Picking The “Sure Bet”

News

|

Posted 01/11/2016

|

7083

Millions of Australians will be having a punt today on the Melbourne Cup. Rarely does the favourite win. The “smart money” seems to get it wrong every year and that “sure tip” you get rarely seems to pay. The same can be said for investing. One of the speakers at last week’s The Great Repression conference spoke of a study involving all major investment houses in Australia where they tracked the performance of shares with a BUY recommendation and likewise SELL recommendation. Year to date those shares the analysts recommended you buy have returned nearly 0%. Those they said you should sell have returned on average 20%! (yes, you read that right). This, in the context of an All Ords up 3%. How’s them for odds…

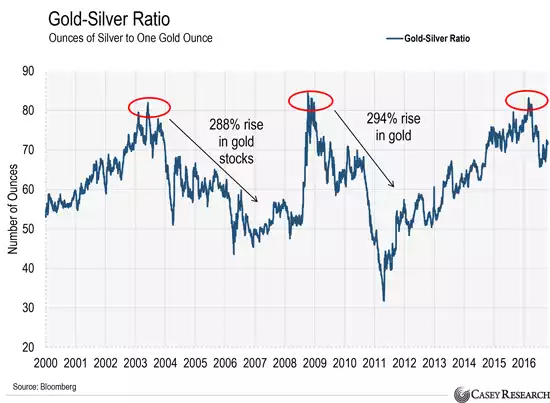

One predictor that has given much better results for gold’s performance is the Gold:Silver Ratio (GSR). We have written many times about how this is flashing bullish for silver right now. As a very quick recap for newcomers, the 100 year average is around 45, that is, it takes 45 oz of silver to buy 1 oz of gold. It’s over 71 now and that is screaming silver is undervalued compared to gold on simple ‘reversion to the mean’ maths.

When this ratio peaks, as it did in February this year at 84, history has shown gold also turns to a rally (and silver even more so as that ratio drops). We saw this play out this year as gold rallied and silver more so until the ‘correction it had to have’ happened over the last couple of months. You can see how the ratio below has ticked up from 66 back up to 72. That is normal and historically it looks like it is due to drop again. The last 2 times this century saw around 290% gains for gold and much higher for silver after each turn. That is much better odds than those Buy and Sell recommendations…. Now as any disclaimer says, history is not necessarily a predictor of future events but Mark Twain probably put it best:

“History doesn't repeat itself but it often rhymes,”