Mike Maloney’s Top 10 Reasons to Buy Gold and Silver: Part 1

News

|

Posted 12/07/2018

|

12185

Mike Maloney is the host of an excellent video series, The Hidden Secrets of Money; former Rich Dad/Poor Dad advisor; author of the best-selling precious metals book, Guide to Investing in Gold and Silver, and founder of GoldSilver.com. For more than a decade, Mike’s travelled the world sharing his economic insights with audiences from Hong Kong to Rome and from Silicon Valley to Wall Street.

He recently produced a top 10 list of reasons to buy Gold and Silver that we considered to be a highly relevant and timely reminder of why the precious metals are such an important component of our investment portfolio. He highlights why it is important to remain vigilant as fundamental changes can take a long time to become established in the background, but then the impact can be felt unexpectedly quickly, which can be financially devastating for the unprepared. Maloney’s Top 10 reasons were originally presented over a number of videos, but we have summarised them here for you in our own 2-part series.

Mike Maloney’s Top 10 Reasons to Buy Gold and Silver: Part 1

10. All the world’s currencies are fiat and all fiat currencies eventually fail.

Since 1971 it has been the first time in history that all of the world’s currencies are fiat currencies. Simultaneously, 99% of the world population is not aware of the fact that we no longer use money, and that we only use fiat. Fiat currencies are faith based and are not backed by anything of value. There have been thousands upon thousands of fait currencies throughout history and every single one of them has eventually failed. There is no reason to believe this time around will be any different.

9. The current state of the global economy.

When currencies were backed by gold all countries “trading balances” would automatically balance. The debt based global monetary system has allowed for:-

• Deficit spending.

• Trade imbalances.

• Bubbles to persist.

• Credit/debt bubble and the derivatives bubble threaten to take down the world economy.

8. A new world monetary system.

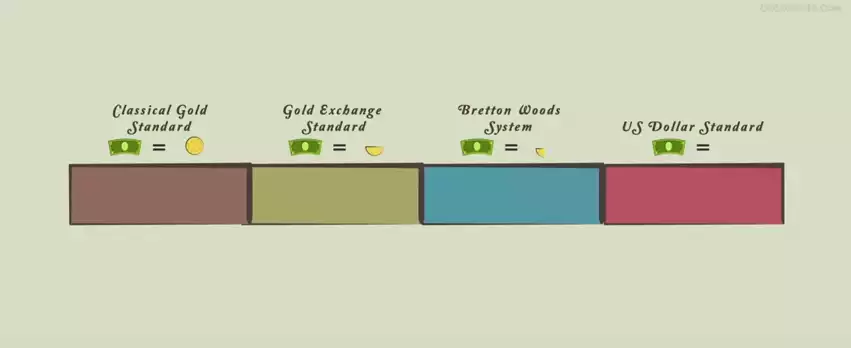

Every 30 to 40 years we have an entirely new monetary system. We have had 4 different monetary systems in the last 100 years.

The above diagram clearly shows how gold has slowly been eradicated from backing the US Dollar over the last 100 years. The system we are in today is the US Dollar Standard. Monetary systems inevitably get old, develop stress cracks and then implode. As Maloney stresses, “our current monetary system is well overdue for its own demise”. As the US dollar represents more than half of the value of all the world’s currency, a dollar crisis would cast doubts on ALL fiat currencies. The pendulum will then swing back to quality money/real money, i.e. Gold and Silver.

7. Gold and Silver come with a central bank guarantee.

In 2007 we had the threat of deflation with the GFC. This was followed by the continuous churning of the printing press of QE (Quantitative Easing), which has led to inflation. Real deflation and then hyperinflation are next in line according to Maloney. Real deflation will come about when the “Everything” bubble made up of the Credit bubble, Bond bubble, Debt bubble, Derivatives bubble and the Fiat currency bubble IMPLODE. Such an event will in turn cause the central banks to print like crazy which will in turn create hyperinflation. Should this play out as Maloney thinks it will people will be fleeing back to the safety of gold, as gold revalues itself (as it has done numerous times in the past). With this revaluation, gold’s purchasing power will rise exponentially.

6. Everything else is a scary investment.

• Stocks have been in a super bubble for more than a decade now;

• Bonds are in the latter stage of a 30-year bull market;

• Real estate is still deflating from the biggest bubble in history;

• Gold and silver haven’t been in a bubble for more than 30 years.

Stay tuned for part 2, where we explore the top 5 reasons, tomorrow!