Gold – Faith, History, and Timing

News

|

Posted 23/07/2015

|

4092

Billionaire hedge fund manager George Soros, on how to make money, famously said - "Find a widely held precept that is wrong and bet against it". On Tuesday Jim Rickards tweeted “#Gold is plunging because China has less than expected, & Fed is raising rates. Except that China lied and Fed can't raise rates. Go figure.”.

These 2 quotes fit nicely for those that understand. We are in the middle of a central bank induced (printed money and ultra low interest rates) asset bubble with weak fundamental support (low GDP growth, financial instability) whilst carrying and rampantly adding unsustainable debt.

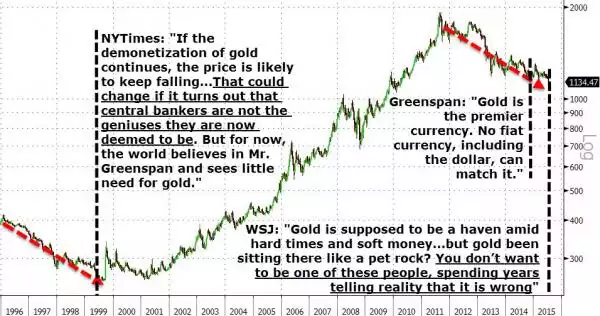

There are no end of mainstream press commentaries about gold falling out of favour. In the Wall Street Journal in the weekend there was an article describing gold as “like a pet rock” and owning it as an “act of faith”.

The annotated chart below (courtesy of ZeroHedge) revisits the timing of a similar article from 1999 in the New York Times. In essence the choice and faith equation is very simple. You can trust that central banks (the US Fed has been around for just over a century – but only 42 years without gold backing the currency) can steer us out of a situation they created by continually creating more credit / Fiat currency - OR – you can trust 5000 years of history of gold being the only real money, money that we humans revert to every time the credit experiment goes wrong.

Soros’s quote may not be more relevant than it is right now.