RBA Rate Cut v Japan’s New Record & Helicopter

News

|

Posted 03/08/2016

|

7634

Yesterday the RBA dropped our interest rate to a record low 1.5% drawing widespread criticism from economists that it will both achieve little and leave less bullets in the gun for when it is really needed. On the latter point, we wrote about the RBA’s “Emergency Playbook” for when rates get near 1% and that is getting close. When one of the main reasons for the cut is deflating our dollar the critics appear right as it has barely budged. Indeed this morning it is actually up. Why?

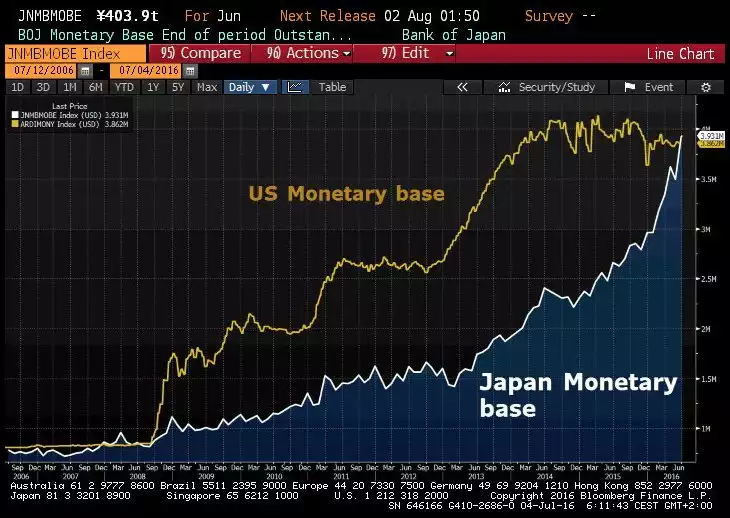

The fact is everything is relative and when the rest of the world is easing more aggressively than Australia, 1.5% still looks attractive. Japan has been the leader in debt : GDP at an eye watering 400%. Per the graph below, they have now exceeded the US, an economy 4 times bigger, in monetary expansion. That monetary stimulus is increasing too…

Unlike the US Fed, who cannot buy equities and ETF’s, the Bank of Japan, having run out of debt to buy, has been aggressively buying shares and ETF’s with all this freshly printed money. Like their debt levels the scale is incredible. The Bank of Japan are now a top 10 shareholder of 200 of the Nikkei’s 225 companies! They also own around 55% of all Japanese ETF’s, buying around $58 billion per year.

There is of course still the expectation they may yet unleash ‘helicopter money’. This from Reuters:

“Central banks might inject no more cash into economies by dropping money from aircraft -- whether real or imaginary -- than via well-worn QE schemes, but in breaking a long-standing taboo they may do far more damage to currencies.

After decades of zero interest rates and quantitative easing-style asset purchases, Japan is still mired in deflation.

The other big risk is the cure becoming worse than the disease.

Global bond investor PIMCO said that since the 18th century there have been 56 examples of direct monetary financing, from France in 1795 to Zimbabwe in 2007. All had dire economic consequences.

Dropping cash directly onto consumers may well be the end of that line and, if that fails to work, governments may be very reluctant to reinstate monetary financing bans in future - creating the threat of systemic collapse.

"The main difference between helicopter and other possibilities, lies in the credibility of the whole monetary system," Swiss economist Reto Foellmi told a discussion on Reuters Global Markets Forum this week. "If helicopter money is done literally, they would cross a point of no return."

As the country gears up for yet more stimulus, financial market speculation has swirled that the Bank of Japan may now go one step further and, by introducing direct funding of government with newly-minted notes, cross into the realm of 'helicopter money'.”

When you combine this with negative interest rates and most of their bonds negative yielding you start to see why our RBA dropping rates 0.25% to 1.5% can’t compete…