On the Cusp of a Bear Market

News

|

Posted 15/11/2018

|

8629

Yet another night of falls on Wall St last night saw both the Dow and S&P500 challenging the all important 200 DMA (Daily Moving Average) and whilst the big FAANGS hold up those big cap shares, the Small Cap shares, captured by the Russell 2000 index last night saw its first “Death Cross” since that rout in 2016. The ‘Death Cross’ is the occurrence of the 50 DMA (orange line) falling below the 200 DMA (red line) per below:

Whilst everyone blames the trade wars for the market’s woes, the irony is the Russell 2000 small caps are those companies who derive the majority of their earnings domestically and hence viewed as less affected by the effects of trade wars. The chart above indicates there is something else afoot….

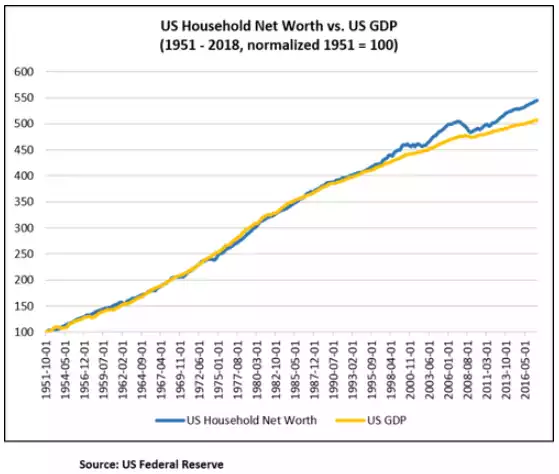

Yesterday we spoke of the Ponzi scheme effect of debt bought economic output. The effect of that is pulling forward future growth through credit. Have a look at Household Wealth compared to GDP for the US since 1951 below. As you’d expect, US citizens were no more or less rich than the rate that the economy grew. Makes sense yeah?

But then we discovered the wonder of credit and central bank stimulus…

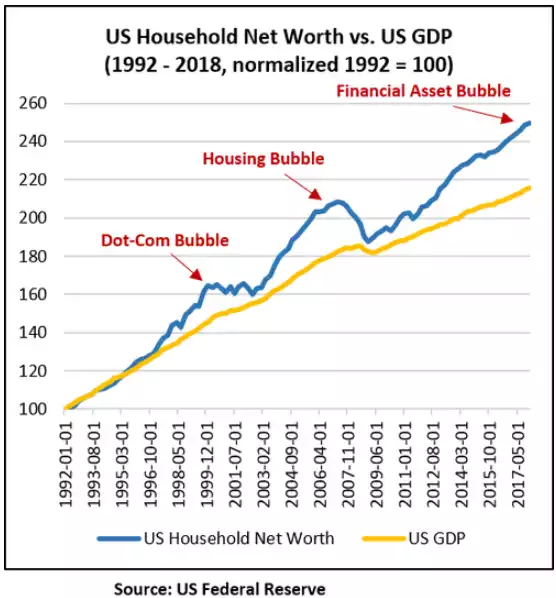

Each time we ‘went too far’ (bringing forward future growth) it came crashing back in line with GDP wiping hundreds of billions of dollars from people’s net worth, largely via the sharemarket and property crashes. Have a look where we are now… Welcome to the “Financial Asset Bubble”, otherwise affectionately known as the “Everything Bubble”

So whilst that Death Cross in the small cap Russell 2000 makes sense in this context, what about the Dow and S&P500 which are, in theory, still in a bull market? The key word there is ‘theory’. Corrections to a market (from bull to bear) have no hard definition but are generally accepted as taking place when the market falls 20% from its high.

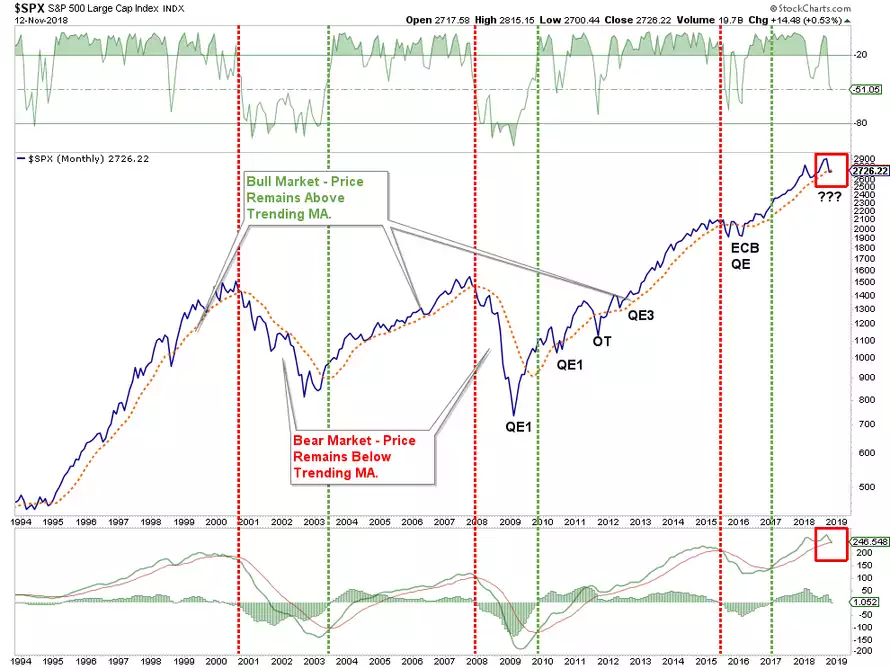

Whilst the S&P500 is not down 20% (yet), it is moving through its 200 DMA per below:

Lance Robert’s of RealInvestmentAdvice.com has this to say:

“There is an important point here to be made about “bull markets” and “bear markets.”

While there is no “official” definition of what constitutes a “bull” or “bear” market, the generally accepted definition is a decline of 20% in the market.

However, since I really don’t want to subject my clients to a loss of 20% in their portfolios, I would suggest a different definition based on the “trend” of the market as a whole. As shown in the chart below:

If prices are generally “trending higher” then such is considered a “bull market.”

A “bear market” is when the “trend” changes from positive to negative.

The vertical red and green lines denote the confirmation of the change in trend when all three indicators simultaneously align.

- The price of the market moves below the long-term moving average. √ [Yes]

- The long-term overbought condition is reversed (top indicator) √ [Yes]

- The long-term MACD signal changes from “buy” to “sell” X [Not yet… but close]

It is worth looking very carefully at this chart and understanding what’s happened since the last big bear market in the GFC. QE1-3 are the Quantitative Easing programs of the US Fed, OT is Operation Twist which in effect was just QE as well. EVERYTIME they stopped printing money the market corrected and they came back with QE+1 to save the day. In 2016 the Fed resisted and so in came the European Central Bank with gusto with their version of QE to again save the day. So at a time when all central banks are now both tightening and have no ‘bullets left’ what happens this time? Back to Roberts:

“Currently, with Central Banks globally beginning to reduce or extract liquidity from the financial markets, and the Federal Reserve committed to hiking rates, there seems to be no ready “backstop” for the markets currently.

However, since this is a monthly chart, we will have to wait until December 1st to update these indicators. However, if the market doesn’t begin to exhibit a more positive tone by then, all three indicators of a “bear market” will align for only the 4th time in 25-years.”

The writing seems clearly on the wall. Are you truly positioned ready for it?