QE “Fixes” Nothing

News

|

Posted 19/07/2021

|

6416

The weekend saw another opinion piece in mainstream media with the headline “Australia’s inflation rate could skyrocket as US CPI rises”. The article went on to outline much of what we have shared in previous weeks about US inflation taking off, how the US always leads and we will follow, and how that would see rates rise and our property and share markets get “wobbly”. It concludes “The American experience is a warning for us. We are enjoying the economic upside of our spending spree now, but we must be wary of what follows.”

However the inflation debate at higher levels of thinking rages on and it is certainly not clear which path it will take. Last week saw the release of US bank data that shows lending has flatlined whilst deposits are spiking. All the printed money is not leading to more private debt it seems. That’s not good news for the Fed.

In an excellent article by Real Investment Advice they also point out that QE is simply not working for anyone other than the wealthy benefiting from inflated financial asset prices.

“Fed Requires Debt Issuance

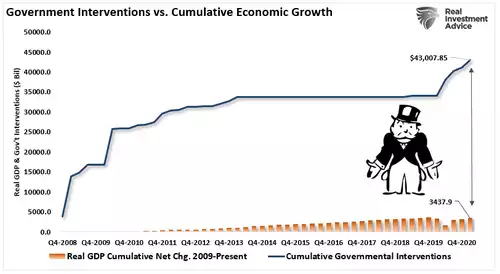

Of course, the Federal Reserve requires debt issuance by the Government to facilitate Quantitative Easing. Since the “Financial Crisis,” total Government interventions surpassed $43 Trillion into the economy to keep it “afloat.”

I say “afloat” rather than “growing” because, since 2008, the total cumulative growth of the economy is just $3.5 trillion. In other words, for each dollar of economic growth since 2008, it required $12 of monetary stimulus. Such sounds okay until you realize it came solely from debt issuance.

Government Spending Has A Negative Multipler

Here is the problem. Excess “debt” has a zero to a negative multiplier effect. Such was shown in a study by the Mercatus Center at George Mason University by economists Jones and De Rugy.

“The multiplier looks at the return in economic output when the government spends a dollar. If the multiplier is above one, it means that government spending draws in the private sector and generates more private consumer spending, private investment, and exports to foreign countries. If the multiplier is below one, the government spending crowds out the private sector, hence reducing it all.

The evidence suggests that government purchases probably reduce the size of the private sector as they increase the size of the government sector. On net, incomes grow, but privately produced incomes shrink.”

Notably, politicians spend money based on political ideologies rather than sound economic policy. Therefore, the findings should not surprise you. However, the conclusion of the study is most telling.

“If you think that the Federal Reserve’s current monetary policy is reasonably competent, then you actually shouldn’t expect the fiscal boost from all that spending to be large. In fact, it could be close to zero.

This is, of course, all before taking future taxes into account. When economists like Robert Barro and Charles Redlick studied the multiplier, they found once you account for future taxes required to pay for the spending, the multiplier could be negative.”

Monetary policy, in its current form, is not helping the economy. As a result, the Federal Reserve has lost the ability to influence economic growth.

Conclusion

The Federal Reserve has no real options unless they are willing to allow the system to reset painfully.

Unfortunately, we now have a decade of experience of watching monetary experiments only succeed in creating a massive “wealth gap.”

Most telling is the current economists’ inability to realize the problem is trying to “cure a debt problem with more debt.”

In conclusion, the Keynesian view that “more money in people’s pockets” will drive up consumer spending, with a boost to GDP being the result, has been wrong. It hasn’t happened in 40 years.

The reality is that monetary policy is not expansionary but rather contractionary. Unfortunately, deflation remains the most significant threat as permanent growth doesn’t come from an artificial stimulus or debt.

But such is a lesson that has yet to get learned.”

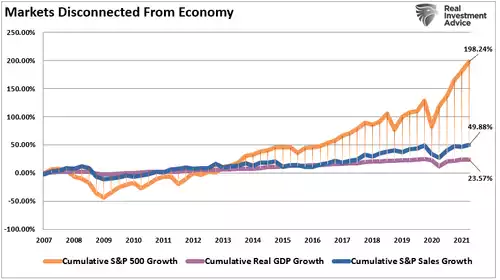

As a reminder of how distorted perceptions are that everything is awesome because shares are high, the following chart both clearly illustrates that narrative but also how hefty that ‘painful reset’ could well be.

Remember gold is driven by providing shelter to such distortions. Negative real rates can be derived from high inflation with ‘normal’ rates OR by normal inflation but near zero or negative rates. The market experts are torn between the transitory or sticky inflation debate. Should you own gold you could, respectfully, not care. If inflation does stick, the mountain of debt, the Fed’s trap and the bond market mean rates can’t go much higher. Negative real rates. If as the piece above predicts, we will move to a dis-inflationary environment, the bond market is already telling you that’s its choice with falling and very low yields, the Fed will either allow the painful reset (VERY unlikely) or double down on monetary stimulus. Again, negative real rates AND safe haven trade AND real money v debased currency trade. Heads you don’t lose, tails you win.