Nervous times in shares

News

|

Posted 04/08/2014

|

3406

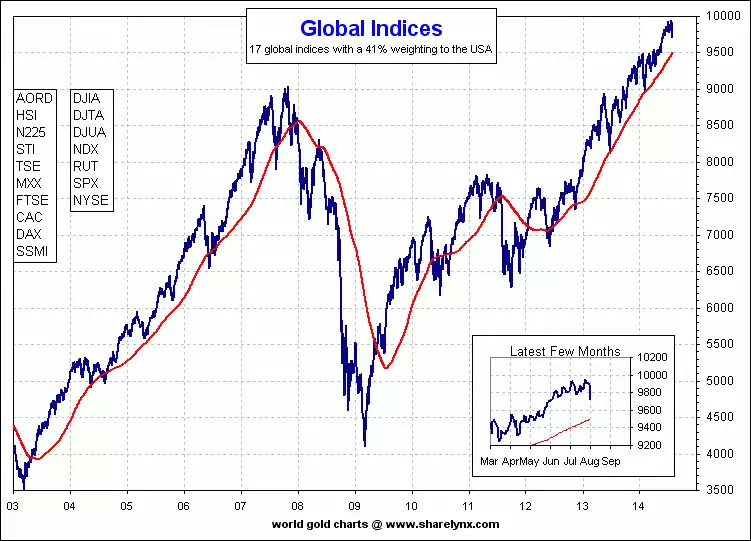

Consider the graph below in the context of what is going on in the world right now. As Argentina defaults (with as yet unknown CDS derivative consequences), US and Europe sanction Russia (with as yet unknown consequences), wars escalate in Gaza, Ukraine, Syria, Libya, etc etc, struggling economies continue with or ramp up easy money / debt, the BRICS alliance continues it move away from the USD (with the latest being India and Russia looking to commence non USD trade), etc etc.

The graph below is a collection of global equities indices weighted 41% to US shares. The graph is clearly at heady heights and Friday just a small glimpse of how flighty it could be in the above environment. No one knows how long or high it could go but in this current environment a bit of safe asset hedging just seems common sense.