Markets Worried about Italy

News

|

Posted 19/10/2018

|

7986

When we recently published the article “What will cause the next financial crisis” one of the themes was a Euro crisis spurred on by Italy’s fiscal woes. Last night global markets saw another rout on exactly that issue, together with more sharemarket losses and yuan devaluations in China.

Italy has for some time been trying to deliver a budget that fits within the EU’s rules around deficits, government spending and assumptions. Under the EU law, the commission must approve any budget to be adopted. Italy’s latest version is poised to be rejected (the first rejection under the rules established in 2013) after a letter to Italy from the Commission said:

“Those three factors would seem to point to a particularly serious non-compliance with the budgetary policy obligations laid down in the Stability and Growth Pact,”

Their issues are:

- Deficit rising by 0.8% when they need to deliver a 0.6% cut

- That of course means their debt rises, and at 130% of GDP it is supposed to be reduced to a maximum of 60%

- Government spending rising by 2.7% against a limit of just 0.1%

That is not a new letter but last night ECB President Draghi added fuel to the fire threatening:

"Questioning of the rules inside the EU can lead to worsening of the conditions in the financial sector and therefore damage growth...Rules must be respected in the self-interest of all parties, especially the weaker ones... There is no evidence that to undermine all the rules will lead to prosperity, but it will carry a high price tag for all actors."

Italy’s populist government is not exactly a big fan of the EU arrangement and such threats and tensions raise fears of Italeave (Italy’s Brexit) and what that would mean to the EU with Italy the 3rd biggest economy. That of course makes this a very different prospect to the relatively insignificant Greece debacle that similarly played out in recent years.

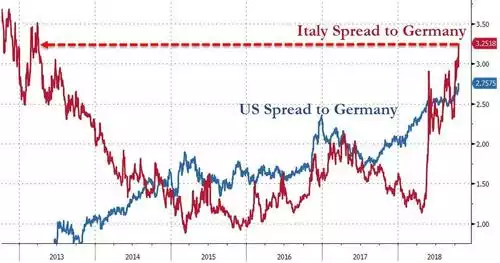

Contagion fears saw big moves in government bonds overnight with 10 yr US Treasury yields falling to 3.17%, but with further rates hikes again flagged by the Fed this week we could see that climb again when we are already seeing the biggest spread between US Treasuries and German Bunds ever (see below). Those Bunds yields of course are low largely off Italy fears and the spread between Italian and German bonds spiked to 2013 highs (fresh out of the 2012 Euro debt crisis).

To the east we saw even more carnage in China with their sharemarket dropping to end 30% down from its highs earlier this year and importantly, the yuan dropping yet again.

So unsurprisingly the Dow gave up all its Monday bounce gains to finish 327 points lower, the S&P500 down 40 points and the NASDAQ dropping over 2% or 157 points. Despite the USD hitting its highest level in a week, gold and silver rose again buoyed by safe haven demand. Futures indicate the Australian market will take a fall today too.