Russian to buy gold…

News

|

Posted 17/12/2014

|

7449

Russian to buy gold…

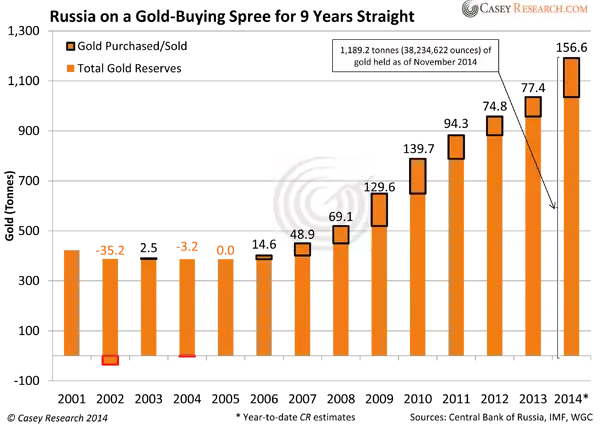

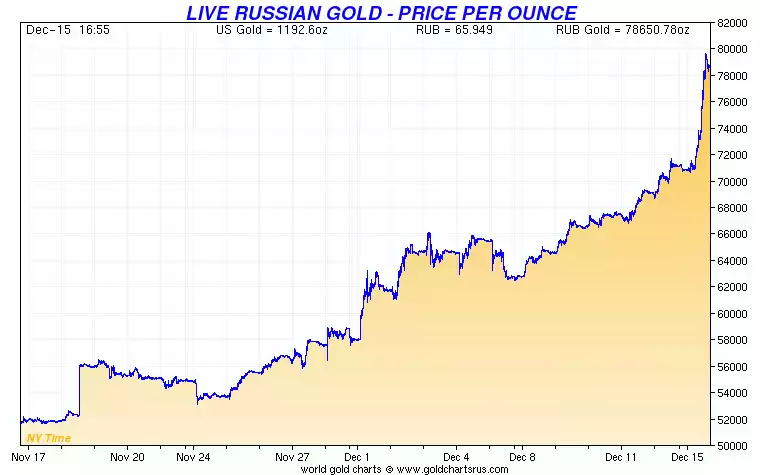

Markets were a flutter the other night as rumours spread of Russia selling its gold to counter its falling Rouble. It now appears this was complete rubbish and you can read why here. In fact Russia has been one of the bigger purchasers of gold since the GFC, as the 1st graph below attests, and now has the 6th largest holding in the world. If you missed yesterday’s news they are also getting out of US paper. Russia has a raft of problems of late, lead by sanctions and now a falling oil price for the world’s biggest producer. The Venezuelan President said what everyone is thinking this week – that the Saudis are trying to cruel Russia (many believe it is also designed to cruel the high cost, highly leveraged shale oil industry in the US leading some to say US oil loans will be the GFC1 US subprime housing equivalent for GFC2). Tensions of war rose this week too as the US passed, very quietly, an act which authorizes "providing lethal assistance to Ukraine’s military" as well as sweeping sanctions on Russia’s energy sector. Their Rouble has the honour of being the world’s worst performing currency, literally halving in value which lead them to make the shock announcement yesterday of increasing their interest rate from 10.5% to 17% in one hit to try and salvage it. The second graph below depicts clearly the wealth preserving benefits of gold against a falling currency; something Aussie investors should take close note of. Finally, I am midway through reading “The Colder War” by Marin Katusa and can highly recommend it (so far) as an entertaining and educational read on Putin’s great plan and, between the lines, why holding physical gold is a good move. It puts a lot of what is happening right now into clear context and it is clear only a fool would write Russia off. Just note I’m reading the iBook version and could not find a book shop in Brisbane that hadn’t already sold out (restocking in Jan apparently).