Silver Manipulation Exposed – Curse or Opportunity?

News

|

Posted 09/12/2016

|

8115

As we reported today in the Weekly Wrap, Deutsche Bank have entered an early settlement now on rigging gold fixing as they had already done in silver fixing…. “Just two months after paying $38 million to settle a silver price-fixing case, Deutsche Bank agreed to pay $60 million to settle a private U.S. antitrust litigation by traders and other investors accusing the German bank of conspiring to manipulate gold prices at their expense.”

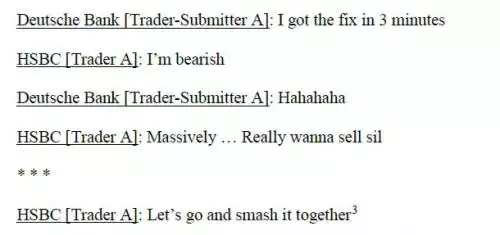

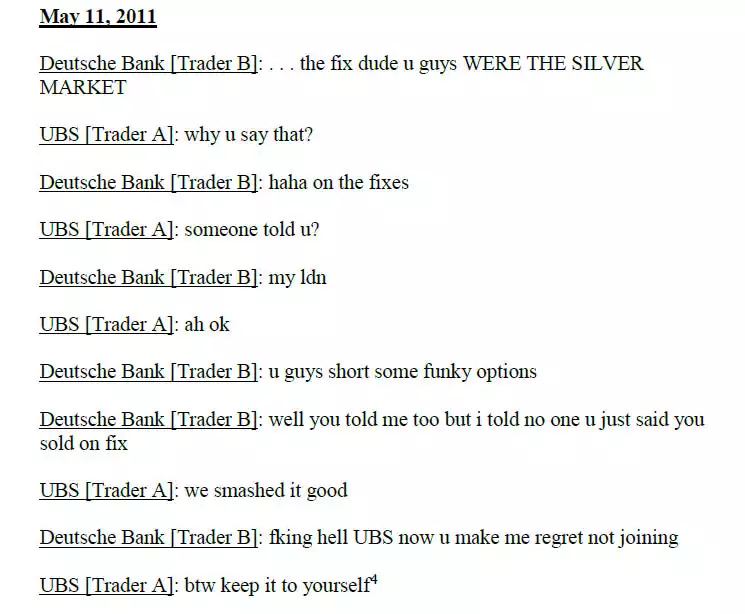

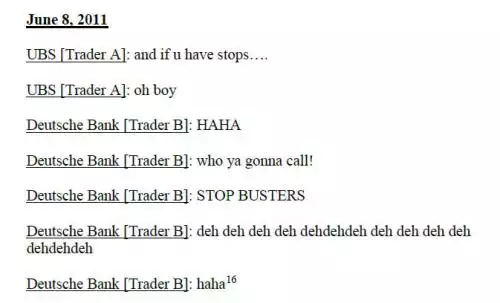

What has come out this week however is release of the evidence they have presented on the current list of UBS, HSBC, and Bank of Nova Scotia, but now also implicating Barclays, BNP, Standard Chartered, and Bank of America. It’s also the first time we’ve been given insight into how they have colluded to do this with the following extracts:

All sounds fun huh? The problem is, this manipulation has at times suppressed silver prices meaning real losses for both miners and investors (having to sell at that time) alike. Great if you’re buying but plain criminal on any level. The Plaintiff’s Lawyer summarises as follows:

“UBS was the third-largest market maker in the silver spot market and could directly influence the prices of silver financial instruments based on the sheer volume of silver it traded. Conspiring with other large market makers, like Deutsche Bank and HSBC, only increased UBS’s ability to influence the market.”

In addition to the above transcripts apparently the evidence outlines the various techniques used “included sharing client order books, how to trigger client stop-loss orders on their own books, and the oversimplified but commonly used term “spoofing”. Spoofing is essentially bluffed orders with no intention of honouring the bid or offer if called on it.” (Vincent Lanci)

Of course the silver and gold fix rigging is incredibly small in scale by comparison to the LIBOR fix scandal that saw nearly $8 billion in fines to banks manipulating it last year, over $3b of that was to Deutsche Bank again.

Whilst cold comfort to anyone who had to sell their silver during these periods it should come as good news that this may well be stamped out for current owners and potentially still represent a once in a lifetime buying opportunity as well. It’s probably coincidence but silver has demonstrably outperformed gold since this was released with the Gold:Silver Ratio dropping from 73’s to now just 68.7 at the time of writing. As a reminder, that is still a LONG way off the circa 45:1 100 year average, lows of 30 in 2011 and 18 in 1980. We wrote about the GSR here when it was 83 just before it topped at 84 earlier this year.