That’s Mean! – Hidden Danger of US Corp Debt

News

|

Posted 14/11/2017

|

8206

Just as we wrote recently of the dangers of misinterpreting percentages, so too beware of averages when medians may tell a more accurate story.

Société Générale’s ($1.5 trillion financial giant) Andrew Lapthorne recently addressed the perception that US corporate debt is in an acceptable range because of the average or mean. However he describes US balance sheets as ‘increasingly polarized’ due to the cashed up big caps washing out the highly leveraged smaller guys through averages. He says:

“we have been highlighting for some time now the risks associated with highly leveraged US companies, particularly among the smaller capitalisation names. Our message has been clear; US corporate leverage is abnormally high for this stage in the cycle and a handful of cash-rich mega caps are masking significant problems elsewhere."

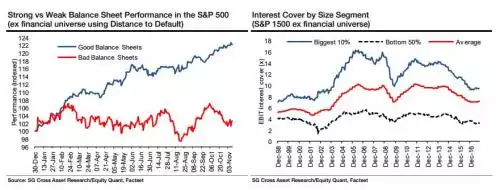

He points out that in the last few weeks this is becoming more pronounced and points out that (and in reference to the graphs below):

"once you peel away the biggest and strongest US companies, the picture is entirely different…..interest coverage for the smallest 50% of US companies is near record lows, at a time when interest costs are extremely depressed and when profits are at peak."

In April this year the IMF sounded a similar warning in their Global Financial Stability report, concluding that over 20% of US corporations were at risk of default should rates rise.

There were some startling charts in that IMF report and we covered it here at the time. It is an article worth revisiting as it again highlights what SocGen are saying. Back then the median net leverage of S&P500 companies was at an all time high whereas the mean was below both the peaks just prior to both the GFC and dot.com crashes.

So let’s fast forward to now… Earnings look to have peaked, market euphoria is at record highs and volatility at record lows, the Fed is widely expected to start their rate rises in just one month and embark on the reduction of their QE-amassed balance sheet. You will be hard pressed to find a balanced financial analyst that doesn’t concede the main reason for this bull market is those same low rates and central bank stimuli…. And now we see a very high percentage of S&P500 companies highly leveraged into this environment, indeed with an all-time high median. So how did SocGen’s Lapthorne conclude his report?

"It is difficult to envisage a scenario in which this ends well."