No happy Easter for Aussie banks.

News

|

Posted 29/03/2016

|

6597

This morning as the corporate wheels begin to turn again following the Easter break, we look into the news fallout from the ANZ and Westpac announcements late last week relating to an upswing in resource related bad debts. That news saw banking stocks as a whole drag the Australian stock index into the red with the afore mentioned falling in the vicinity of 5% for the day while NAB and CBA fell 3.5% and 2.5% respectively. Total market losses for the shortened trading week were around 2%. 82% of the market drop was attributed to the big four.

Australian investors are typically sensitive to bad news relating to our domestic financial institutions as such news tends to threaten the perception of dividend payment stability and the health of our economy as a whole.

According to the AFR overnight, it is fairly certain that Aussie banks have to-date underestimated bad credit. Michael Smith writes that “it will be surprising if NAB and CBA do not also increase their bad debt provisions ahead of May, which is when three of the big four report half-year earnings”.

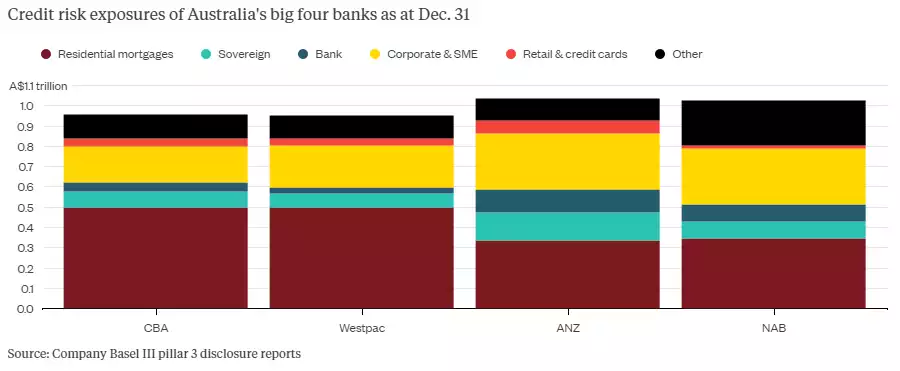

The consensus opinion seems to be that resource related woes are only a small part of the picture. Issues such as real estate exposure (which we will address further) and disrepute in both the wealth management and life insurance areas would tend to conclude that trouble is brewing for our finance sector; the provider of admirable investor returns for a decade or so. According to Westpac’s George Frazis, “pockets of stress” are now evident within consumer loans; typically first appearing as credit card payment issues prior to issues related to the servicing of automotive and residential payments. When the latter becomes impacted, we will likely see a greater reaction than the one we saw last week and this is largely due to the relative credit exposures of our big four.

Let’s look beyond our shores to obtain a different perspective here. Overnight, Bloomberg was one of a number of foreign sources to pen articles relating to our financial sector. They introduce again the concerns relating to our cooling property market which mirror those we’ve written about in recent times. In a nutshell, it is the pairing of a high residential mortgage exposure with the cooling of the valuations of those mortgaged properties. Bloomberg columnist David Fickling suggested that investors would be well served by “fretting over the fact that home prices in Sydney recorded their biggest quarterly drop in more than seven years in December.”

Recent credit risk exposure for CBA, Westpac, ANZ and NAB is pictured below which allows for easy visualisation of the mortgage bias involved here. Mr. Fickling suggests that even if the circa A$65 billion in mining exposure was to be completely eliminated from the books at our big four, it would still be an event “less serious than a 4 percent decline in the value of their A$1.68 trillion in residential mortgages” citing that CBA has a greater exposure to farmers than miners.

This all amounts to worrisome deliberation for investors who have previously relied upon Aussie banks to be a typically strong vehicle for the investment of spare capital or advancement of retirement savings.

Evidence of an uncomfortable correlation between our financial sector and the plethora of risks that we often write about is mounting and this emphasises the importance of balancing wealth in an unbalanced world.