Serious Headwinds for the Aussie Dollar

News

|

Posted 03/04/2018

|

8098

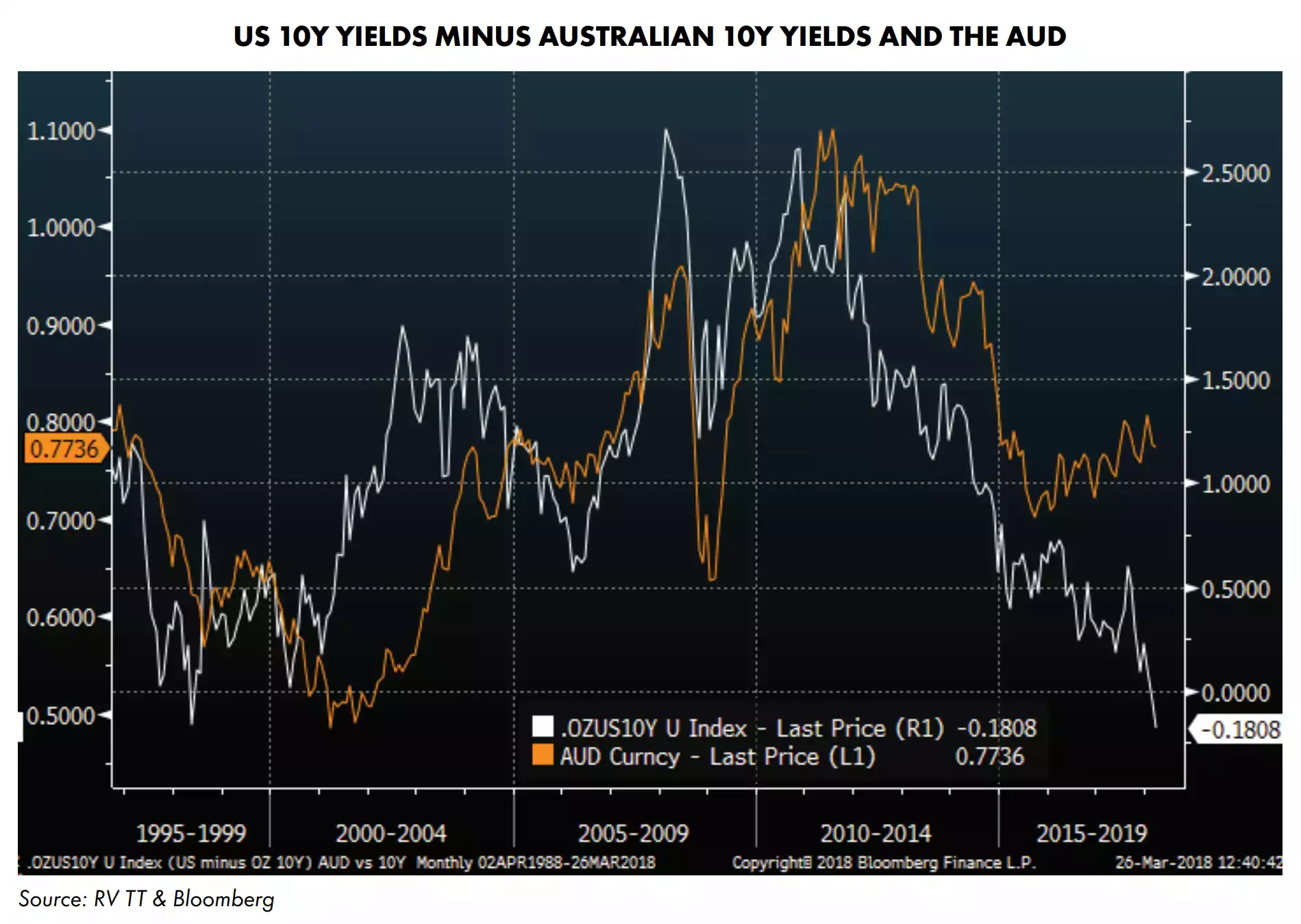

Recently the spread between the Australian 10-year minus the US 10-year bond yields has fallen to the lowest level in over 30 years. Despite this, the Aussie Dollar (AUD) has been remarkably resilient. Several economists have commented that this is largely on the back of an historical “certainty” that Australian debt was always a sure thing if you were an international investor, as you always received more return than pretty much anywhere else with the security that the Australian investment environment provided. This may now be a thing of the past.

The AUD has been moving higher in a generally upwards trend channel against most of the other major currencies over the past few years. Beyond the better yields, a lot of this has been attributed to the return of strength in commodities with relentless growth from China. This has changed recently however, with copper starting to struggle, and iron ore prices seem to have begun a rolling over process. European resource stocks have also broken their 2-year uptrend which would provide further evidence that the demand from China may be starting to weaken.

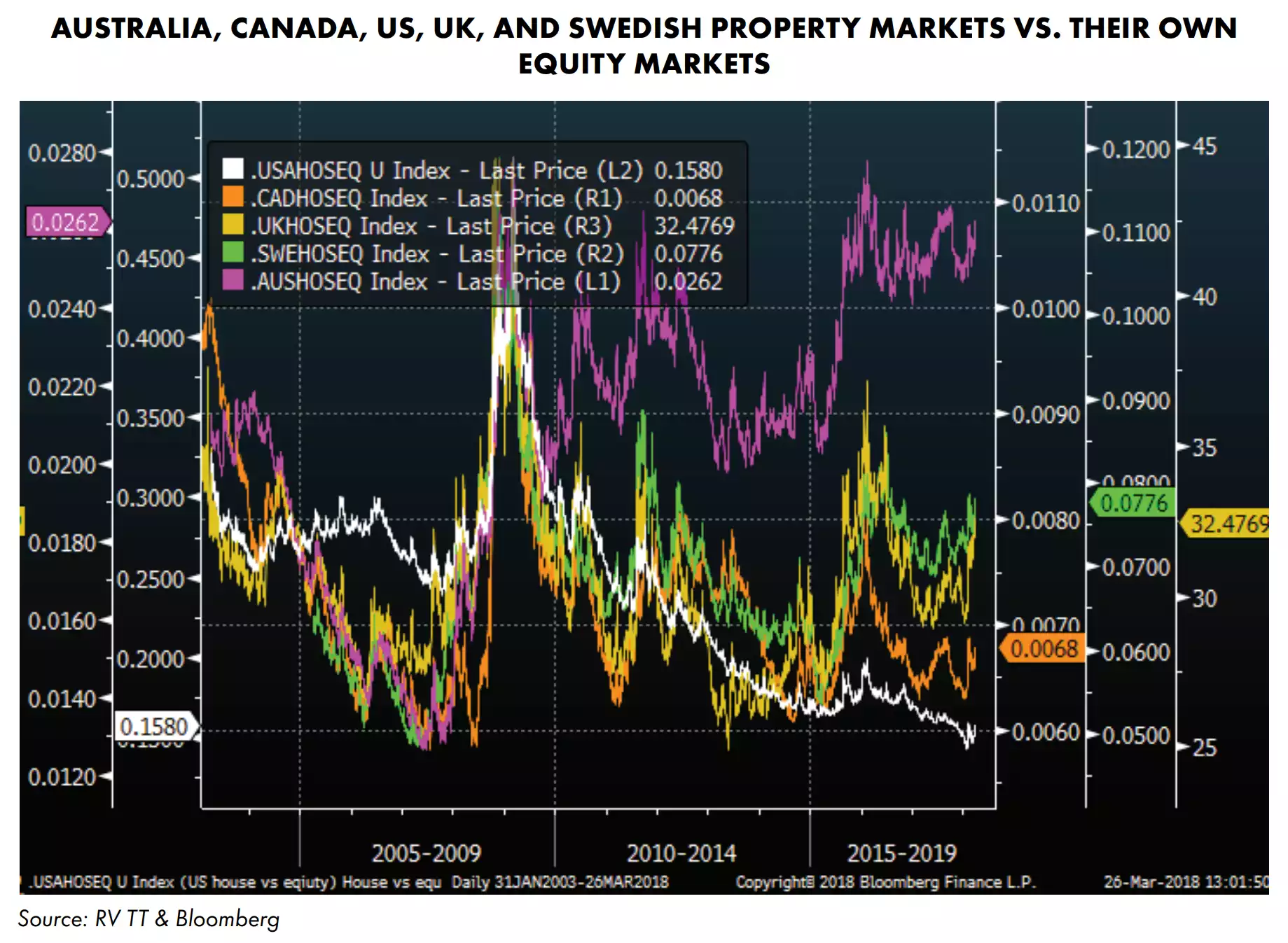

Australian banks could be at particular risk from a broader slow-down in China as there is a strong correlation to the performance of the banks and the inflows accruing to superannuation funds which are highly dependent on continued global and Chinese growth. This is further compounded by the risk of higher global yields generally which would put pressure on the local property sector. As the chart below shows, Australian property already looks extended compared to our equity market, more than in other countries, which themselves are also significantly stretched by historical standards.

The support for the uninterrupted growth of the Australian economy appears to have been primarily provided by a property bubble inflating on top of a mining bubble, built on a commodities bubble, driven by a China bubble. In other words, there has been a lot of luck involved (we are the “lucky country” after all), but signs are indicating that our lucky free ride may be just about to end.

For now, the AUD remains relatively strong, but it is worth keeping a close eye on as early weakness would be a significant lead indicator that Australia, as a major beneficiary of global capital flows, is about to face headwinds too strong to shrug off. In that case the currency could lose its long-running stability on the back of coordinated global growth. This would provide yet another reason to consider the diversification benefits of precious metals and crypto as a hedge against currency risk, as a sudden and unexpected drop in AUD purchasing power could be very damaging if you are holding a traditional domestic/AUD focussed asset portfolio.