Rest in Suisse

News

|

Posted 07/10/2022

|

15480

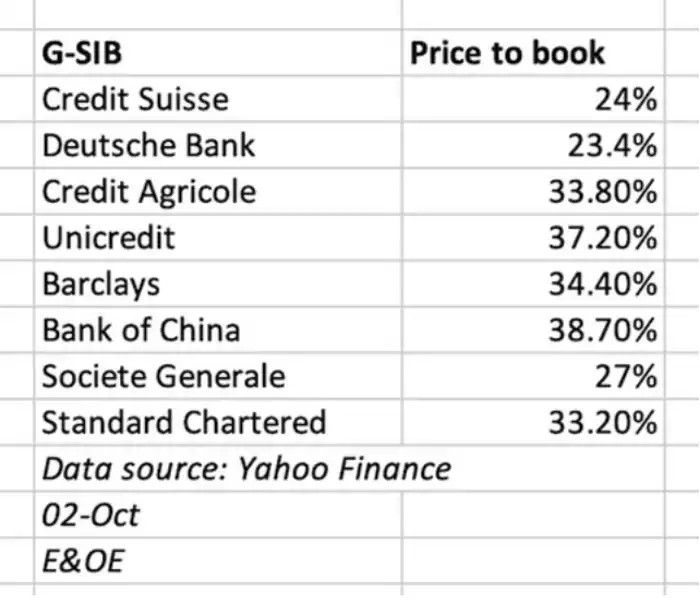

Credit Suisse, one of the Systemically Important Global banks, has now dropped more than 50% on the year and priced for bankruptcy. With a Price-to-Book (PB) ratio of 0.24, the share price is only 24c for every dollar on their balance sheet. For going concerns, healthy companies with dividends and future growth usually have a PB of 5 or more. Will it be Rest in Peace for Credit Suisse?

As a systemically important global bank, the fate of Credit Suisse has been compared to that of Lehman Brothers, with the potential to upend the global financial system. Over the last five years the share price is down 72%, and 53% this year.

The Swiss bank is far from the only institution that is trading at a heavy discount to their portfolios. Deutsche Bank, widely tipped to fall into bankruptcy in 2020, is also considered to be a major systemic risk by a chorus of commentators. The Price-to-Book ratio for the German bank is 23.4%. For reference, this means that if the company had $1million cash, the share would be trading for 234k, i.e 23cents on the dollar.

Ironically, Credit Suisse were calling for falls of 13% or more in PMs and oil as recently as 29 September.

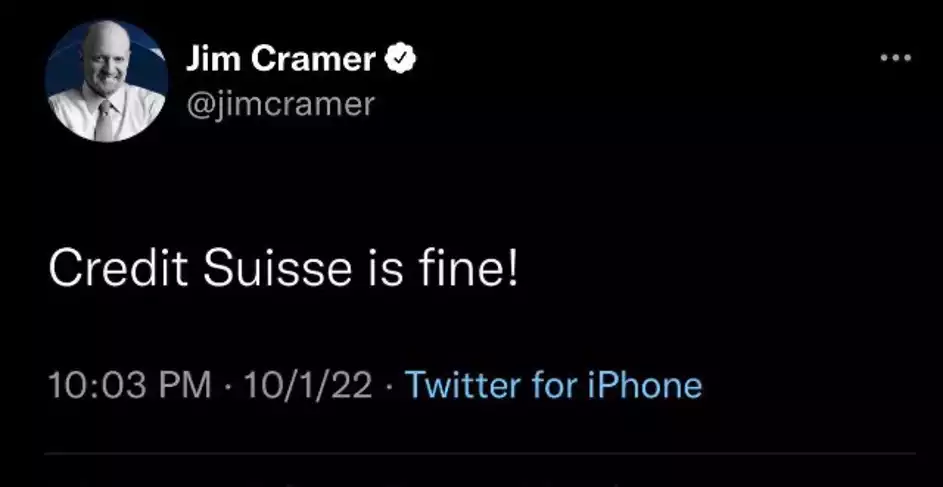

Another nail in the coffin was Jim Cramer’s support earlier this week. “People keep talking about a Lehman moment,” he stated today on CNBC. “I keep thinking, you’re finally going to be able to get a bank merger. And whoever gets Credit Suisse is going to do quite well if you cordon off those losses because boy, that is some great franchise.” The Mad Money host is famous for poor calls, here’s a short compilation of his worst calls.

Pundits aside, Mr. Market is looking for solutions to the carnage before a public somewhere is ultimately on the hook for the CS’s losses. For investors that hold bonds issued by Credit Suisse, if they want insurance against the default of the lender, they can buy a “Credit Default Swap”. The price of these swaps mirrors the level of counter party risk that the debt holds.

From looking at these credit default swaps, it might be time to say ‘Rest in Peace’ for the embattled lender, or rather ‘Rest in Suisse’.

While the institution may well already be bankrupt, the metals that they have produced from their refiner will never meet the same fate, thus is the salient reminder around counterparty risk associated with ‘paper’ assets such as bonds compared to hard assets such as precious metals. There is, quite simply, none for precious metals. It is no one’s liability. We have Credit Suisse branded Platinum Minted bars available in both Brisbane and Melbourne.