Rick Rule – Triple Gold Demand

News

|

Posted 14/07/2021

|

9458

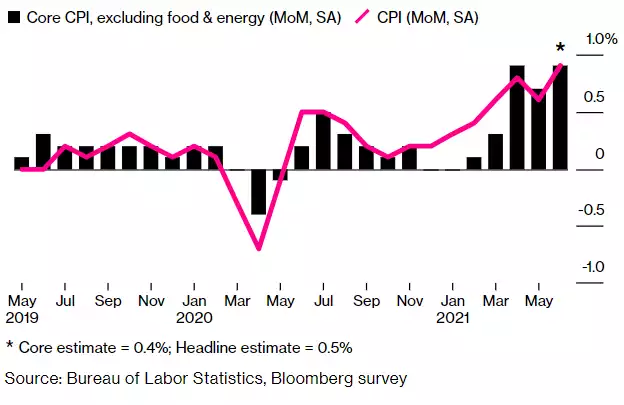

Whilst today we share some excellent insight from Rick Rule, first the important context. Last night saw the 3rd red hot inflation print out of the US in a row. Against expectations of 0.5% the US CPI jumped a whopping 0.9% just for the month of June, nearly double ‘expert’ expectations, its highest print since 2008, and up 5.4% from June last year. Core CPI (excluding food and energy) rose 4.5%, the highest print in 30 years. In the three months to June, core CPI increased more than 8% annualised, the fastest since the early 1980s. Importantly too, this isn’t seeing a flow through to wages yet with inflation-adjusted average hourly earnings falling 1.7% in June after slumping 2.9% a month earlier. Still think this is transitory?

The market’s reaction was very interesting. There seems a slight move away from the ‘transitory’ belief / narrative. Shares fell, gold rose and the USD rose. Topically on the dollar, and as a reminder of this market absurdity, let us rephrase that. On the news that the dollar is being devalued at a 3 decade high pace, the dollar price surged…. The same can be said for shares which fell on the news that would ordinarily be interpreted as bullish for the economy. But it’s not is it? Rising inflation, if not transitory, will mean rising rates and the market is burdened by an amount of debt that simply cannot handle that. Period. The Fed WILL increase monetary stimulus to stop it.

And so what of bonds? They whipsawed but tellingly, we ended up with higher short term yields and falling longer term with the ‘mid’ 10 year US Treasury marginally down. However right at the end of the day there was a disastrous 30 year UST auction which dragged all yields up to end the day higher and the ‘transitory’ inflation narrative seriously questioned when the rubber hit the road.

So why did gold rise? It would be hard to put it better than the legendary Rick Rule, recently retired CEO of Sprott US Holdings, courtesy of a recent interview with Real Vision.

“Precious metals, but particularly gold, do well for many reasons, many reasons having to do with fear, but most specifically, a fear of the efficacy of the ongoing purchasing power of one's savings in conventional savings assets, particularly assets denominated in US dollars, the world's reserve currency. This is a bit of an American-centric answer, but the truth is that the dollar is the world's reserve currency and the US 10 Year Treasury is the savings instrument against which all other securities are priced.

The reasons for concern about purchasing power savings denominated in US dollars are I believe, from my own point of view, well-founded. Let's go through them. The first is quantitative easing. Jack [interviewer], if you did it, it would be called counterfeiting. If you decided to print up ‘jacks’ and use them as specie, you would be put in jail unless you were a congressman, in which case, they would be very popular and get you re-elected. Popularity or not, quantitative easing is in fact counterfeiting that makes people nervous about the efficacy of the security, printing more of them with no backing is not a good thing.

The second that's more pernicious, debts and deficits. I pointed out the last time that I was interviewed by Real Vision that the on balance sheet liabilities of the US government number is higher now at $28 trillion, are basically unserviceable. Think about servicing $28 trillion with a budget of $3 trillion a year in deficit. When you're in a hole, you're supposed to stop digging, but we keep digging. The problem, though, Jack, is not the on balance sheet liabilities, but rather the off balance sheet liabilities.

Off balance sheet liabilities, like entitlements. The net present value of those liabilities according to the Congressional Budget Office exceeds $120 trillion. If you combine the on balance sheet and the off balance sheet liabilities that we allegedly owe each other, the number comes to $150 trillion, which is just plain unserviceable. That makes people nervous about the purchasing power of savings denominated in US dollars too, both from a crowding up perspective but more particularly, from a credit quality perspective.

The third is the most important reason of all, negative real interest rates. My friend Jim Grant, who I believe you have interviewed describes the US 10 Year Treasury as "return free risk". Think about the arithmetic around the US 10 Year Treasury. At present, today, I think they pay you 135 basis points, 1.35% in a currency that by their estimation is depreciating by 4.5% a year. That means for the first time in your young life, your government has told you the truth, if you give them money, they will give you back less, they guarantee it.

Negative real and lower nominal interest rates are, from my point of view, the prime reason why we are in a precious metals bull market, and I see them continuing. I don't see that they have the ability to, as an example, pay higher interest rate on the government debt or let higher interest rates permeate through the rest of the economy. I think they're trapped with negative real and low nominal interest rates. But there's one more reason too, and that's precious metals market share.

The market share in US markets of precious metals and precious metal securities is about one half of 1%. That is the market share of total investment savings assets and estates comprised of precious metals and precious metals related assets is a little below one half of 1%. The three decade mean exceeds 1.5%. Gold doesn't have to win the war against the US dollar. It just needs to lose less badly. It needs merely to revert to mean.

Where precious metals and precious metals related assets to return to mean, demand for them in the largest savings and investment market in the world would triple. That's precisely what I think is going to happen.”