Smart Money Not Buying Goldilocks

News

|

Posted 06/06/2018

|

10278

There is a truly fascinating thing happening in the US sharemarket right now. Amid mainstream talk of ‘everything’s awesome’ economic buoyancy spurred along by Trump Tax Cuts, the reality behind the scenes is anything but.

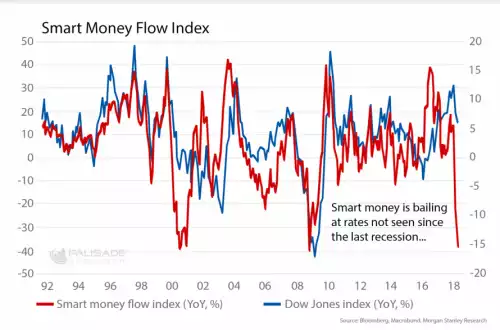

It would appear the so-called ‘Smart Money’ aint buying it. The chart below from Morgan Stanley shows that Smart Money is running for the exit at rates only seen before each of the last 2 crashes…

‘Smart’ doesn’t get any bigger than Bridgewater, the world’s largest hedge fund. Earlier this year they had a net long position in US shares of 120% of assets. Last month they reduced that to just 10%. Why? This is what they said:

“Markets are already vulnerable, as the Fed is pulling back liquidity and raising rates, making cash scarcer and more attractive - reversing the easy liquidity and 0% cash rate that helped push money out of the risk curve over the course of the expansion. The danger to assets from the shift in liquidity and the building late-cycle dynamics is compounded by the fact that financial assets are pricing in a Goldilocks scenario of sustained strength, with little chance of either a slump or an overheating as the Fed continues its tightening cycle over the next year and a half.” And “We are bearish on financial assets as the US economy progresses toward the late cycle, liquidity has been removed, and the markets are pricing in a continuation of recent conditions despite the changing backdrop."

We’ve warned ad nauseum in our articles of the danger of all that monetary stimulus having inflated the ‘everything bubble’ now being unwound. Bridgewater’s warning doesn’t come any clearer.

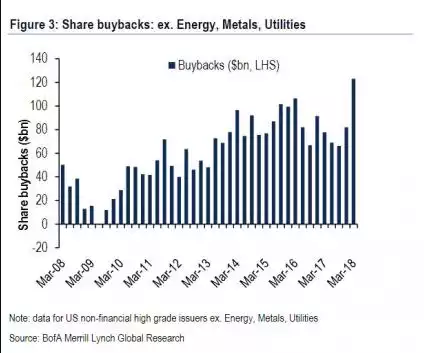

But if all that Smart Money is leaving the sharemarket why isn’t it crashing already? Firstly, you will note it is often a leading indicator, though clearly in the GFC they went down with the rest. But secondly we have just seen a huge spike and record quarter of company share buy backs:

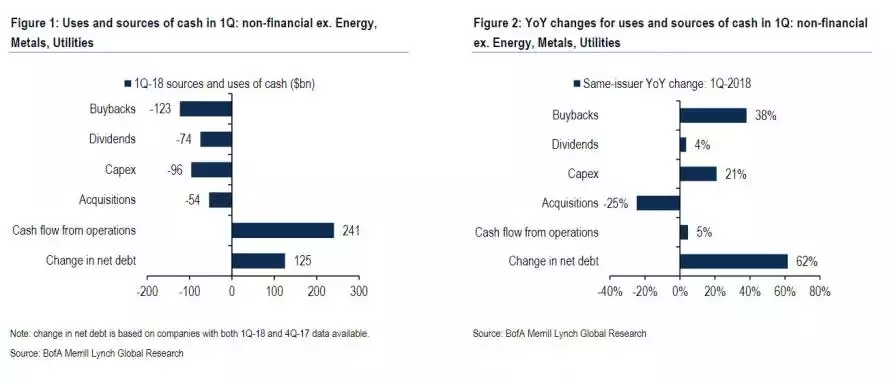

So to be clear, that is companies buying back their own shares to bolster their share price because the smart money doesn’t want to… When Trump announced the company tax cuts it was meant to boost REAL growth through investment of those cash gains into productive things like Capex (capital expenditure). But whilst Capex did increase 21%, buybacks increased almost double that rate at 38%.

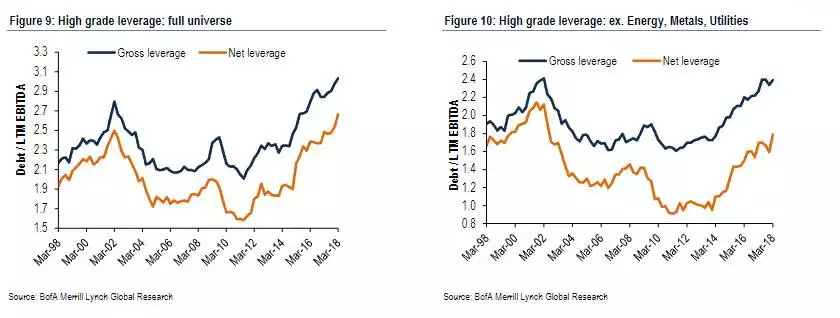

As you will note, the binge on debt continues. BofA illustrates below that these corporates are at debt leverage levels never seen before.

And hence the Smart Money’s concerns. All that debt is fine if ‘Goldilocks’ continues. History suggests that almost never happens. Even the fairytale ironically has Goldilocks wake up from her complacency surround by bears….