NY Fed Gold Outflows – Coincidence or Signal?

News

|

Posted 03/11/2015

|

5735

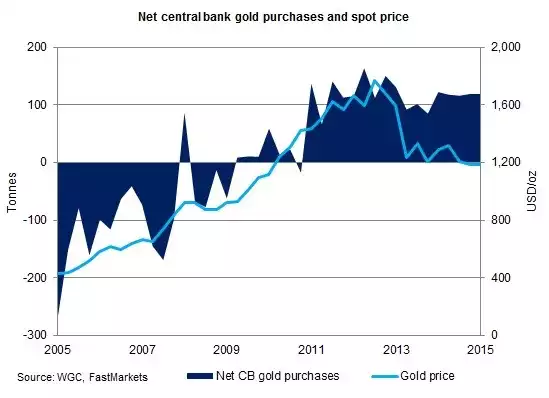

It would be fair to say the thrust of a lot of what we report deals with the various threats of an economic collapse soon and the need to protect your wealth (and indeed profit) through the world’s oldest and most trusted safe havens, physical gold and silver. The main catalyst for the severity of the coming crash is the unprecedented monetary stimulus program the world’s central banks have undertaken trying to kick start the post GFC global economy, preaching ‘gold is dead, hop on board the free currency train’. The irony is they have also been BIG buyers of gold over that same period. Since the world left the gold standard in the early 70’s, central banks were selling their gold; it was all about credit expansion. Since the GFC (the first major glimpse of the implications of debt fuelled expansion) central banks have been big buyers of gold each and every year. Note below the correlation with the gold price until 2013…

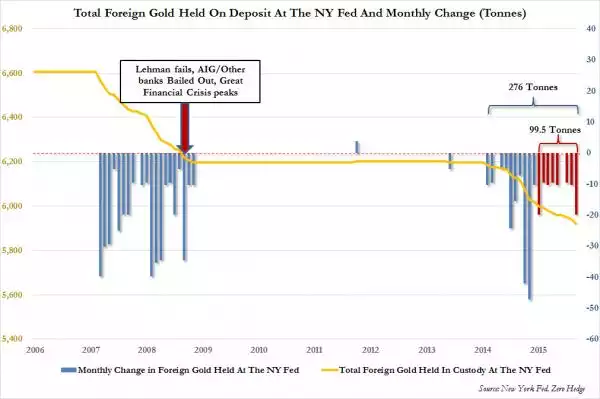

What’s more, recently more of them have been removing their gold holdings from the world’s biggest gold vault, the US Federal Reserve in NY and repatriating it. It doesn’t take a genius to figure out why. The chart below shows very clearly the historic context where there were also major withdrawals immediately prior to the GFC. Coincidence or do they know what’s coming and are getting ready?…. again. Also at what point will the price suppressing paper shorting on COMEX fail and the price correlation pictured above resume?