Silver Explodes, “Perverse” Central Banks, Yield Curves Invert Deeper

News

|

Posted 28/08/2019

|

12674

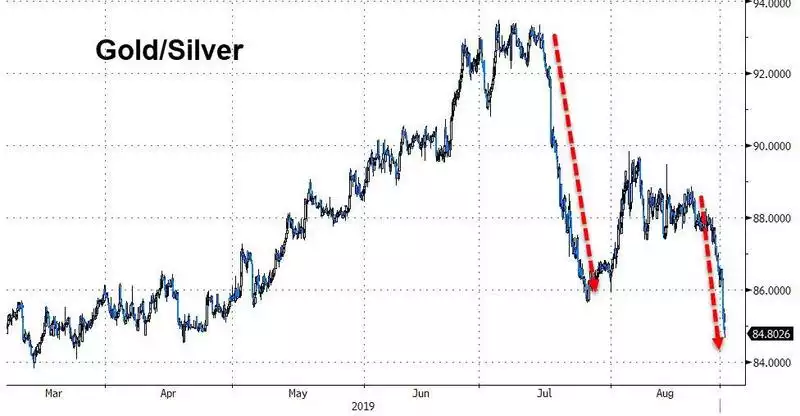

There appears no stopping this gold and silver rally gaining real traction with silver up a whopping 3.4% or 90c overnight and gold up 1.2% or $28 in tandem with red all over Wall St. The gold silver ratio dropped to 84.7, now down nearly 10 from its 94 high in July but well off that 45 average and more importantly wherever it finds its base after the reversion (30 in 2011, 18 in 1980).

Last night’s move by silver saw it narrowing in on gold which is up $485 or 27% off its April low this year compared to silver now up $5.32 or 26%. Silver is now at its highest price since July 2016 (April 2017 in USD terms).

It wasn’t just gold and silver either, bonds continued to rally and we saw yet another inversion of both the 3m10y US Treasury curve together with the all important 2y10y falling to the most inverted since Lehman Brothers collapsed and the GFC went next level. Indeed that 3m10yr curve is just as ominous with David Rosenburg tweeting overnight:

“We now have had three months of a 3-mo/10-yr yield curve inversion. The track record this has had in predicting recessions: 100%.”

There is most certainly growing concern globally amongst more and more ‘mainstream’ players around the effects of the monetary stimulus agenda of central banks. Big bank after big bank is coming in bullish on gold with Goldmans, UBS and BofAML just in the last week calling for higher gold prices from here. As BofAML said:

“ultra-easy monetary policies have led to distortions across various asset classes……..it also stopped normal economic adjustment/ renewal mechanisms by for instance sustaining economic participants that would normally have gone out of business……We fear that this dynamic could ultimately lead to "quantitative failure", under which markets refocus on those elevated liabilities and the lack of global growth, which would in all likelihood lead to a material increase in volatility……At the same time, and perhaps perversely, such a sell-off may prompt central banks to ease more aggressively, making gold an even more attractive asset to hold.”

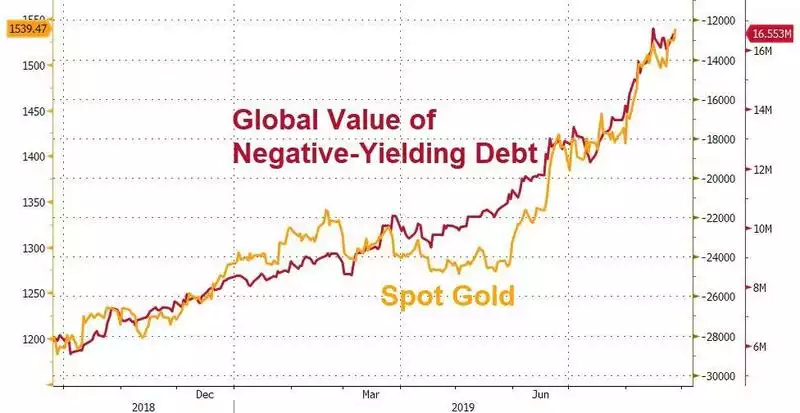

Consider Exhibit A:

In other words the central banks’ preoccupation with avoiding a recession at all costs as opposed to allowing natural business cycles to play out is just creating a bigger and bigger bubble that will have a bigger and bigger pop. One could assume that they know this next recession, or importantly the financial crisis it will herald, may be the worst in history and don’t want it on their watch. It’s a God complex that will hit us all hard when it fails. The enormity of this situation was succinctly summarised by Bank of England head Mark Carney at the global central bankers ‘love in’ at Jackson Hole this past week:

“Past instances of very low rates have tended to coincide with high risk events such as wars, financial crises, and breaks in the monetary regime.”

Breaking that down, we currently already have heightening geopolitical tensions threatening war, markets teetering at all time highs with record inflated valuations, and safe havens such as gold rallying. On the ‘monetary regime’ breaks, Carney added fuel to that fire by suggesting the need for a crypto based blended currency to replace the USD. This is all about to get very interesting. Those with gold and silver will sleep much easier as it plays out.