Record Silver Demand From Just 1%

News

|

Posted 23/10/2015

|

5752

Record Silver Demand From Just 1%

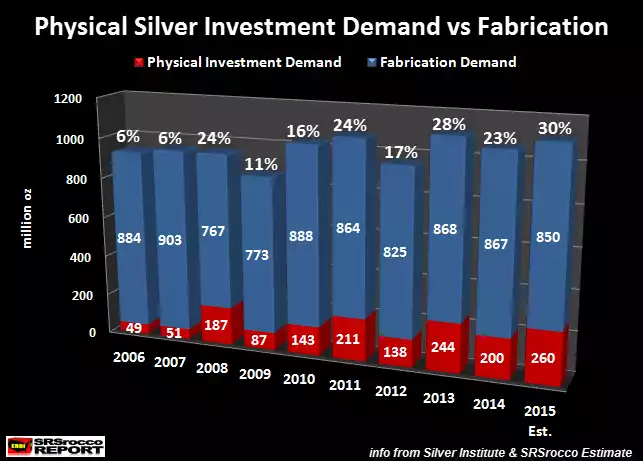

It should come as little surprise to anyone who was trying to buy silver last month that 2015 is set to break records for physical investment silver demand. The graph below shows physical investment demand compared to total fabrication demand. The main drivers look to be another astonishing year of physical demand from India for bars and North America for the widely reported demand for US Eagles and Canadian Maples, just the two of which accounted for 68% of global coin sales last year. A report just released says India is on course to import around 350m oz in 2015.

But analysis by SRSrocco points out the real implication of this by pointing out that less than 1% of investors are buying silver (and most of those in India). What that means is that in 2015 less than 1% of investment capital represented silver demand equating to nearly one third of total silver fabrication. A relatively minor shift of investment focus to (clearly undervalued) silver of say 1 or 2% would completely overwhelm the physical market.

Why do we keep writing physical in front of investment demand? Well that in itself is the explanation for the price not corresponding with demand. The sad fact remains, for now, that the paper silver market (Comex futures and ETF’s) still dominates pricing. Futures contracts rarely see physical metal change hands and are leveraged at over 100:1 contract claims to physical metal. The paper shorts are winning for now but when just a 1% change can change the physical dynamic like it would, mother nature must win at some stage soon.