Talkin Bout My Generation

News

|

Posted 09/07/2018

|

6168

Similar to Warren Buffett, who misses no opportunity to hate on Bitcoin, companies such as Vanguard have no interest in making Bitcoin sound too interesting as an investment. They want their clients to continue to put their money in traditional investment opportunities. There is more behind this than just the discussion around the potential of Blockchain technology however. It is the foundation of an inter-generational conflict.

Millennials, people aged between 18 and 39, are deeply influenced by the last financial crisis. This coincides with the fact that this is the generation which grew up with internet access. A whole range of recent studies have shown that Millennials are the most likely to be interested in crypto assets, and this could play a significant role in the way this space develops in the years ahead, as they become the dominant financial decision makers.

The combination of technological trust and wariness towards the financial system is a dangerous one for providers of legacy investment products. It is to be expected that established players such as Buffet and Vanguard will be become more and more outspoken against Bitcoin. Others such as Goldman have already decided to go a more proactive route and be first in line when it comes to institutions embracing the new sector.

In light of this increased exposure, Blockchain Capital decided to undertake a series of surveys to gauge awareness and sentiment toward Bitcoin and get a better sense of where Bitcoin is in the adoption curve. Some of the key results are highlighted below:

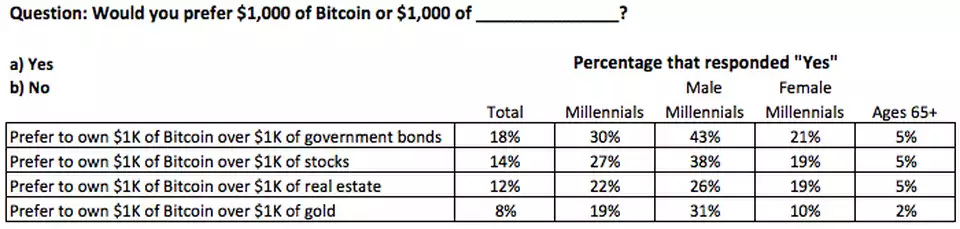

More than 1 in 4 millennials prefer Bitcoin to stocks, 27% of whom said they would prefer to own $1,000 of Bitcoin over $1,000 in stocks. The number was even higher for male millennials - 38% of whom said they prefer Bitcoin.

And it’s not just stocks. Many millennials prefer Bitcoin to other traditional financial assets as well. Given the choice of either $1,000 of Bitcoin or $1,000 of a traditional financial asset, 30% of millennials said they would choose Bitcoin over government bonds, 22% would choose Bitcoin over real estate, and 19% would choose Bitcoin over gold.

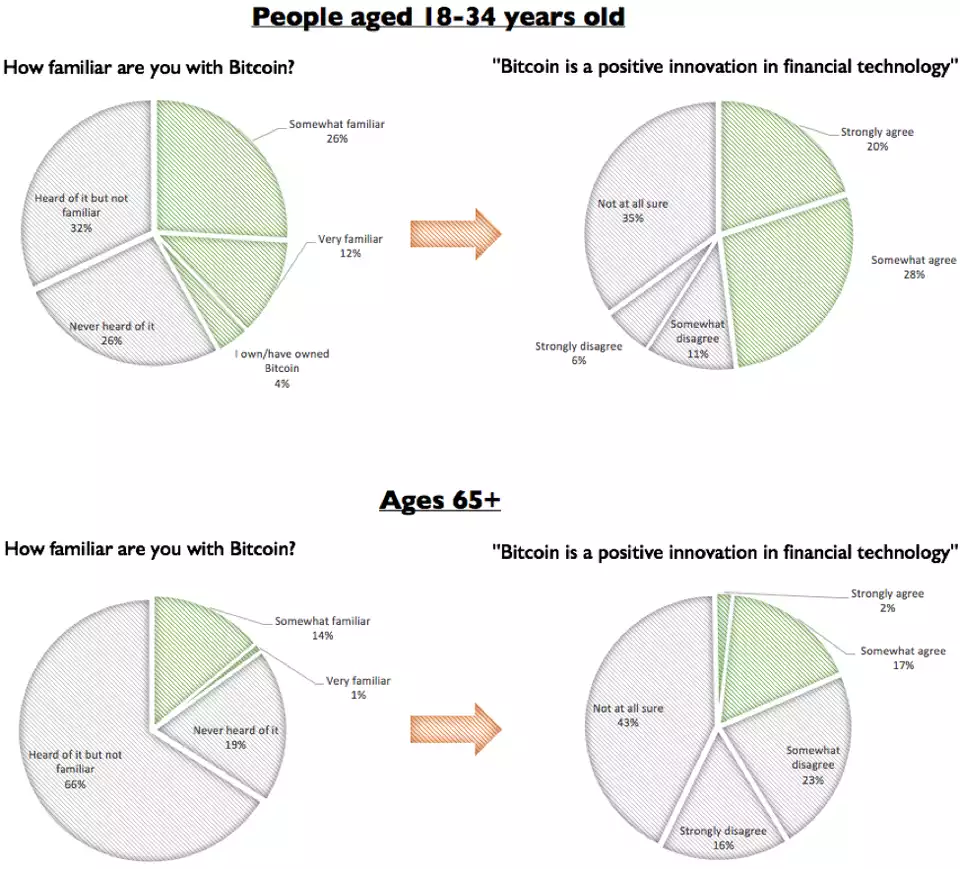

However, the results also show that only 4% of millennials have owned or currently own Bitcoin - indicating there’s a significant gap between preferred and actual ownership rates. If millennials close that gap as their purchasing power increases, it would be a significant and meaningful tailwind for Bitcoin adoption.

Younger demographics are often a leading indicator of the future, especially as it relates to technology. So, what’s going on here? Why is Bitcoin more appealing to younger demographics?

Perhaps as a result of their greater awareness, millennials are significantly more likely to view Bitcoin favourably compared to older demographics.

Millennials don’t seem to view big banks as particularly trustworthy

One particularly interesting insight from the research was the opinions of millennials towards the established banking system. When given the choice of whether Bitcoin or big banks are more trustworthy, millennials choose Bitcoin (8+ year history) over the big banks (400+ year history) at a surprising rate. Overall, more than 1 in 4 millennials (27%) think that Bitcoin is more trustworthy than big banks.

The figure is particularly impressive if we again consider that only 42% of millennials described themselves as at least “somewhat familiar” with Bitcoin. We can reasonably assume that those who identify as less than “somewhat familiar” with Bitcoin (58% of millennials) would not choose Bitcoin as more trustworthy than big banks - or least not at a meaningfully high rate.

Overall, sentiment and surveys, such as those presented here, can give an interesting insight into future trends. Of course attitudes and perceptions can change over time, but it would be dangerous to underestimate the impact that the millennials will have on driving the direction and magnitude of crypto adoption going forward.