Money v “Money”

News

|

Posted 03/02/2016

|

6820

Whilst we are on a roll this week of parabolic/exponential charts the following are most compelling when remembering that sage investment quote of the 4 most expensive words in investment being “this time is different”…

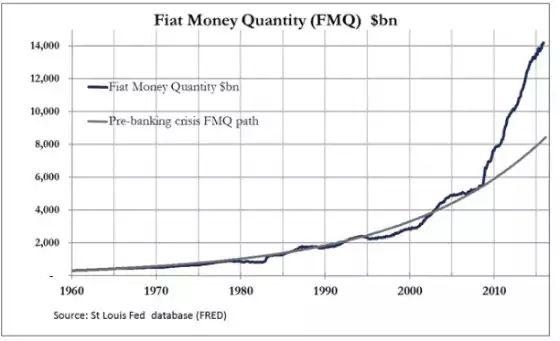

First, we often talk about the sheer scale of money printing since the GFC as central banks have tried to stimulate and reflate the system that almost broke then. You can’t simply do this when you have a gold backed currency. When you have a Fiat currency, as the world has had since 1973, it is backed by nothing more than the promise of the Government, so (for a while) you can print all you like, especially if you have the reserve currency as the US do. Look below at how it kicked up after the 1982, 1990 and 2001 crash/recessions and then really went exponential after the GFC. You will note after the previous three they normalised after everything was ‘fixed’. We haven’t seen that this time because, well, it’s not fixed…?

What’s that got to do with gold you ask? The chart below illustrates the ratio of the price of gold (real money) compared to the US Monetary Base (total amount of currency circulated – fiat “money”). As you can see that ratio, at just 0.3, recently hit its lowest EVER i.e. Gold is as cheap as it has ever been compared to the monetary base. As important, you can see that ratio is now kicking up, just as it did at each recession. The last two times it got nearly as low coincided with the start of the big bull markets of 1970’s (up 2270%) and 2000’s (up 636%). Is it different this time?