Oil Crash Implications on Gold

News

|

Posted 23/04/2020

|

21847

Unless you have been under a rock this last week you’ve no doubt heard and read extensively on the WTI oil price heading deeply into negative territory and oil more broadly crashing to lows not seen in decades.

To briefly recap, WTI oil May futures crashed to negative $40/barrel. Futures contracts see delivery on expiry. When the contract (which expired Tuesday) goes negative it means it is cheaper for producers to pay the people holding the contracts to take the oil away rather than shut down production because the producers have run out of space to store it. The June contract remained positive for now but at historically rock bottoms levels and plenty of pressure to see those negative prices again. Why is all this happening? Fundamentally demand has crashed. With lock downs we aren’t driving our cars, flying in planes, manufacturing goods, etc. We are literally using a fraction of the oil being produced. That’s the demand side.

To quantify that and put the scale of this into perspective, the world is producing around 20 million barrels of oil too much every day, or said otherwise there is no demand for roughly 20% of global output every single day. Moreover, on the supply side we have seen the earlier actions of OPEC+ and Russia refusing to cut supply as they can clearly smell the blood of the expensive US Shale operations. US Shale oil is expensive to produce (breaking even at around $30-60), highly indebted through junk bonds, and geopolitically gives the US energy independence. The allure to break that from a competition perspective by the Saudi’s and geopolitically by Russia in particular is understandably high. Kicking whilst down appears to be the order of the day.

So let’s break that down in terms of the implications for gold. Until last year there had been a long established and reasonably tight correlation between the oil price and gold price. Simplistically this was underpinned by the fact that higher oil prices tended to drive up CPI due to increased costs of making and transporting goods. Coincidentally gold is the historic go-to for inflation protection, with the price rising in an inflationary environment.

Geopolitically oil historically has been produced in volatile parts of the world where the US has historically liked to wage wars or producers have simply waged war amongst themselves. Such wars would drive up the price of oil and coincidentally see a flight to the safety of gold.

However with continually falling demand for oil due to environmental forces, lacklustre real economies post GFC, trade wars and the like, oil from a demand sense has been under protracted price pressure. However the same drivers for that lack of demand (apart from environmental) has seen central banks flooding the world with new or cheap money to try and get said poor fundamentals going again which is supportive of a higher gold price.

Geopolitically shale oil gives the US critical energy independence and when combined with a falling demand, means markets are less likely to panic bid oil on any attack or similar in the middle east. However at the same time, gold will often rise on prospects of war.

And so on both fronts we have seen a fundamental shift in the correlation of oil and gold, and both reasonably structural.

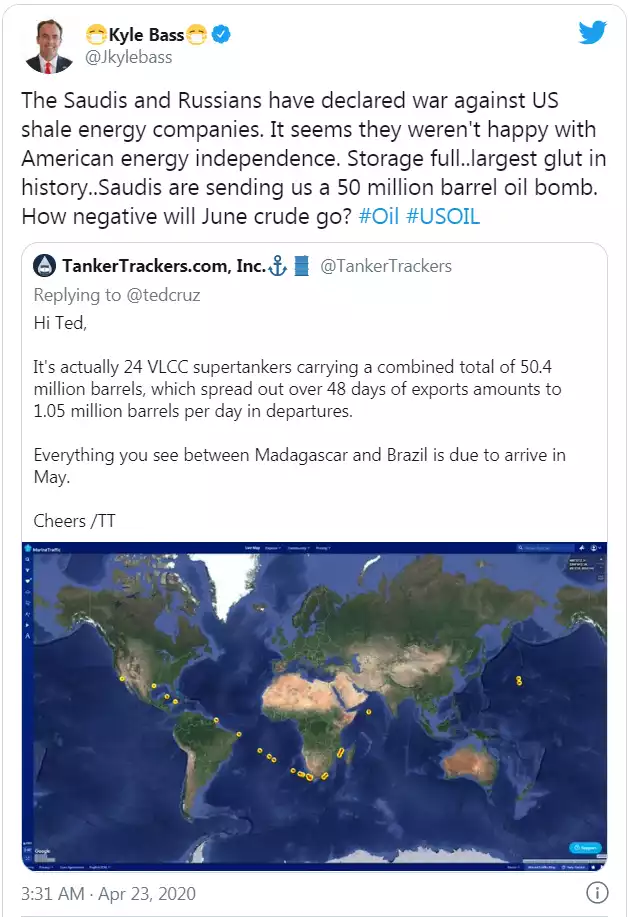

What we have now seen in the last couple of months is an escalation of this on a grand scale. Never before have we seen such a fast and universal shutdown of demand for oil. And hence never before have we seen the phenomenon of negative oil futures. When this happens we have what’s called contango where you can buy oil now cheaper than the future delivery price. In other words, if you can store it, you can buy (or as we’ve just seen get PAID to buy) oil now, store it and be ‘guaranteed’ a higher price in the future. This has seen participants doing exactly that and filling every available tanker with ‘cheap’ oil on the basis they can sell it higher in the future with certainty. However the availability of tankers is running out, prices for them spiking more than 10x, and no one knows when oil may rebound as this virus continues to see lock downs extend. To exacerbate this simple supply/demand dynamic, we have the geopolitics at play where the Saudi’s seem hell bent on making this worse. They have more than 20 supertankers en route to the US and a few already anchored in the US Gulf ports, each with around 2 million barrels of oil. Senator Ted Cruz tweeted “20 tankers—filled w/ 40mm barrels of Saudi oil—are headed to the US. This is SEVEN TIMES the typical monthly flow. At the same time, oil futures are plummeting & millions of US jobs in jeopardy. My message to the Saudis: TURN THE TANKERS THE HELL AROUND.” raising the spectre of the US banning the tankers or slapping them with prohibitive tariffs.

Such is the desperation in the market, the Saudi’s have tried this on speculatively.

For gold investors the takeaways are clear and the historic price correlation with oil so apparently broken.

Whilst gold is an inflation hedge and these are extremely deflationary forces (for now), the reason for and actions taken against the deflation are what is seeing gold climb whilst oil plunges.

Oil is one of many clear signs of just how bad this economic crisis is. Oil is the economic blood of the world and it has stopped flowing. Whilst we will likely see deflation, it will be deflation borne of a sharp crisis and the safe haven play of gold will be the short term driver of its price. The prospect of this hope phase bounce in equities (after the initial panic phase) turning structurally down looms large and the safety of gold to the fore. For those looking beyond the short term, it is the eventual inflation borne of central banks and governments around the world simultaneously flooding the economy with new and cheap money that is supportive of the gold price. Bloomberg Intelligence commodity strategist Mike McGlone sums up:

"The indication for gold is bullish. Lower oil has strong companions in bond yields and plunging interest rates, globally. This enhances the value of non-interest bearing gold and is indicative of the room central banks have to keep stimulating, flushing the system with money, which is also bullish for gold,"

On a lighter note: