Silver Price Manipulation?

News

|

Posted 07/08/2018

|

10744

Yesterday we updated you on the record gold short position by the Managed Money sector on COMEX along with US Treasuries as everything is awesome. We omitted silver as there is possibly a whole other story to talk about there. We’ve discussed previously theories of manipulation of the silver markets in particular by the big banks. There were even convictions as we reported last here. Whilst escaping those last convictions, no other bank gets more mentions in this regard than JP Morgan, the biggest non-asian bank in the world at $2.5 trillion in assets (remembering assets include loans).

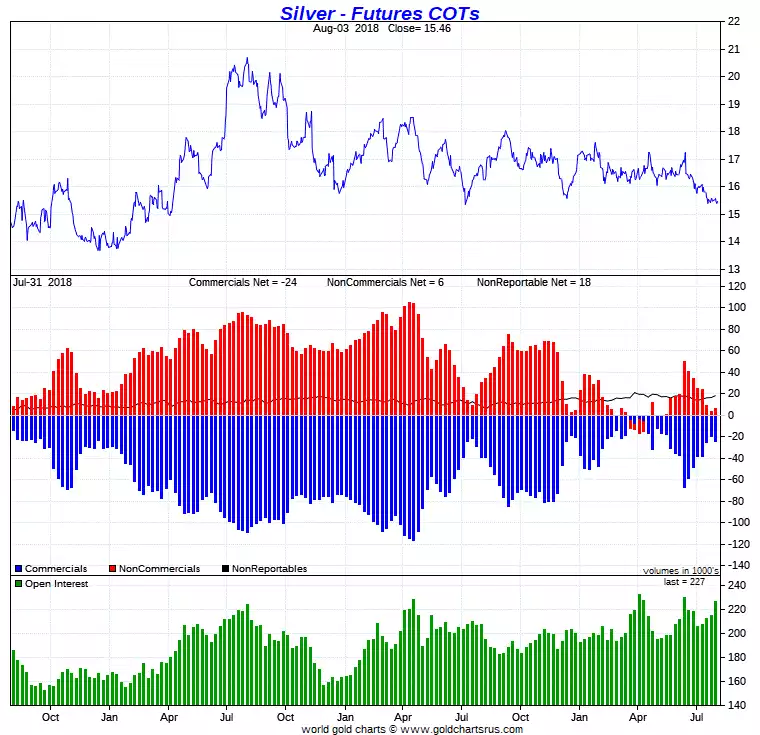

So let’s look at the current Commitment of Traders report from COMEX in silver:

We’ve discussed previously this epically bullish set up (here). The above is similar but with even higher Open Interest. But where do JP Morgan sit in this? COMEX analyst Ted Butler estimates that JP Morgan’s short position (in the blue bars) is around 20,000 contract or 100m oz of ‘paper’ silver. That puts them at around 33% of the entire short position of the so called Big 4 commercial traders. 100m oz also represents around 11% of the entire global silver annual production figure… all in paper…. AND, as you can see in the chart, this position is a mere fraction of what they held just a couple of months ago.

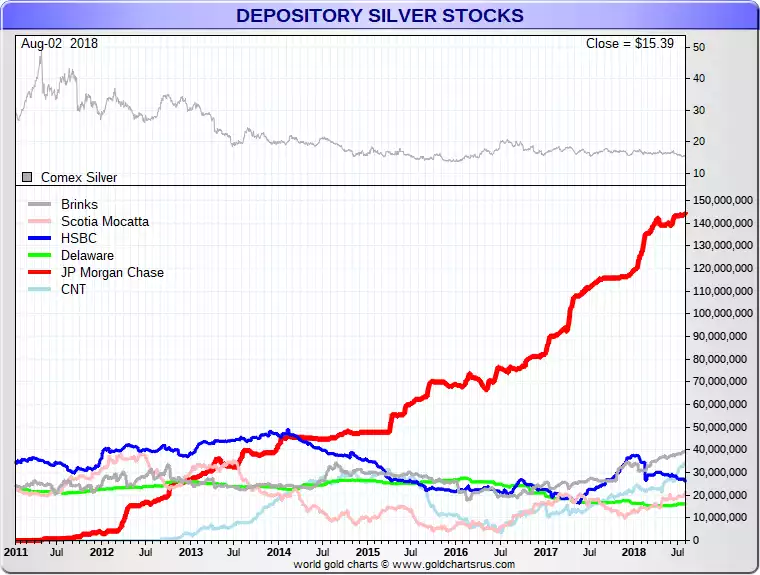

So JP Morgan hold this massive paper short contract meaning a massive bet on the price declining. So you’d think that would mean they are pretty bearish on silver yeah? So explain the following:

Yes, you are reading that right. JP Morgan hold around 145m oz (4,510 tonne) of PHYSICAL silver in COMEX. Those countering the manipulation theory contend it is completely normal to have a paper hedge against such a big physical holding.

However the manipulation theory goes, that if you were one of the world’s biggest banks with $2.5 trillion dollars exposed largely to financial and property markets, and you escaped collapse in the GFC but learned some lessons, then wouldn’t it be cool if you used your massive book and the spoofing techniques outlined in the above link to short the paper silver market for years on end whilst amassing your own physical pile at the bargain prices you helped create as the ultimate insurance hedge. When things get nasty, you could, say, take your foot off the price and let silver take off and enjoy the benefits of holding 4,510 tonne of the stuff…. Along with everyone who has patiently held and bought up cheap just like you…

A possible sign of beginning that process would be greatly reducing your short position which may well be why we normally see the price rise soon after such a juncture as we are looking at now.