No Recovery until 2023

News

|

Posted 17/09/2020

|

11195

Last night the US Fed confirmed it was keeping near zero interest rates until 2023 and would continue with at least the current indefinite $120b per month QE program ($80b US Treasuries and $40b Mortgage Backed Securities). So to be clear, things are SO bad they need to stimulate for 3 more years and yet shares in companies generating earnings in such an environment went… UP!? Again the key message was that the central bank can’t do all the heavy lifting, any recovery needs to be lead by government spending. The news was no better for Australia.

Our own RBA was bemoaning our high AUD, stating it needed to drop to really allow us to recover and yet they continue to do nothing more themselves to facilitate that actually happening. Instead the calls for government fiscal spending continue. There have been a number of reports arise just in the last few days that outline the central bank and government’s dilemma.

On the JobSeeker front the COVID supplement is due to be reduced from $550 per fortnight to $250 next week, and abolished altogether by the end of this year. Deloitte Access Economics concluded that doing so would cost 145,000 jobs in just 2 years and reduce GDP growth by $31.3 billion.

We then have the mortgage repayment holiday and impending ‘cliff’ when it is removed, timed to coincide with the aforementioned JobSeeker as well as the JobKeeper reductions and the end of the early access to super. Over the coming weeks around 450,000 mortgage holders and 100,000 small businesses with loans will be contacted by the banks to give them the bad news that the holiday just means more payments need to be made up and the extra interest accrued on top of that. It was a holiday not a pardon. The impacts on consumer spending (impacting GDP) and forced sales (driving lower property prices) could be enormous.

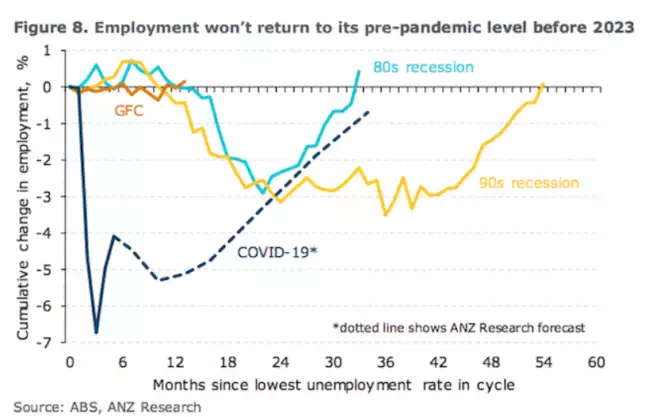

ANZ economics released a report stating that even assuming an extra $180b in fiscal spending over the next 4 years they don’t see our labour market recovering until 2023.

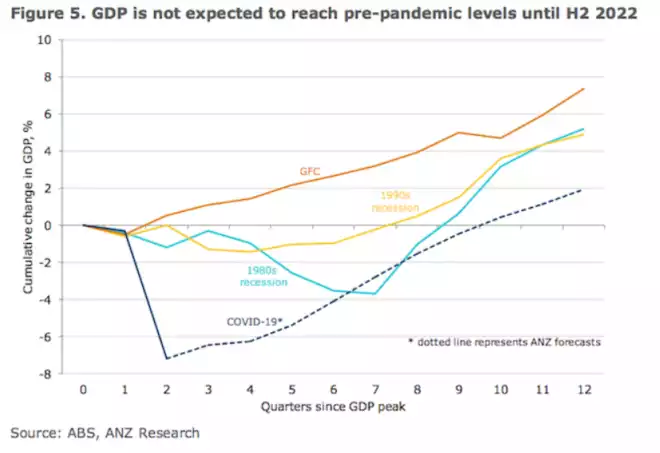

In terms of GDP they don’t see a recovery until the second half of 2022. The following chart paints a clear picture of just how deep this hole is that we need to negotiate our way out of.

Last night the OECD reinforced this position and also highlighted the dilemma before ScoMo right now on the pressure to extend all these support measures versus the long term fiscal impact in doing so. The OECD have assessed that the 2nd wave and lockdown measures employed by Victoria just pushed out our timing to recovery. Like ANZ they are saying it will be 2022 before we recover. Whilst they ‘upgraded’ our 2020 forecast from -5% to -4.1% they slashed the 2021 recovery by nearly 40% to just 2.5%, off that low base and hence no recovery until 2022. Only France and Italy had bigger downgrades. However, whilst joining the chorus for fiscal spending on public infrastructure, they warned against the continuation of support measures such as JobKeeper and loan support. Essentially calling for a ripping off of the bandaid and letting some businesses fail, they warned:

"Failure to do so could hinder aggregate productivity and the economic recovery by trapping resources in non-productive 'zombie' firms and jobs, and reduce the prospects for job switching to more productive and higher-paid positions. Young people are particularly exposed to these risks,"

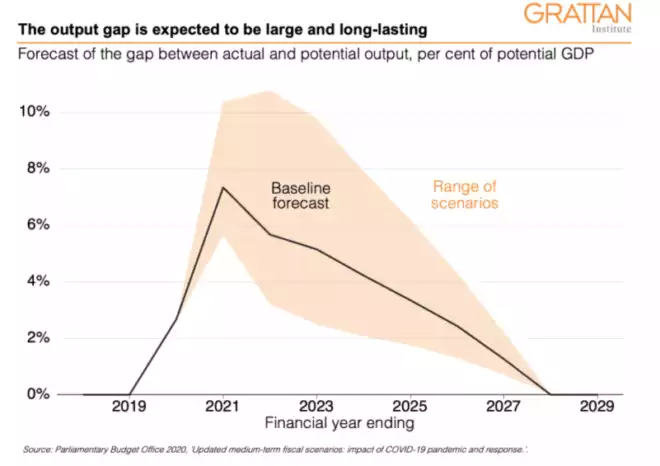

The Grattan Institute believe it could take almost an entire decade for us to recover lost output without $100-120b of new government economic stimulus.

“It’s inevitable that we’ll have a large output gap this year – the second-largest state in the country has been in some form of lockdown for most of the financial year so far. But the really scary part is that the output gap is expected to persist for more than half a decade. On the PBO’s [Parliamentary Budget Office] projection, we won’t close the gap between actual and potential output until 2027-28. In total, the output gap over the period between now and mid-2027 is projected to be around $620 billion in inflation-adjusted terms.

This projection should shock. If it comes to pass, we’re in for the better part of a decade with the economy operating well below potential, with unemployment higher than it could be and living standards below where they could be.”

What is clear is that this is not an easily negotiated nor quick exit from the worst recession in a generation. Talk of V shaped recoveries are overly optimistic. Central banks will continue to ease for years to come enticing speculation into a fundamentally weak market, governments will employ deficit funded stimulus but more likely into infrastructure than helicopter money meaning more short term pain at the consumer level before that translates to jobs, albeit in targeted areas and industries. It is hard to see share prices (at current valuations) or house prices rising amid such fundamentals. But fundamentals will be offset by stimulus and things could get more bubble like before this debt inflated bubble eventually pops or has a drawn out deflation.

By all means have a punt, but ensure you have your safe haven hedge in place or invest in assets that can’t recklessly be debased.