The Coming Return to Zero Percent Interest Rates?

News

|

Posted 30/01/2019

|

10286

Over the past 2 decades, the US Fed has changed position substantially from where it was for most of the post-World War II era. The last two recessions have been different - they have been worse than most, and they were each at least partially precipitated by asset bubble collapses. These collapses were responsible for major investment losses and reductions in household net worth that created persistent spending issues that were not normal features of the typical business cycle recessions seen between the 1940s and the 1990s.

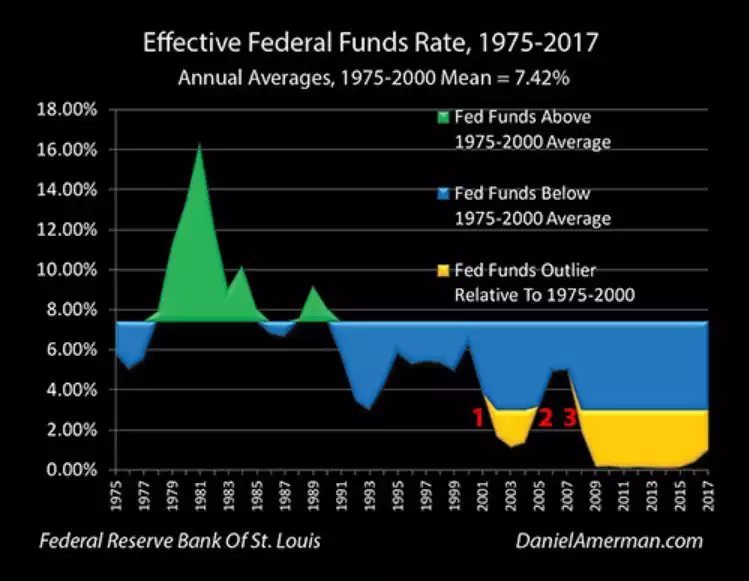

The tech stock asset bubble collapse triggered the 2001 recession and because interest rates started from such a low base at the time, the Fed had to cut rates all the way down to a 50-year low, as can be seen below.

The chart shows Fed Funds Rates that fall in the range experienced between 1975 and 2000 in green and blue, and interest rate outliers - Fed Funds Rates that are entirely outside of that range - in gold. As can be seen by the red numeral 1, in response to the 2001 recession the Federal Reserve knocked interest rates far down into the outlier range.

One of the primary reasons that the real estate bubble formed was the extraordinarily low interest rates created by the Fed's response to the 2001 recession. When the real estate bubble collapsed, it helped to fuel the Great Recession. Unfortunately, Federal Funds rates started at an even lower level than they had been before 2001, and the Fed needed to reduce interest rates all the way down to zero percent in order to exit that recession, as can be seen below.

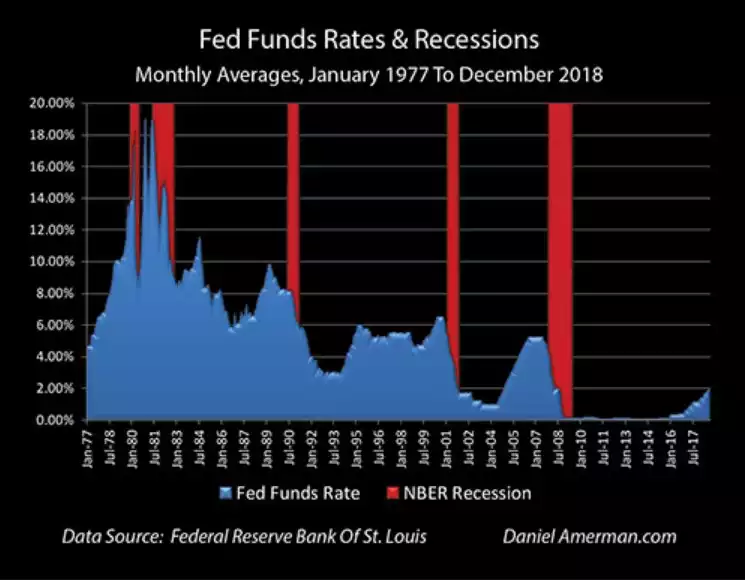

When looking at the chart of recessions and Fed Funds Rates, it becomes clear that from the current levels, when a potential recession hits, the starting point is already historically very low.

We're starting at a less than a 2.5% Fed Funds Rate, and it is a little uncertain what the Fed will do now that we face a possible recession in the next 1-2 years. There are current discussions that the Fed will indeed "pause" in 2019, with no further rate increases. If rates do go up, the probabilities currently look very high that they will not go up by more than 0.5% or so, perhaps 1% at the maximum. Anywhere within that range, from no increase up to a 1% increase, would still result in us entering the next recession with much lower starting interest rates than with any prior recession in the last four decades.

It is very difficult to make definitive statements regarding the economic future, but if there is one statement that can be made with close to 100% confidence, it is that if there is another recession, then the Fed will quickly slam interest rates right back down to zero percent (or less).

Many investors view zero percent interest rates as a bizarre anomaly, which never should have happened, but are now safely in the past. However, if we look at Federal Reserve policy history and assume that the consistent cycle of responses is not broken, as sure as night follows day, interest rates will immediately move right back to zero percent (if not lower).

This cycle has radical consequences for investment prices, leading to significant profits and losses depending on how investors are positioned as events unfold. We are likely to see a series of some of the biggest price changes since the last crisis, and these changes are likely to impact every investment category. Historically speaking, precious metals outperform considerably during such significant volatility and asset repricing, so owning some physical gold and silver as insurance against the uncertainty of a zero percent future makes a lot of sense to us.