The bond bubble v gold

News

|

Posted 05/02/2015

|

6658

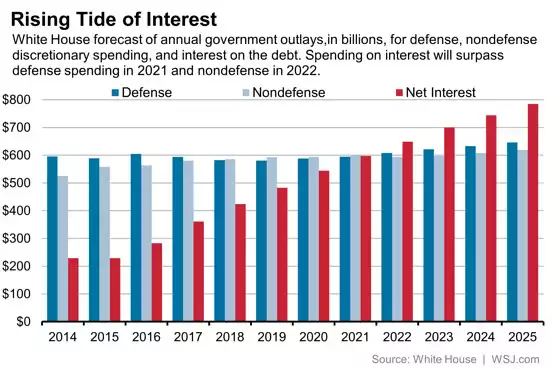

Yesterday we briefly touched on our doubt the US can raise interest rates any time soon or at least by any material, non market appeasing token amount. The graph below, from the White House itself, shows the cost of servicing their over $18t (and growing) debt into the future. This gives just a small insight into why they can’t afford (literally) an interest rate rise. Every 1% increase in rates means around $170b in interest payments per year so the graph below clearly doesn’t factor much in, moreso just growing debt. Indeed you will recall from this earlier article that in just the last 2 months of 2014 the US issued over $1 trillion in new debt (US Treasury bonds) printing money to pay for the previously issued debt (US Treasury bonds) that was maturing. This ponzi scheme bubble is not contained to the US. The world’s nations have issued over $100 trillion in debt, the highest ever and now growing by trillions every few months again because governments continue to spend more than they receive and need to service the already issued debt. Should any of these nations lose control of interest rates the whole bond bubble pops and unlike the sharemarket or property market bubbles popping, it wont be investors going broke, it would be whole nations. The other safe haven to these bonds is gold and silver. They have not gone bust in thousands of years…