Record Commodities Surge on Full Fear

News

|

Posted 07/03/2022

|

6491

Friday night was another volatile one on global markets with the bearish news of the Russian attack on the power plant and the conflicting news of the US NFP employment figures showing a much stronger than expected surge in new jobs of 678K (v 423K expected) but also unexpectedly weak wage growth of just 0.5% amid the rampant inflation reinforcing Main Street America is going backwards.

Gold extended its gains by 1.25% and silver up another 1.7% whilst shares were all in the red, the NASDAQ leading the falls, down another 1.7%. CNN’s Fear & Greed Index printed an 18, the worst since the COVID March/April rout in 2020…

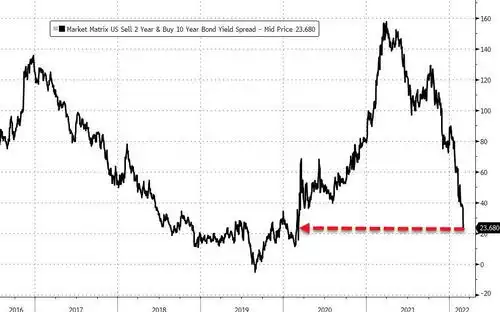

Unsurprisingly gold and silver weren’t the only go-to’s amid the panic with bonds surging and the yield curve plummeting toward zero. Below is the 2yr 10yr and you can see it is again at those COVID crash levels. Inversion, as happened in 2019, is an almost faultless historic precursor to a recession soon after. Again, the US was heading toward a recession regardless of COVID. COVID simply triggered what was already pre-ordained.

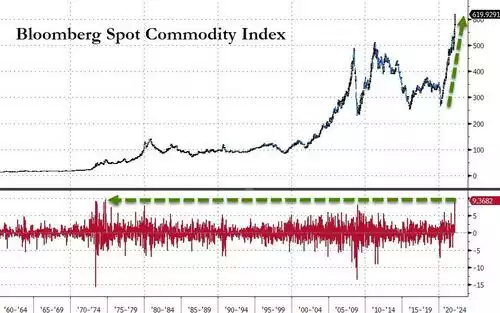

But as we discussed last week, a bond is still a debt instrument being bought as a safe haven during a debt crisis… It should come as no surprise then that commodities, the basket of hard assets left behind in the ‘free money growth trade’ into tech etc, are screaming back into vogue as the penny drops with investors. You can see below that the Bloomberg Spot Commodity Index saw its biggest jump since the stagflation crisis of 1974…

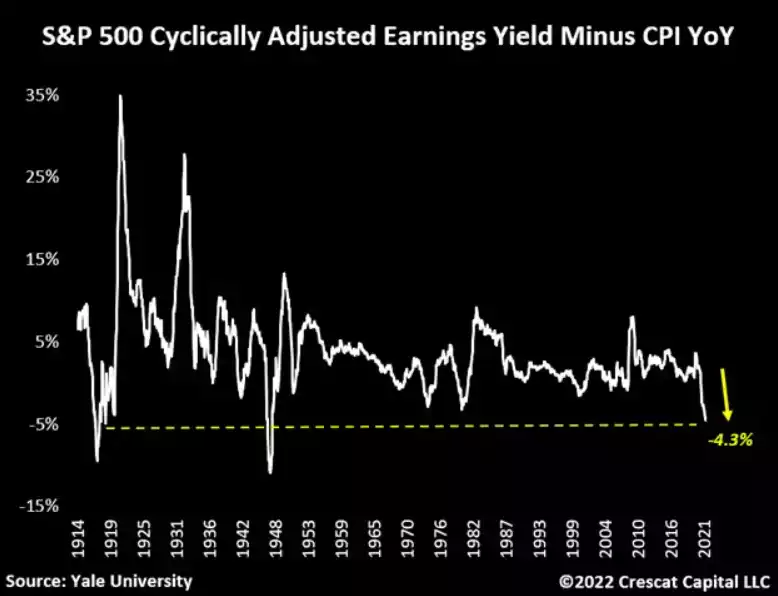

The rotation from growth into value still has some time to go. From Crescat’s latest research paper:

“If we invert Professor Robert Shiller’s Cyclically Adjusted Price to Earnings (CAPE) [for S&P500] and subtract by inflation rates, today we have the lowest yields in 75 years. The last two times we reached such depressed levels were in 1917 and 1947. Most of those declines were driven by double-digit inflation rates. This time it’s driven by both excessive valuations and historically high inflation rates. US equity markets are extremely expensive today.”

So not only do we have deeply negative real yields across the bond spectrum but also on shares. When the criticism of gold by some financial advisors is its lack of yield, you can see why such an environment as this, where the capital value prospects are so strong against no relative real loss of yield per se, is perfect for gold and silver.

We are currently at the convergence of both the prospect of a deteriorating global war and deteriorating economy. As Crescat has said themselves… “You cannot own enough gold and silver”.