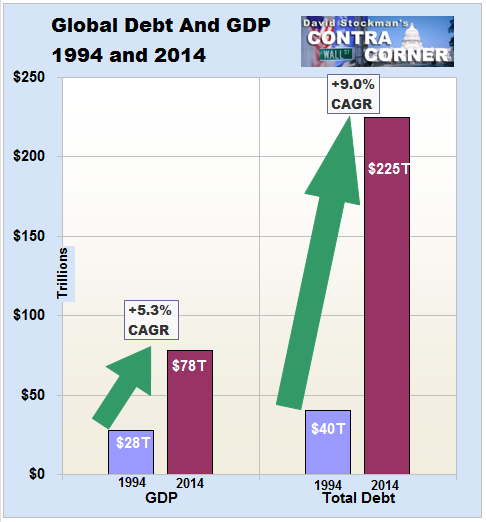

We have been warning for a while that global debt levels have grown unsustainably, and a recent chart by former director of the U.S. Office of Management and Budget David Stockman shows just how unsustainable this growth is.

Source: David Stockman's Contra Corner

This is a really important chart because what should be clear here is the lack of sustainability of the debt load the world has been growing. Worldwide compound annual growth of 5.3% since 1994 is a little over half of the growth of global debt that has been growing at 9.0% per year. In a healthy economy, these numbers should be reversed as debt growth should be used to finance GDP growth above and beyond the debt being borrowed, or at least at the same pace.

When debt growth is greater than GDP growth, then that signals that a lot of debt is being used for non-productive purposes and is being given out a bit recklessly. This may be fine when debt burdens are low, but when global debt is close to 300% of global GDP, then there may be some major problems.

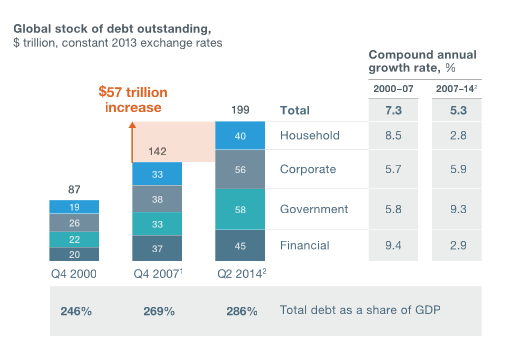

A similar chart by the McKinsey Global Institute backs Mr. Stockman's numbers:

Source: McKinsey Global Institute

While we will not get caught up in the few trillion in differences between the two estimates, the pace differential between debt and GDP growth is clear. Additionally, investors need to remember that the 5.3% growth percentage used by Mr. Stockman is since 1994, while the global GDP growth since 2007 was much less than that - thus, recent increases in debt loads have still outpaced global GDP growth.

So What is the Problem?

The problem is that the debt growth over the past few years (indeed decades) that has been juicing GDP cannot continue to grow, and when that happens then expect GDP growth to slow or reverse as well. This is the credit cycle that has happened over and over throughout history, but what is different about our current global situation is the massive amounts of debt that overhang the financial system - much greater as a percentage as what we have seen in the past.

We are not talking one specific country or area, world debt growth has grown across the board in all regions. Should we be that surprised as historically low interest rates have simply fueled individuals, companies, and governments to issue more and more debt. Additionally, since many investors now believe in the "Central Bank Put", where central banks will bail out the system in the case of any major crisis, it has caused complacency to be at extremely high levels - and thus investors are loaning out money at these extra low interest rates.

Hence, our current situation where debtors seek any opportunity, no matter how inefficient, to grab debt at current rates, while investors seek any debtor to take their money as they expect central banks to ultimately bail them out in the case of crisis.

The scary thing is that one default can set off a domino effect across markets and cause investors to flee all types of debt - in a massively over-indebted world that would be very bad. What we would see next is interest rates rise as investors seek more return to compensate for their risk, which in turn would lead to higher debt levels and lower growth rates as debtors must now portion off a larger portion of revenues to service debts.

Economist Carmen Reinhart (of "this Time is Different" fame) already has been predicting that 2016 would be the year that sovereign defaults started taking center stage. We have already begun to see it as Puerto Rico started off the New Year with the announcement it would be defaulting on some of its bonds. Interestingly enough, despite the overwhelmingly obvious signs of financial hardship, bondholders still were not worried - which is exactly the kind of complacency that one sees right before a major debt crisis.

What Should Investors Do?

Now, we come to gold. It should be obvious now that globally we are massively over-leveraged with debts which are not sustainable as debt growth now dwarfs economic growth despite record-low interest rates. When this reality sets in with investors, we will start to see money leave debt instruments and move to assets that are unrelated or negatively correlated to debt - the ultimate one being "cash".

Investors need to remember that not all "cash" is created equal, and when it comes to over-indebted governments, their currency is only as strong as the confidence in their ability to pay back their debts without inflation. Thus, investors may start moving assets into a number of "cash" type assets, but will eventually flock to the ones that have the greatest liquidity and the greatest ability to maintain purchasing power.

We may already be seeing this as the traditionally negative relationship between gold and the U.S. Dollar has evaporated over the past few months. Though we think the U.S. Dollar is not as safe as investors believe (and certainly not as safe as gold), but this is a discussion for another day. The take-away here is that the recent strong positive correlation between gold and the U.S. Dollar may be the result of investors starting to question the increasing global debt load.

Investors will seek assets that can perform well when there is panic or even defaults in the debt market - gold is clearly one of the few assets historically that has done very well when debts have performed poorly.

Conclusion for Gold Investors

Thus, wise investors will be seeking investments that do well when debt instruments do poorly, and that will lead them to gold. So while investors and fast-money traders in the gold market are focusing on frivolous short-term things like the recent U.S. jobs report and the latest omission from the Fed minutes, they are clearly missing the forest for the trees as unsustainable global debt loads are a ticking time bomb.

This is a great opportunity for investors to accumulate physical gold and the gold ETFs (the SPDR Gold Trust ETF (NYSEARCA:GLD), the Sprott Physical Gold Trust (PHYS) and Central Fund of Canada (CEF)) - though be very careful as ETFs work well in certain circumstances, but in others physical gold is much more desirable and investors should own both. For investors looking for higher leverage to the gold price, they may want to consider miners such as Goldcorp (NYSE:GG), Newmont Mining (NYSE:NEM), Agnico Eagle Mines (NYSE:AEM), or even some of the explorers and silver miners such as First Majestic Silver Corp (NYSE:AG) or Pan American Silver (NASDAQ:PAAS). We're not suggesting these companies specifically but only suggesting them for further investor research.

Now is the time that investors should be buying assets that are uncorrelated to the debt markets - gold is the asset that has historically performed well when we have debt market panics. Investors shouldn't miss the forest for the trees here and get caught up in short-term price moves - there is a debt crisis brewing and investors better be prepared with some gold investments.

______________________________________

Article by Hebba Investments on seekingalpha.com