NFP fails – Bad News is Good News (For Now)

News

|

Posted 05/09/2016

|

6706

On Friday night the US NFP employment figures were released and were well below expectations on a number of measures. Against the backdrop of a 3 month average of 232,000 new jobs and market expectations of 180,000, the August print was just 151,000. Whilst that was bad it was joined by very disappointing earnings data as well. Hourly earnings growth came out half of that expected, a third of July’s number, and barely above zero at 0.1% and weekly earnings actually fell from August and now sees the annual growth rate at its lowest in over 2 ½ years.

The data also showed the continuing trend of the dominance of lower paying hospitality jobs, and of course (in our ‘stimulated’ Wall St World) financial service jobs, but a decline or stagnation in jobs that actually produce things.

This was a data print the world was hanging on to gauge whether the US Fed will raise rates sooner than later (or at all!). The disappointing numbers saw those odds fall dramatically and up shot everything except the USD as the free money game looks set to continue. Bad news is good news prevails. Gold and silver jumped too as negative real rates remain and it is now becoming blatantly obvious this will continue until financial markets crash.

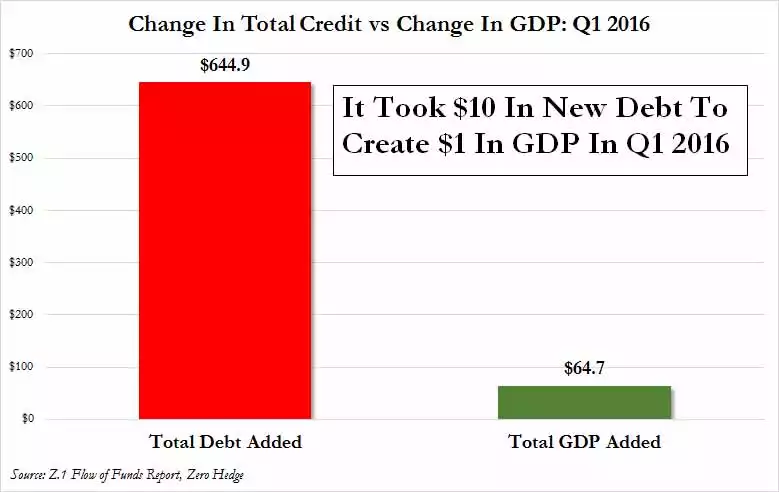

Should this outcome really be a surprise though? A September rate rise just before the most contentious US election in living memory was always destined to be thwarted somehow (and as the latest Reuters poll has Trump ahead). It was also in the week we saw Q2 GDP growth in the US finalised at a woeful 1.1% despite that easy money. What would it be with tighter monetary policy with higher rates??? If you want a picture of this there is no better than the following. The situation is not hugely different in Australia as we’ve written before. The simple fact is we are borrowing at a far greater rate than economic growth. Regular listeners to the Weekly Wrap know that whether its GDP growth, company earnings, manufacturing and service business indices, or the aforementioned employment figures - they are all below expectations but the debt burden just keeps growing. Until it can’t. Soon bad news will be bad news.