Silver Production Under Pressure

News

|

Posted 27/04/2017

|

6258

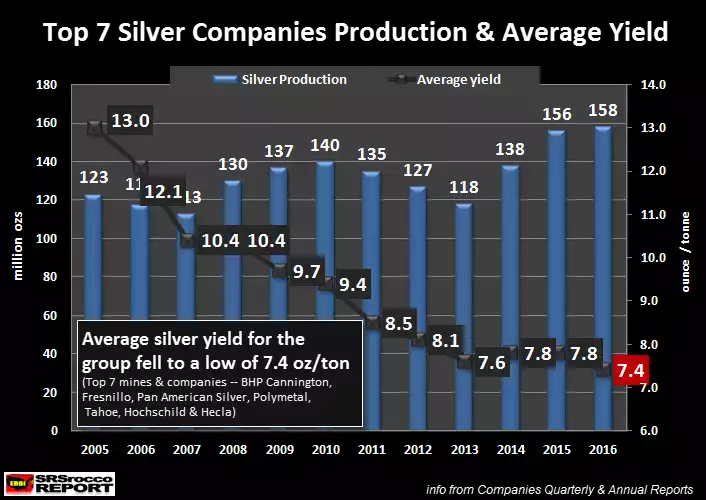

Whilst calls that 2015 saw ‘peak gold’ production seem to have support, the same can’t yet be said for silver. Silver has seen massive inputs from the new Tahoe Resources high grade Escobal mine which in 2014 and 2015 produced an incredible 20m oz of silver. We then saw the ramp up of Fresnillo’s Saucito mine which, when combined with Escobal, saw production amongst the world’s top 7 producers reach a record high 158m oz in 2016. However there is an underlying trend and broader global scope which should have investors paying attention.

Behind those increasing production numbers is a more concerning trend for miners, and that is yield. Despite Escobal’s incredible 16.3oz per ton yield in 2014 (one of the highest recorded) the overall yield amongst the top 7 has recommenced the decline we’ve seen over the last decade with 2016 seeing an all time low of just 7.4oz per ton of material mined.

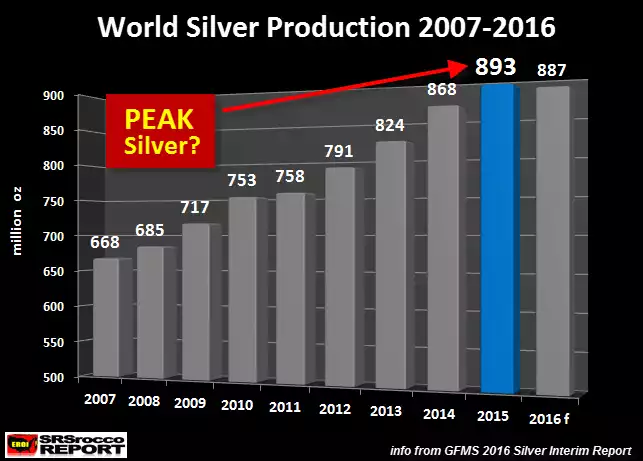

Whilst we don’t have official numbers yet for 2016 the graph below gives the most recent forecast when it comes to total global production (as opposed to simply the top 7 producers above) and raises the question again of whether indeed 2015 saw peak silver production.

Irrespective of whether 2016 does see a drop in production, 2015 certainly saw a marked slowing of growth to just 2% and when combined with the dropping yield is something to keep a close eye on.

It appears silver is getting harder (and hence more expensive per oz) to mine and supply is diminishing whilst demand remains strong. As an investor in silver that is potentially great news.

For your general interest, there were two mines bigger than the aforementioned Saucito in Mexico (22.0m) and Escobal in Guatamala (20.4m), and that was Australia’s Cannington (22.2m) and Russia’s Dukat (22.3m). Australia dropped to 5th biggest producer in 2015 as Russia took 4th spot just as Russia is challenging our second place for gold right now.

887m oz is 27,586 tonne. Total gold mine supply in 2016 was around 3,236 tonne. So we saw around 8.5 times as much silver mined as gold. A little different to a gold silver price ratio of 71 huh….