Risk Versus Reward For Australians. Where Are We In The Bigger Picture?

News

|

Posted 28/07/2017

|

7932

From time to time, it is useful to take a break from the daily news cycles and short term trends in order to facilitate a broader look at what we are attempting to achieve when considering financial allocations.

Ultimately, investing is about making decisions that balance the risk versus reward ratio with an individual’s risk appetite. The risk/reward ratio is a measure of how much risk or potential loss an investor is taking on compared with the potential upside or gain. Typically, the further out on the risk spectrum an investment is, the more potential reward it is exposed to.

Selecting a financial investment that is of a suitable risk exposure is predicated however on the ability to choose from an appropriate selection of investments on the risk spectrum. Such a selection is not always available however and in modern times, finding investment instruments that provide a reward commensurate with the risk exposure is arguably an extremely challenging task.

Overnight, the founder of Casey Research, Doug Casey, summed up the current financial risk versus reward landscape nicely when speaking with Daniela Cambone of Kitco.com

“The most important thing at this time is preserving capital. Yes you could speculate in the stock market and possibly make perhaps five to fifteen percent but at the risk of losing half of everything. You can’t be in the bond market, that’s in a super bubble. You can’t be in real estate, it’s illiquid and in a bubble in major cities around the world. This is a twilight zone situation we have right now. The best place to keep your money is in gold, not for capital gains but for preservation of capital.”

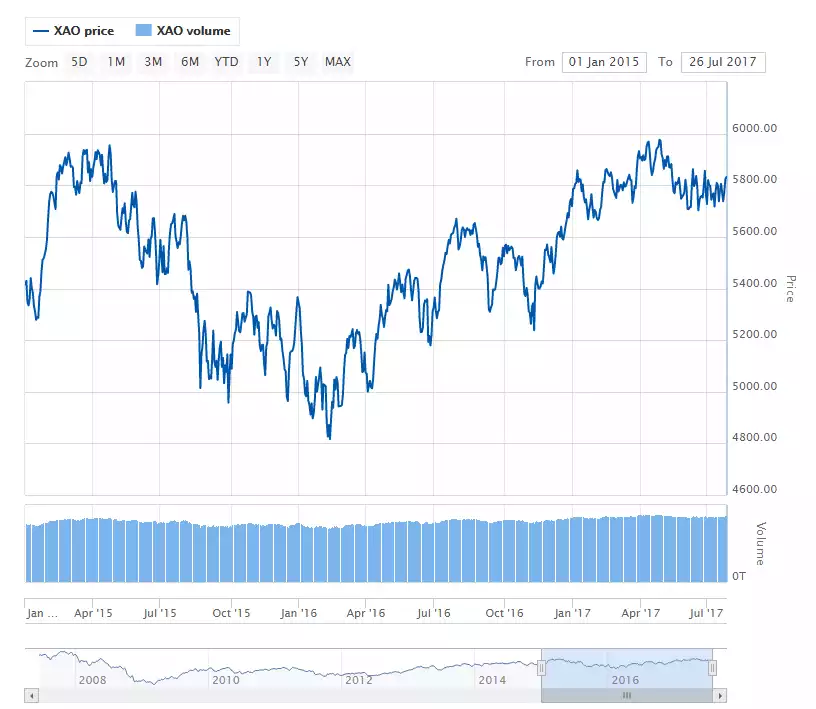

To explore the risk involved in not pursuing a capital preservation allocation at the moment, let’s first look at equities. Unlike the US equity markets, labelled by Gregory Mannarino of traderschoice.net overnight as “massively overvalued”, Australian equity investors are experiencing something a drawn out sideways grind. There has been very little reward for the risk of equity exposure in recent times.

Exemplifying this below is the YTD plot of the All Ordinaries which clearly shows the market’s stagnant performance. Expanding this plot to show the XAO performance since the beginning of 2015 shows a decidedly sideways trend as pictured subsequently. As these plots are not inflation adjusted, a sideways equity grid actually represents a loss in real terms. In fact the index hasn’t seen a 59xx handle since early May and has hence arguably provided insufficient reward for the risk.

When we speak of “the risks of equity exposure”, we refer to the damaging effects of market crashes on long term wealth. This is no better illustrated than by the plot below produced by Jeff Clark, Senior Precious Metals Analyst at goldsilver.com. Jeff’s analysis shows that the time to recover capital from major S&P 500 crashes over the last century is often well over a decade.

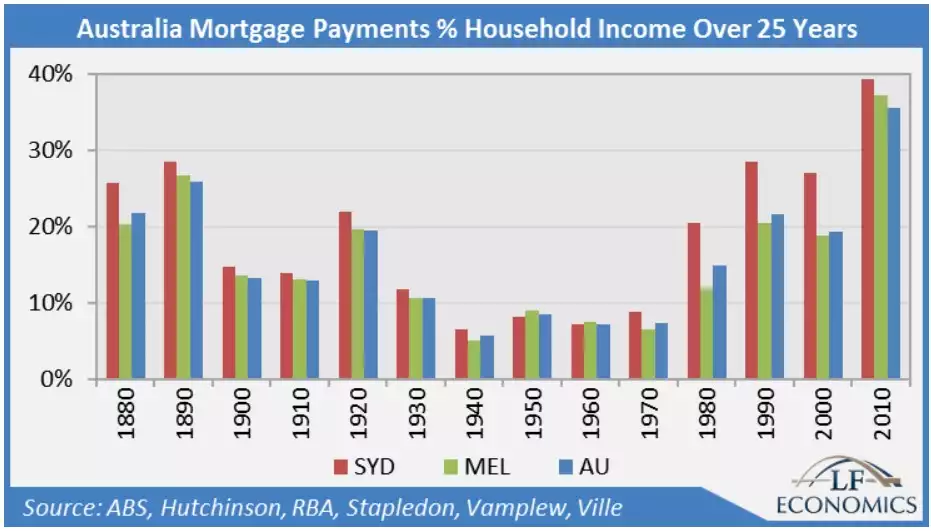

Property is also widely held as an expensive investment instrument at the moment. Aligning with Doug’s comments come those from Lindsay David and Phil Soos of LF Economics who two days ago published an assessment of Australian housing affordability. Measured by mortgage payments as a function of household income, the publication claims that Australian housing affordability is now at its worst level in 130 years as pictured below.

Given the currently historic lows in interest rates, the inflated mortgage to income figures are obviously representative of inflated housing prices given that wages are stagnant. Those already in the property market may have seen good “on-paper” gains but to continue to hold these assets or to consider acquiring them at this time is again an arguably high risk, low reward proposition.

Returning to Doug Casey, “the US Government is running a cash deficit of $1 trillion a year. Where are they getting the money to finance that? The Chinese aren’t buying paper anymore; they’re basically selling it all to the Federal Reserve. It’s not going into the economy at large, it’s going into the financial markets. We’re at the edge of a precipice, which is where we have been for the last several years.”

Doug also notes that “gold is the only financial asset that at the same time isn’t someone else’s liability. It’s not a speculative vehicle; it’s savings in the most basic form.”

It is important to remember that savings play a critical role in long term wealth accumulation cycles. A savings vehicle protects capital against high risk, low reward periods to ensure that wealth survives in order to be deployed again when a more amenable environment returns. In no uncertain terms, Doug is telling us that gold alone is that savings vehicle.