Stagflation Signals From Fed

News

|

Posted 03/05/2018

|

8920

It was another wild ride on markets last night all courtesy of the US Fed. Whilst few expected them to raise rates (and they didn’t), it was the change in language in the minutes that spooked the market. In simple terms they are torn between two asymmetric masters – rising inflation and slowing growth. The former normally sees a ‘hawkish’ response (tightening of monetary policy) and the latter a ‘dovish’ response (easing of monetary policy). Go too far either way and you cause out of control inflation or crash the tepid recovery. Combined, and you get stagflation – high inflation but low economic growth. That’s a nasty mix. Accordingly, on the news the USD fell and gold surged. They both settled down in the end but shares had another bad night with the Dow down 174 points.

We are talking subtle wording changes but it’s the first crack in the ‘everything’s awesome narrative’ from the Fed. The Fed’s preferred inflation indicator hit 2% but they ‘modestly’ downgraded their economic outlook.

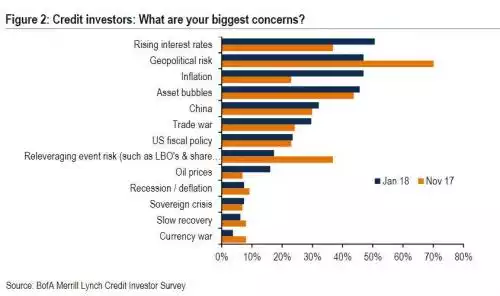

We discussed the market nervousness around inflation and rising rates back in February here and the chart below is a reminder:

That same article reported the turn in the history making fall in the velocity of money that has recently occurred and the Fed will be painfully aware of this as well. Why? Well look at #4 on the list above…. The ‘everything bubble’ is courtesy of all that printed money going to financial and property markets, not the sorts of things measured by the inflation index. The turn in the velocity of money is seeing that change. Last night was just yet another demonstration that the market knows this bubble is at risk either way and is nervous.

Topically, another news piece last night reminds us of what happens when you lose control of inflation and see a loss of faith in your currency. Venezuela’s inflation woes are well documented. In a desperate attempt to have a stable ‘currency’ for international trade they launched their El Petro ‘oil reserves’ backed cryptocurrency earlier this year. They’ve just offered India a 30% discount on their 300,000 barrels per day oil if they pay in El Petro….

At least with Nobel Peace Prize nominee Donald Trump at the helm, clearly all that geopolitical risk at #2 is going to go away….