 270,000. New South Wales’ population is only 8 million. So you have this huge stream coming in and a huge stream fleeing for cheaper places to live.

Source: Macrobusiness

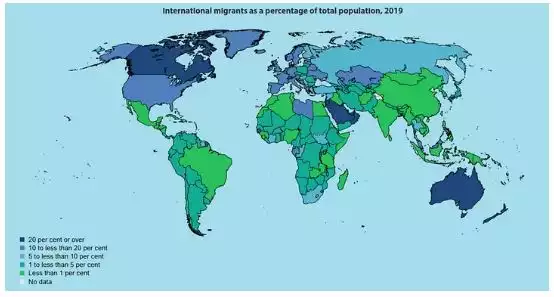

30% of the country is now born overseas, the highest among western nations. In NSW, it’s 35%. Here, 33% have both parents born in Australia and 43% have both born overseas.

Source: United Nations (2019)

The turnstyle of migration into Sydney last financial year netted out to 55,000 going mainly into Parramatta and inner south west, displacing 52,000 Sydneysiders who leave, 40% to the country and 60% Queensland and other States. Births minus deaths add 35,000. This inbound is to skyrocket, with Sydney forecast to grow from 5.3 to 6.1 million by 2033.

The solution is to build a third city called Bradfield in outer south west Sydney, next to the new Western Sydney International Airport and not far from Eagle Vale where you can rent a backyard to put up a tent for $130 a week.

This third city will be 60% the size of the CBD. The location does have its challenges, such as being the hottest place in the world. That’s what it was in 2020, when it reached 48.9C.

The Australia Institute found that “Western Sydney is among the most affected regions of Australia when it comes to extreme heat. Its inland position at the foothills of the Blue Mountains prevents the cooling impact of a coastal breeze and works to trap heat”.

It’s “projected to have the highest number of days over 35C, a month/year by 2050. By 2090, this will double. [..] Human influence compounds this through the removal of heat-reducing green spaces, replacing them with materials such as concrete and asphalt”.

2018 and 2019 both had over 44 days, outstripping the worst case. I’m also not an urban planner, but I would guess that removing, say, 114 hectares of green space and replacing that with a concrete and asphalt city, might make things worse.

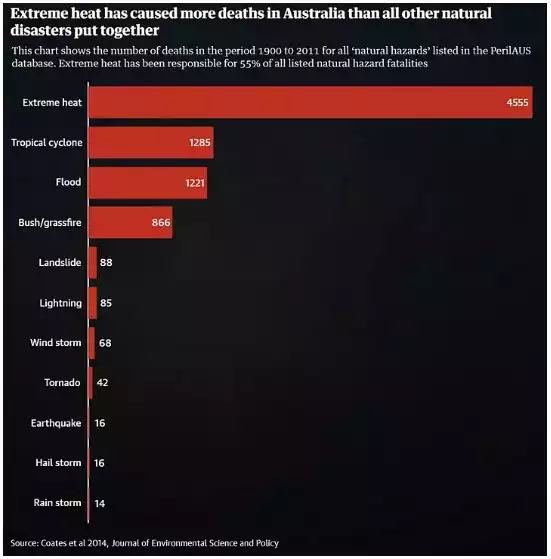

Since mortality increases by 20% over 30 degrees for 24 hours, and heat causes 55% of all natural hazard deaths, a better name for Bradfield might be.. Hell.

Source: Guardian, Journal of Environmental Science and Policy

I also presume Bradfield is where they expect all the teachers, police, and hopefully- the firefighters and paramedics will live.

If you’re going to build a city and all these apartments, you need roads and rail.

Material costs are at a 30-year high, and somehow, despite 730,000 coming into New South Wales each year, labourers have remained unchanged at 300,000 for a decade. It won’t be 300,000 for long with every tradie heading to Brisbane for the 2032 Olympics and better pay.

Costs are blowing out. The 30km City and Southwest Metro was budgeted at $12 billion and is now $20.5b, the same price as Trump’s 732 km wall. The Grattan Institute estimates 28% of billion dollar projects are blowing out, the median blowout being $627 million.

All up, NSW will spend $116 billion on infrastructure to accommodate these new people. Given Premier Minns campaigned on a platform of ending privatisation, one might wonder how we’re going to pay for this if it’ll stay on the books.

Well the answer is debt, and NSW will be in it deep, $187 billion deep by 2026. Naturally, the government says surprise, the interest rate is higher than expected at 5.2% and climbing, costing taxpayers $6.8 billion a year by 2026, more than was collected from land tax, pokies, casinos, health insurance and parking levies combined last year.

As they say in public policy, the dildo of consequences rarely arrives lubed.

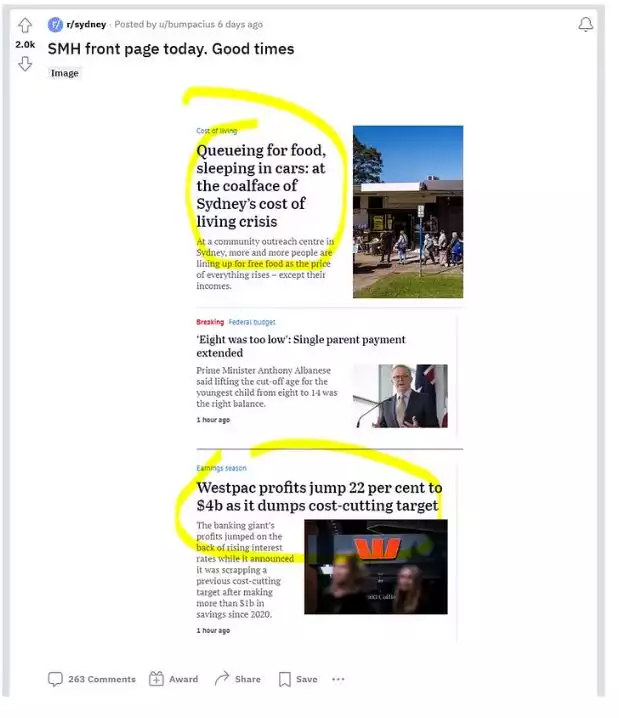

With mass immigration driving out of control inflation, property costs, infrastructure demands, construction collapses, business insolvencies, debt and the greatest erosion of Australian living standards on record, one would think that something might break.

You might also be thinking, who exactly do these politicians think they are working for? Government of the people, by the people, for the people. Which people, exactly?

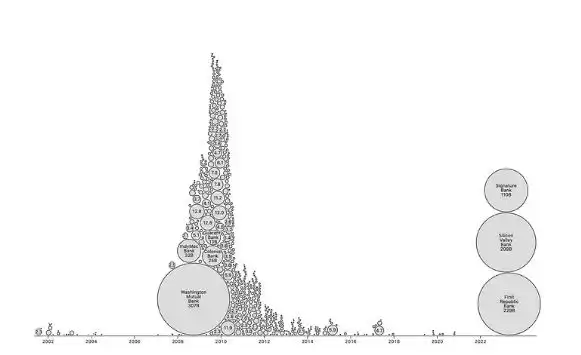

This is with the backdrop of five banks with over US$2 trillion in assets failing in 50 days: Credit Suisse, Silvergate, Signature, First Republic and Silicon Valley Bank.

Source: US Bank Failures, Mike Bostok

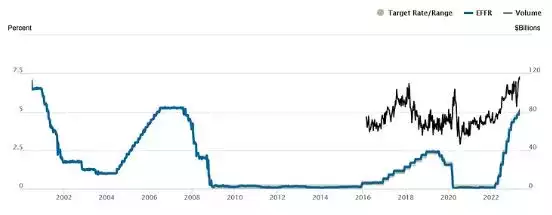

At Silicon Valley Bank business was good, deposits were up 4x in four years. The problem was borrowing short and lending long, investing $91b in t-bills and mortgage-backed securities at a crappy yield of 1.56%.

Like the GFC, all the Fed needed to do was hike to 5.25% and all debt became untenable.

Source: New York Federal Reserve

Startups burning cash deeper for longer forced a $21b loss selling these bonds, leading to a bank run at SVB, the most critically important bank in technology.

Another critically important bank that fell into this trap, losing $45b on $538b, resulting in negative $12b of equity. The losses are on Australian government bonds, and the bank is the RBA. Going too hard during Covid they’re about 22% of GDP. For 50 years it’s been at 7%.

To stop inflation, you need to raise rates above it, otherwise there’s no incentive to save instead of spend. The Taylor Rule, looking at the Consumer Price Index, says rates should be at least 7%. They’re currently 3.85%.

If you don’t look at the Fantasy Football Index and look at the price of sirloin the pub index, last year it was running at 8.5% ($38), this year over 26% ($48). That would mean rates more like ’82 when they were 16.5%. Certainly the debt and money printing today is much higher.

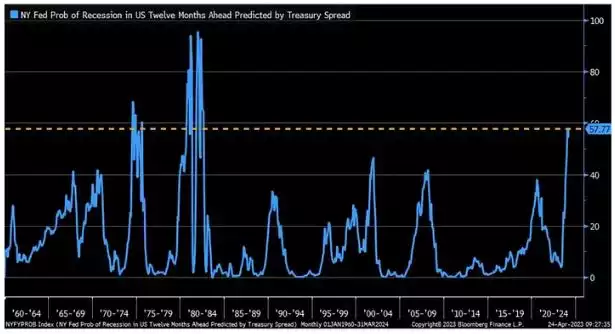

It’s clear interest rates will keep rising, straining bank profits and liquidity as asset values decrease, with limited options for intervention. It is not practical for the Fed nor RBA to guarantee all deposits, as both are losing money, in negative equity, and lack liquidity. Banks will continue to tighten lending. A recession is likely to emerge.

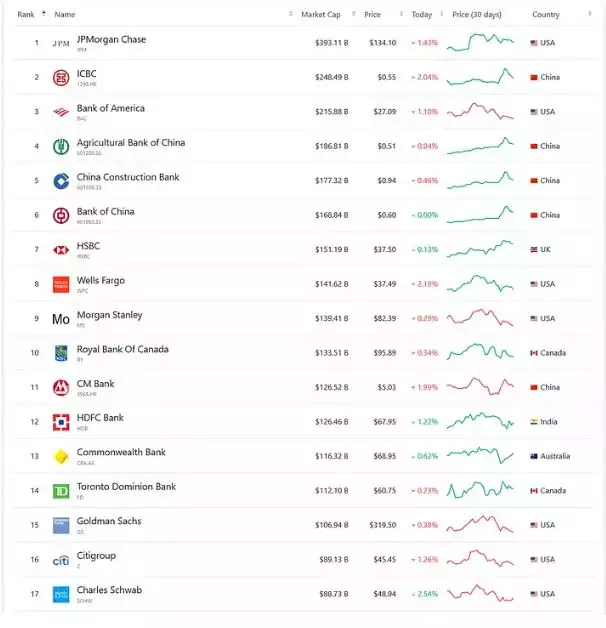

Now you might be surprised to know that Commonwealth Bank has a larger market cap than Goldman Sachs, and NAB is bigger than UBS, even after buying Credit Suisse.

Source: Companies Market Cap

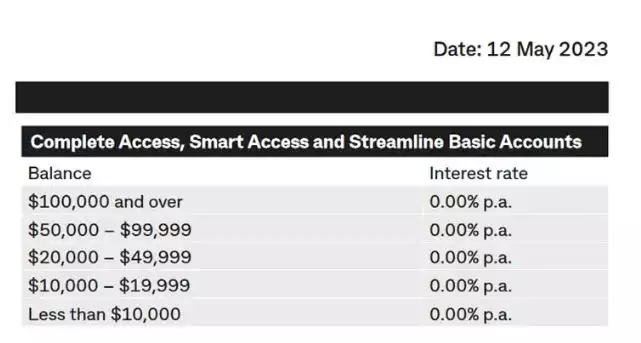

CBA’s latest results look good. But 70% of their book is home loans, a staggering $639b. Business loans are $150b and consumer $17b. Unlike the GFC, deposits cover 75%. But just like at SVB, deposits can burn down in tough times, especially paying 0.00% interest.

Source: Commonwealth Bank

Business deposits are falling. Taylor David says we’re in an “insolvency armageddon”, with 6000 going into administration year to date, 41% in NSW. Retail deposits have been rising, with no small contribution from 400,000 new people a year needing a bank account.

Quite the flywheel has been created. The Big 4 and Macquarie are 22% of the ASX200. Every month, 10.5% of Australian wages go into super, soon to cost 12%. 16% of super is invested into property and 23% into stocks, of which 22% of ASX200 stocks are banks. So relentlessly every month, 5% of wages buy up bank stocks, which helps them lend.. to mortgages.

Source: State Street

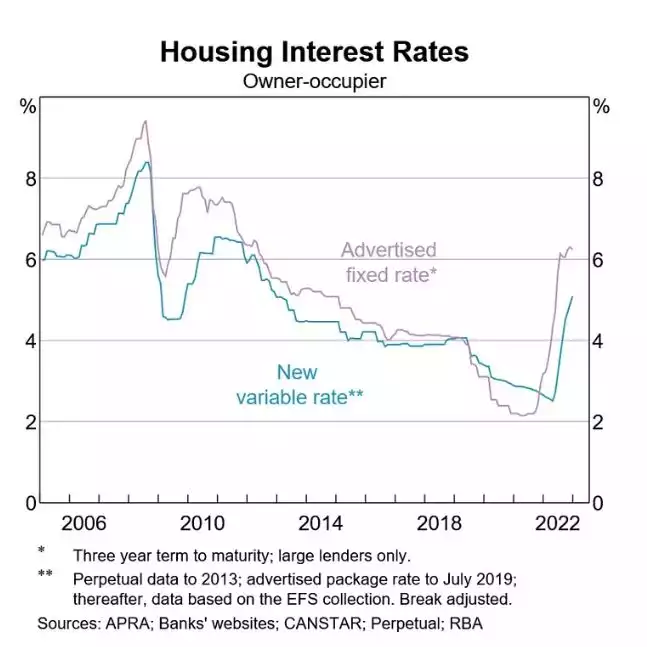

Australian homeowners are now in ‘mortgage hell’, negative cash flow and unable to refinance due to serviceability requirements. NAB says 20% of their loan book is in hell now. If you borrowed between August ’19 and July ’22, 40% are in hell. Many have dynamic loan-to-value ratios where values are forecast to drop 20%.

During 2020 and 2021, Australian banks lent $394 billion in fixed mortgages as low as 1.95% over three years. $350b of that resets this year with the variable rate more than triple.

Source: RBA and others

The brunt is hitting now, with 17% of all fixed rate mortgages rolling off this quarter, 15% next.

If this sounds familiar, it should. There’s a movie where a financial disaster was created from excessive risky lending, particularly adjustable-rate mortgages with low teaser rates that “exploded” after 2–3 years. And explode, they did.

In that movie, Steve Carell talks to a stripper who has five houses and a condo who didn’t realise that her repayments could triple.. “Hey there’s a bubble, short [it]”. That movie was The Big Short, and that was Steve Eisman making US$7 billion.

The Big Short

Today’s stripper in a mortgage mine is a daily feature in the media: Garbage train driver reveals how he built up a 13-home property portfolio worth $12 MILLION while earning less than McDonald’s workers. Western Sydney ex-McDonald’s worker now owns 40 homes worth $20 million, How Sydney dad owns 13 properties despite period of joblessness.

Source: News.com.au

Reckless and dangerous financial advice pumped at you day and night. The tail wags the dog as Domain is about 34% of Nine’s market cap and Realestate.com.au 74% of News Corp’s.

Albanese must have recently been to a strip club, because he’s gone berko on immigration: increasing permanent migration to 195,000, abolishing the skills list, guaranteeing 2.1m temporary migrants a path to citizenship, halving withholding tax on foreigner developers, mulling rent caps, and allowing New Zealanders citizenship. What’s next, Tasmanians?

Source: Macrobusiness

Julie Collins MP, the Minister for Housing who owns five homes and is, unironically, the Minister for Homelessness has announced that from July 1 the eligibility for the First Home Guarantee and two others will be expanded to those that haven’t owned in a decade, permanent residents and “two individuals, siblings, a parent, cousins, a child.. and two friends”.

I guess the guy who won’t stop talking about being brought up by a single mum in a housing commission flat wants the rest of Australia to go through the experience. None of this is about making housing affordable- it’s late stage ponzi moves getting the last suckers to keep buying- at a stratospheric 13.3 times household income.

A ponzi because a constant stream of new fools are needed to keep buying to make those that did buy feel rich. But like all ponzis, sooner or later the number of chumps you need becomes untenable, and the whole thing is undone.

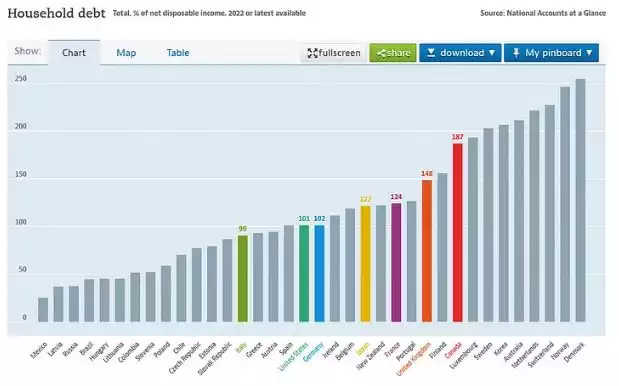

Australia’s household debt is the fifth highest in the OECD, 211% of net disposable income and rising, double the US, a country one associates with credit cards and debt.

Source: Household debt (OECD)

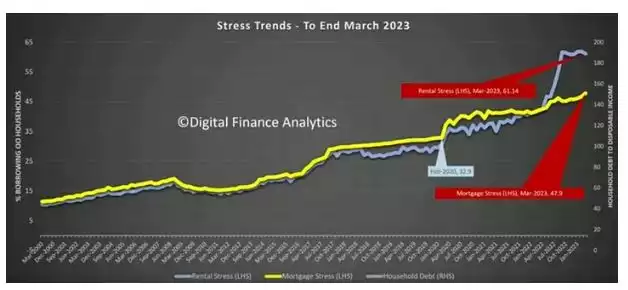

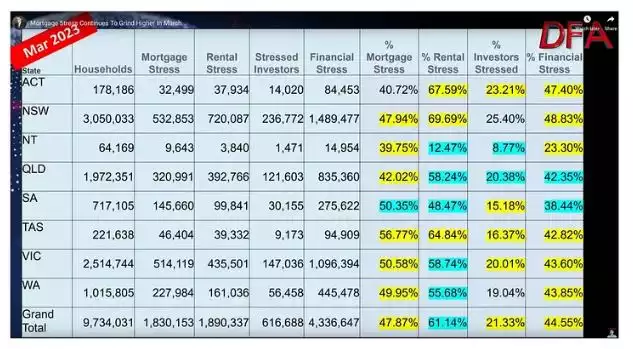

As of March, 61% of Australian households renting were in rental stress and 48% of households with mortgages were in mortgage stress, where stress is monthly outgoings greater than income. Twenty years ago, both were under 15%. In New South Wales, 70% of renters are in rental stress. This cannot go on for much longer.

Source: Digital Finance Analytics

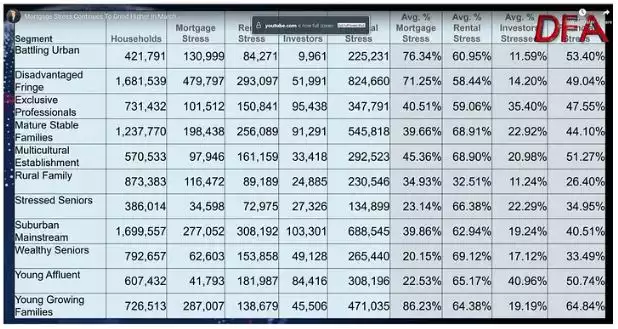

What’s crazy about the ponzi is 69% of immigrants are in rental stress, with outgoings greater than income, the second worst group after the elderly. That’s why they say migrants are net contributors to the economy, because they’re drawing down their savings to live.

Source: Digital Finance Analytics

The $53,900 skilled migrant threshold results in $863 per week after tax, barely enough to eat and rent a tent. Raising it to $70k might allow an upgrade to a shed. We’re at that point in the ponzi where we’re potentially importing future welfare recipients to keep the game going.

Source: Digital Finance Analytics

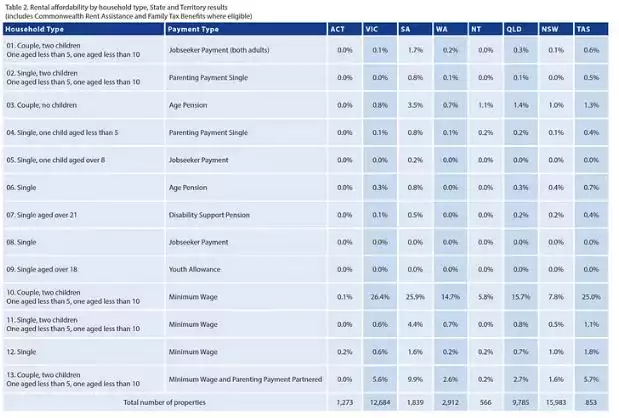

Anglicare’s annual rent report surveyed 46k listings: 345 were affordable on a full-time minimum wage, 162 on the Aged Pension, 66 on Disability Support, 4 on JobSeeker, and zero on the Youth Allowance, “This is the first time we have ever seen the number of affordable listings for a full-time minimum wage earner crash to below 1%”. The Property Club predicts with 190,000 new migrants “the number of homeless [in Sydney] will explode”.

Source: Anglicare

The yield curve has inverted and the New York Fed predicts a 58% chance of recession. This is where the economy contracts, spending crimps, defaults on loans go up and jobs are lost.

Source: New York Fed, Bloomberg

It’s not a question of if the property bubble pops, but when. The US, UK, Spain, Portugal and Ireland all blew bubbles during the GFC, but they all let them pop. Australia kept blowing. Despite what the politicians say, there has never been a soft landing for an asset bubble.

And keep blowing, they do, citing chronic ‘skills shortages’. We need some technical skills because despite kids’ dreams of working for companies like Tesla or Canva, they can’t link school learning to these careers. When I left high school, I thought engineering was something to do with driving trains. Sadly, last careers day, I saw nothing has changed.

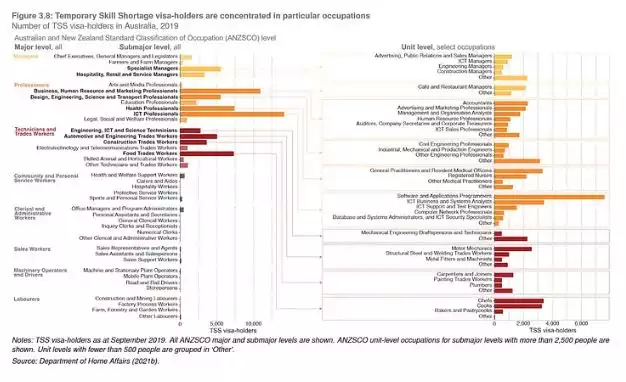

Programmers and analysts are indeed the top skills brought into the country, but the quality coming in is awful. Of 228 applicants I had for a software role last week, 220 were unsuitable.

Source: Fixing Temporary Skilled Migration, Grattan Institute

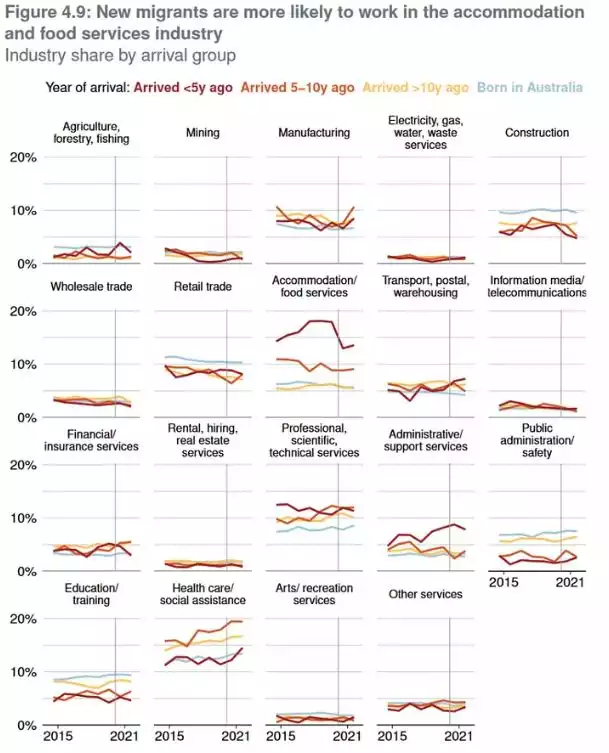

Next are not engineers, nurses or entrepreneurs, but chefs and cooks for accommodation and food, which has the most migrants at 40% of workers and the highest rate of insolvency.

Source: Grattan Institute, ABS

This is the actual skills crisis that politicians primarily bleat about, a crisis created by themselves. Cafes can’t find workers because despite paying the highest casual wages in the world, locals can’t make it work with the cost of living. So we import people and trick them for a while to work in a cafe, before they realise they can’t afford it either.

Unless the robots do it, these poor sods will end up wiping bums as 85s and over are going to 1 million and 65+ are doubling to 6.5 million by 2042. Over 86% of young, growing families with mortgages are in mortgage stress, no surprise the locals aren’t having kids.

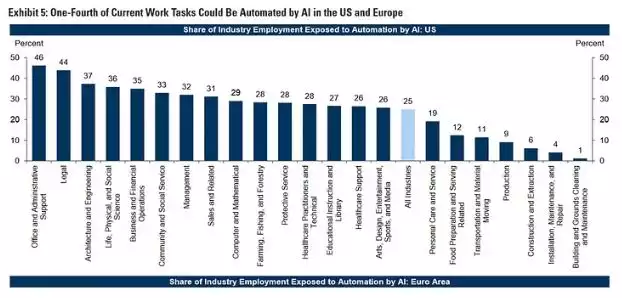

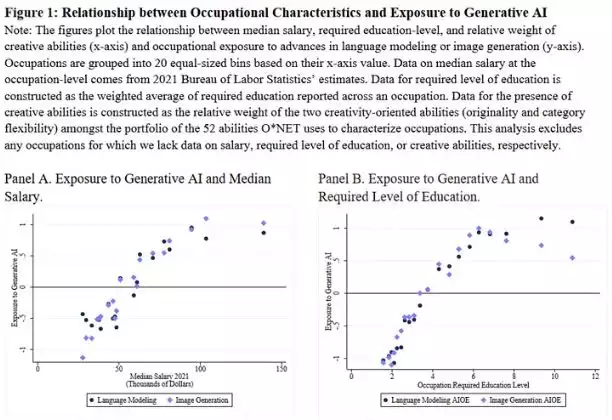

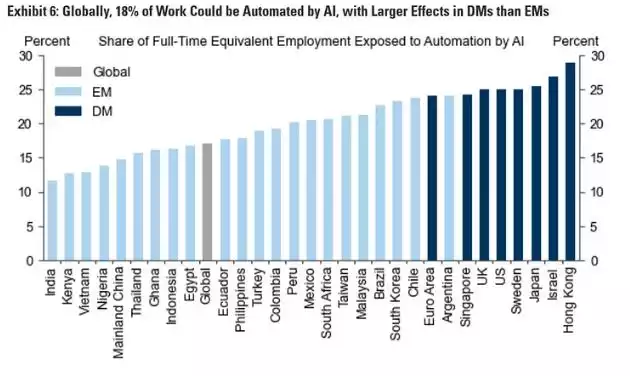

The unfortunate thing is this is all happening at the same time AI is being unleashed upon the world. If you think the Internet was transformative, Generative AI will be bigger.

The breakthrough was the Transformer, allowing large language models to consume large amounts of data: now 10% of the Internet, soon to be all of it. What now comes out is dark juju magic. It can answer any question, speak any language, draw illustrations indistinguishable from photographs, and is now learning to write software.

Source: Twitter

Any job that you can do, the AI can do better. At least, jobs using a computer, for now.

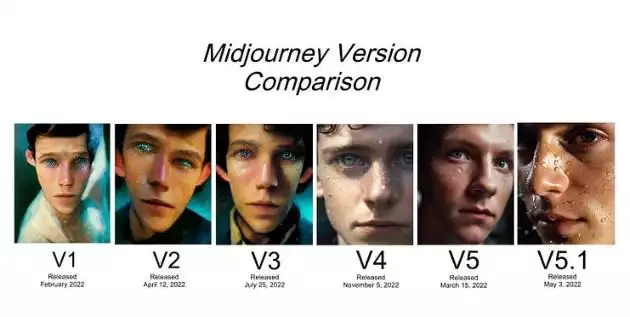

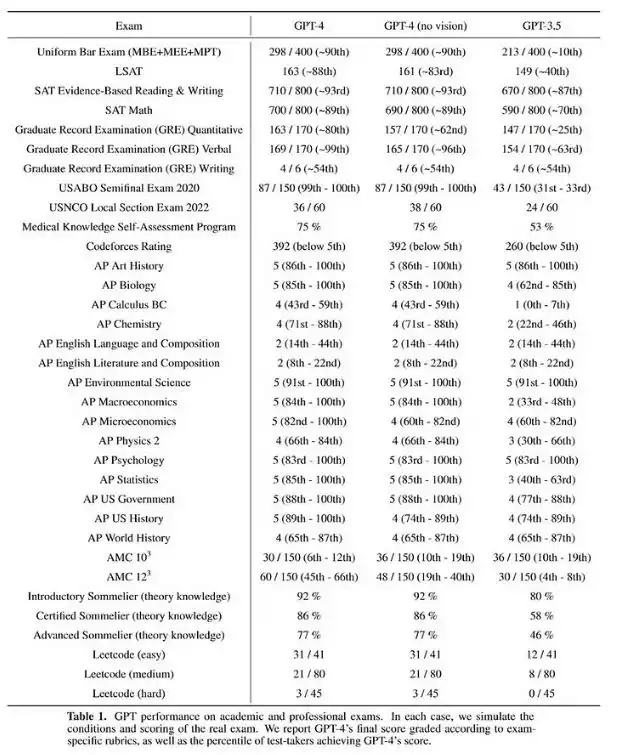

ChatGPT hit 100 million users in two months, the fastest in history. It currently scores in the top 1% in verbal in the GRE, for US grad school, the top 7% in the SAT for undergrad, top 10% in the Uniform Bar Exam, top 12% in the LSAT, and top 15% in advanced placement statistics, art history, psychology and biology.

Source: GPT-4 Technical Report

Every day, the AIs sucks down more data, and every day they’re getting smarter.

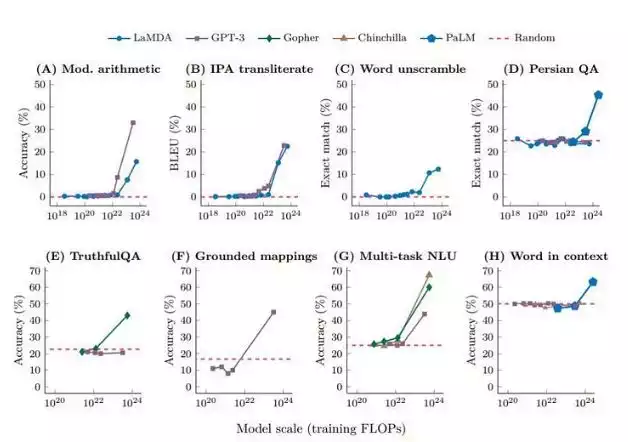

Where it fails, for now, is in what we perceive as creativity. It’s hard to get ChatGPT to crack a joke that isn’t a dad joke. But as we give it more data, we’re seeing intelligent behaviours that we don’t understand and didn’t predict. Scientists are wondering if we’re starting to see sparks of artificial general intelligence. Creativity, heart and soul might just emerge.

Source: Sparks of Artificial General Intelligence: Early Experiments with ChatGPT

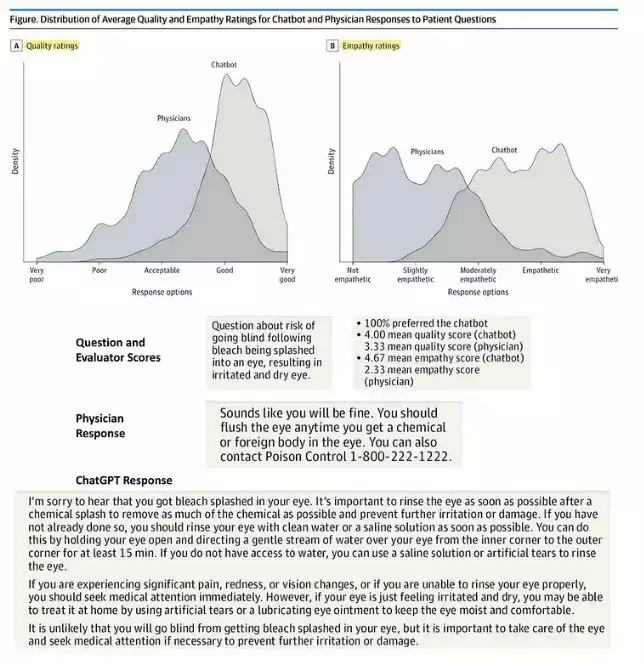

The next biggest job for migrants is being a GP, not that we’ll need as many soon due to ChatGPT. The 8% of the population trying to wangle valium or oxycodone will be happy about that. A study comparing ChatGPT to GPs saw patients preferring the AI 79% of the time with responses four times longer, four times better quality and 10 times more empathetic.

Source: JAMA Internal Medicine

Motor mechanics follow, which electric vehicles need less of, then accountants. I feel sorry for accountants because with OnlyFans models, AI is going to wipe them out.

Half of white collar admin jobs will go. Accounting is rule-based. There’s no room for creativity, or if you’re being creative, the government doesn’t like it.

Source: Goldman Sachs

Half of lawyers are next as, with the exception of deal making or Charles Waterstreet theatricals, most is drafting and ChatGPT can do it better. Instead of paying a lawyer $1200 an hour in 6 minute increments, ChatGPT can write an agreement, letter, patent, research, explain a case, file a suit or fight your parking ticket in seconds, for free.

Minter Ellison, Australia’s largest law firm, panicked first, “Many of our clients have really been grappling with the question of whether the billable hour is the best way to measure our value as professional advisers.” Les jeux sont faits, the game is up. Wads of legal bills annotated with “read email”, pull out template, edit, edit, pretend I did something, “teleconference with partner”, “reply to email” are over.

Frankly, software will be next and even more amenable to LLMs. I told my engineers there’s a chance in 12 months they won’t be writing code, at least not like now. They’ll move ‘up the stack’ more like a product manager, a director or producer.

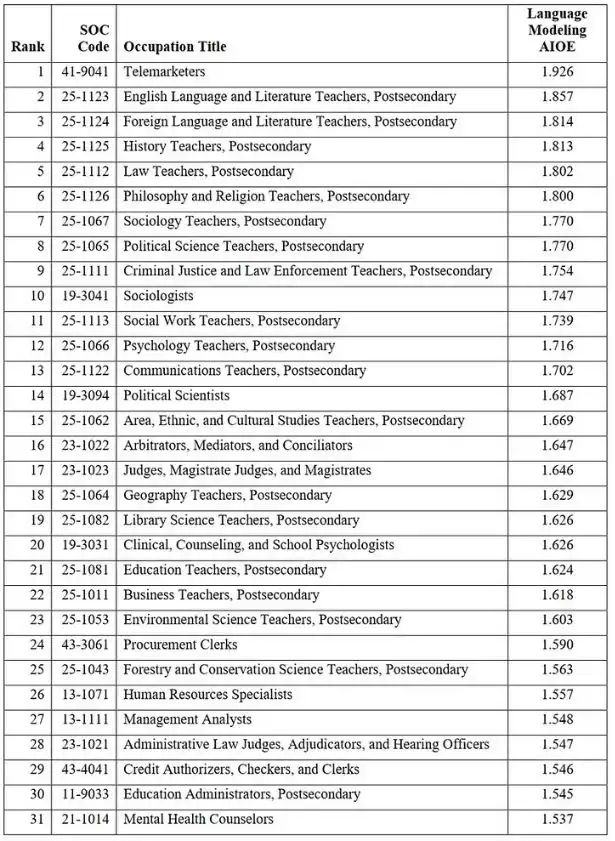

Mass layoffs are coming. We’re going to see the same social displacement and upheaval that the mechanisation of agriculture caused in the 18th and 19th centuries, and mechanisation of manufacturing caused in the 20th century. Only this time it’s with the intellectual classes. The first contributed to the Long Depression of the 1870s, and the latter led to the Great Depression of the 1920s. The higher paying the job, the more vulnerable it is.

Source: Occupational Heterogeneity in Exposure to Generative AI

IBM just announced it’s stopped hiring and that 8,000 jobs in the next five years will be replaced by AI, including 30% of all non-customer-facing roles.

Education, our fifth biggest export, will be heavily impacted. Researchers have found that 19 of 30 jobs most likely to be wiped out are postsecondary teaching. AI can already develop a curriculum better, personalised to a student’s strengths, weaknesses, and learning style. You can now chat to your textbook, as if it were a professor. Chegg, the textbook company, saw their stock fall 48% after they admitted ChatGPT was affecting their business.

Source: Occupational Heterogeneity in Exposure to Generative AI

This might cause a problem maintaining Australia’s scientific edge given teaching cross funds research. But the bulk of immigration is not for that or entrepreneurs that create jobs rather than take jobs. It’s designed for serving us coffees and to keep the bubble alive.

Yet it’s still almost impossible to get a meal in Sydney after 9pm. So rare, that it became a campaign talking point for Dave Sharma and Allegra Spender last federal election after Woollahra Council tried stopping an Indian diner from serving kebabs after midnight.

Source: Daily Mail

This is the same Woollahra Council that launched a Night Time Economy & Footway Dining plan, the result of which was the end of late night dining in Woollahra Council. One might be cynical about the motive given that Double Bay is now an apartment construction site.

Woollahra Council out with their clipboards ensuring nobody has fun

Sydney used to be fun, until developers, politicians, casinos, wowsers, media and councils, shut down 176 venues, by gaslighting the public that violence had “spiralled out of control” when Sydney had just won an award for being the ‘safest and friendliest city in the world’.

Source: Destination NSW, Linkedin

These geniuses knocked down the venues for, surprise, more apartments, planning to move the nightlife to Barangaroo zoned 24x7, conveniently close to the casinos. There, a row of restaurants were built.. which close at 9pm, because they built apartments there too.

Source: Linkedin

Like Captain Renault in Casablanca they were “Shocked! Shocked to find that money laundering was going on here!”, and that the business model of Australian casinos was to launder money out of China, a country whose citizens are prohibited from sending more than US$50k a year overseas and where despite it being illegal to own foreign property outside of China, seem to own a decent number of places in Vancouver, Auckland and Sydney.

Like moving the Powerhouse Museum to a floodplain, every decision is driven by apartments. Just look at an old gig poster to see how it’s changed. You used to be able to go out on a Wednesday to see bands like INX, Midnight Oil or the Hoodoo Gurus from Cremorne to Cammaray, maybe dollar drinks, maybe until 4. You can’t buy anything for a dollar, anymore.

Source: From St Kilda to Kings Cross, Sydney Morning Herald

Which gets us onto the point of corruption.

Transparency International rates Australia the world’s worst money laundering property market, only one of three countries where accountants, lawyers and real-estate agents are not required to report suspicious transactions or do due diligence on customers. New South Wales is the worst state in Australia, where the average price of a house is ‘contact agent’ and the amount paid and beneficial ownership are not required to be public.

New South Wales has 1200 councillors. They’re the best money can buy. Apart from stuffing up fun, the only real power they have is influence over development.

Councillors are paid nothing, $9.5k/year for a small metro, $19k for a regional city. Mayors are paid $10–40k more, unless you’re Clover Moore in which case you’re paid substantially more.

One is asking for corruption when councillors have influence over billions but paid a pittance.

Thus, ICAC is busy: Operation Hector in the Inner West, Operation Galley in Hurstville and Georges River, Operation Dasha in Canterbury and of course, Operational Keppel in Wagga Wagga. Now Ray Williams is claiming senior members of his party were paid “significant funds” to install new councillors in the Hills Shire for a developer.

My parents, ready to retire, own a warehouse in Rhodes, a suburb being bulldozed for yet more apartments. They were content with a well exhibited plan, until one morning, the plan with no explanation suddenly changed for the few who had yet to sell to the major developer.

A road was put through one guy’s land. For my parents and neighbours, controls were gerrymandered with heights, setbacks and FSR such that only a minaret could be built- or sold to the developer at a fire sale price. The kicker? Freedom of information revealed council openly pondering relocating zoning to “deliver these developers a return on their investment”.

Who do you complain to when the Mayor of Canada Bay, General Manager, town planner, major & minor developers and go-betweens are being investigated by ICAC in Operation Tolosa, our local MP found to be engaged in serious corrupt conduct in improperly influencing council decisions an unrelated matter in Operation Witney, and the Premier and her boyfriend are being investigated by Operation Keppel? You can’t make this stuff up.

Tolosa was better than the Sopranos. ICAC, is at the top of their game: surveillance photos of envelopes of cash, a shoebox of cash and rubber bands, and a phone tap of the Mayor’s partner, a councillor from yet another council, gleefully asking if he got his ‘cashy-cashy’.

Source: ICAC

The whole system of development in this state stinks. I would struggle to believe that there was any council where corrupt influence from developers helping councillors build rubber band collections in shoe boxes isn’t the everyday way of doing business.

Thus the challenges for Sydney 2050 are many and complex.

The root of all evil is the cost of property, that squeezes the life and soul out of everything. There is no justification for Sydney being the second most expensive in the world.

With the highest inflation in decades, sharply declining real wage growth, the worst rental crisis on record, overloaded infrastructure, construction blowouts, bureaucracy, mass insolvencies, extreme cost of living and the largest destruction in purchasing power in 50 years- the solution is, as always, more people, despite this being the root cause.

It’s sending the Australian middle and working classes into poverty. It is politically untenable.

Also frankly, I think, morally wrong and a national disgrace.

Source: Daily Mail

At this point, either wages need to go up 50% or house prices need to halve. Businesses can only afford to increase wages if they cut half their staff, and the AI might indeed sack them.

Skilled migration programs can be very beneficial, but they are supposed to strike a balance between meeting labour market needs and ensuring the well-being of both local and immigrant populations. We have a skills shortage in some areas because we neglected skilling up our own citizens, overhauling education and let a brain drain persist for decades.

Australia used to have an economy that made things, but has instead turned into a ponzi dependent on mass migration in order to buy houses, consume things and make us coffee.

The ponzi is in its late and final stage and like all ponzis, unsustainable. The only question is the collateral damage. Many coming here will find that they can’t afford to live, many in search of jobs that we never needed or may no longer exist.

Goldman Sachs predicts AI will take 300m jobs and 25% of all jobs in the US and Australia. New jobs will be created, but will we skill up fast enough before the AI takes them too? If the job uses a computer it can be done better, faster, cheaper by an AI-powered freelancer.

Source: Goldmans Sachs

In short, the country is bankrupt: from the federal government’s $1 trillion of debt through to the Reserve Bank, State, the household and consumer. The piper eventually has to get paid, and only so long can we kick the can down the road. Many debts cannot be paid off, or even serviced for much longer. The options are to default, or inflate them away.

In the 1850s, the discovery of gold near Bathurst sparked the greatest gold rush in history. Half a million came here seeking their luck, igniting a property boom. From 1880–84 Sydney land went up 80% and doubled in Melbourne in ’87. Sound familiar?

Commodities prices eventually soured and banks pulled back lending causing house prices to halve, GDP to collapse and a run on the banks, which depositors had to recapitalise. The crisis of the 1890s was deeper and more prolonged than the Great Depression. If you bought at the top of the market, it took seventy years to break even.

Source: Macrobusiness

Crisis does lead to opportunity, but real issues need to be solved. The die has been cast for economic, social and political instability in the years to come.

Government must find its way back to being of the people, by the people and for the people, rather than a government of bringing in too many people, squeezing the people, and gaslighting & controlling the people.

House prices and the cost of living needs to be urgently addressed, which means immigration needs to slow down. The targeting and quality of such needs substantial improvement. The education, skills, and training of our existing population needs to be lifted, particularly in manufacturing, health, technology and the trades, and to prepare for AI. It needs to be easier to run a business and it’s imperative that we improve the economic diversification, complexity and value-add of our products and services, to drive a real rise in real wages and GDP per capita. There needs to be a significant rethink of how education and healthcare are delivered, and serious regulatory reform in real estate and local government.

Peering through the Overton window, we often find a sideshow setting the agenda, distracting from the real issues: What’s really happening in the world? How is the country really being run? For whose benefit? How is the world evolving, and where are we headed?

More importantly, why can’t you get a meal after 9 anymore?

What you should now realise in reading or watching this presentation is the hopelessness of, quite frankly, ANY Ponzi scheme. Ponzi schemes by their very nature must collapse as there is little to no foundation to the investment or economy. In line with our articles earlier this week the signs are growing that we are in, historically, the latter stages of this. Hard assets uncorrelated or indeed inversely correlated to the financial carnage that will ensue must surely become more and more in demand as the penny drops with more and more people of how this all ends. History is littered with these ‘events’ and only gold and silver have stood the test of each time.