PayPal & CBDC’s – Listen Carefully

News

|

Posted 22/10/2020

|

11673

Fiat currency as we know it is under attack. We wrote to the advent of Central Bank Digital Currencies (CBDC’s) recently here including the opportunities but also some of the threats they present. Last night we saw the announcement by the world’s biggest payment provider, PayPal that they will now facilitate cryptocurrency transactions. From their press release:

“The migration toward digital payments and digital representations of value continues to accelerate, driven by the COVID-19 pandemic and the increased interest in digital currencies from central banks and consumers. PayPal Holdings, Inc. today announced the launch of a new service enabling its customers to buy, hold and sell cryptocurrency directly from their PayPal account, and signaled its plans to significantly increase cryptocurrency's utility by making it available as a funding source for purchases at its 26 million merchants worldwide.”

Going on to bring in the CBDC aspect the press release says:

“Mainstream adoption of cryptocurrencies has traditionally been hindered by their limited utility as an instrument of exchange due to volatility, cost and speed to transact. However, the promise of advanced technological platforms offers the possibility of mainstreaming digital currencies. According to a survey by the Bank for International Settlements, one in 10 central banks – representing approximately one-fifth of the world's population – expect to issue their own digital currencies within the next three years.”

This announcement, just as the list of central banks publicly looking at CBDC’s, including the US Fed, grows cannot be understated. The implications from an investment and wealth preservation perspective are many.

As the world quickly starts to understand blockchain technology and digital forms of money, legitimised through central bank and government adoption, the greatest hurdle to Bitcoin and the like reaching their full potential, being ignorance, is removed. Raoul Pal states correctly that there is a mountain of investment capital looking to get into Bitcoin but the ‘pipework’ is just not there yet. This movement must and will improve that pipework.

Over the last 3 days Bitcoin has risen 14% (at the time of writing) including another surge last night on the PayPal announcement. That might seem impressive but to put that into perspective and why Raoul Pal sees Bitcoin, currently at US$13,000 going to $1m is easy to see in the chart and channel below. He described the chart last night on Twitter as “One of the nicest, post powerful chart patterns I've ever seen”… (note the log scale on the right indicating a $1-$4m price in this channel breakout).

Whilst bullish for Bitcoin as a digital store of value it is also bullish for Ethereum as the engine for the DeFi space that can only thrive in an environment where banks are looking to be more and more exposed to being ‘cut out’ of the loop when central banks can issue directly to individuals.

The other clear benefactor of the CBDC move could be gold and silver. The overt agenda of government and central bank alike to move to not just a cashless system but one where they can directly control all of your ‘money’ presents a double benefit to gold and silver, real money.

Part of their motivation is to better spur on inflation. The current system that sees the Fed expand monetary supply via QE relies on the banks lending out more cash with the newly deposited Fed reserves. That, as you know, is proving more and more ineffectual outside of equities as we remain in a deflationary environment and recession. Put simply, the Fed can’t make the banks lend nor people want to borrow even more. Wealthy investors may be doing so to buy more shares but that must inevitably end and end badly. As the debt burden surges so too does the need for inflation to get rid of it in the absence of real economic growth. Directly crediting individuals, in a targeted way be that UBI (Universal Basic Income) or similar, means they can more effectively dial up inflation. They will know exactly where and how you are spending your money and will be able to adjust the dials accordingly.

The other mechanism then totally in their control is negative interest rates. The IMF have openly discussed a key motivation of a cashless society is that they can more effectively apply negative interest rates (as we explained here) and effectively entice you in to ‘productively’ using your money (causing inflation) to avoid the penalty of having it ‘in a bank’ whatever form that ‘bank’ takes.

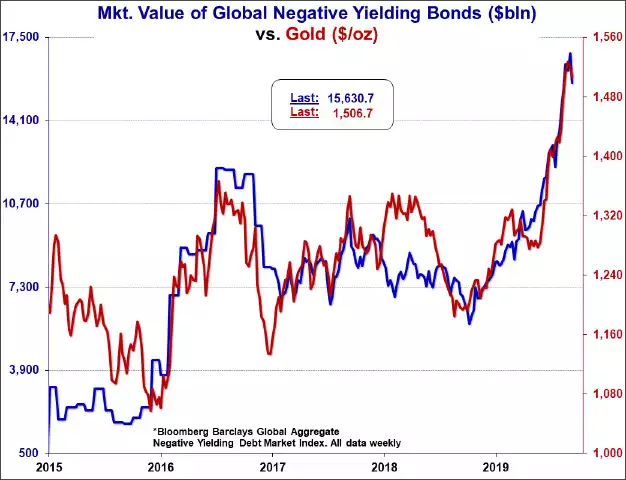

And so we have the dual outcomes of higher inflation, lower rates (and hence negative real rates) and effective monetary confiscation. That has always been a very bullish environment for gold and silver where their historic roles of real money when Fiat systems fail comes to the fore.

Alistair McLeod recently discussed this all and came to the following conclusion, part of which suggests they may not get there in time before the current Fiat system fails regardless.

“Central banks researching CBDCs are motivated by finding an additional means of monetary inflation to the existing means of issuing increasing quantities of fiat currencies. By issuing CBDCs directly to the public, commercial banks are by-passed, and central bankers hope to forensically target where the inflation is applied. A successful introduction of a CBDC could eliminate the impediment of contracting bank credit which occurs at the end of every credit cycle.

The further benefit for central banks is it will increase their power as an organ of the state at the expense of commercial banks, potentially becoming more important than the state itself. However, the current economic situation is deteriorating more quickly than a working CBDC can be introduced, so the whole exercise is likely to be too late to have any relevance to monetary policy in the foreseeable future.”

Irrespective, the very pursuit of this agenda and the unstoppable digitisation of ‘money’ and what constitutes real money seems bullish for both precious metals and high quality cryptocurrencies alike. These are increasingly interesting times in which we live and never before has our trademark been more relevant. Balance your wealth in an unbalanced world.