Market Melt Up before the Melt Down?

News

|

Posted 22/01/2020

|

17848

The term “Melt Up” is being used extensively in reference to the US sharemarket over the last 4 months or so. We spoke to this on Monday in terms of what lays ahead for 2020.

Firstly, Investopedia defines a melt-up as follows:

“A melt up is a dramatic and unexpected improvement in the investment performance of an asset class, driven partly by a stampede of investors who don’t want to miss out on its rise, rather than by fundamental improvements in the economy. Gains that a melt up creates are considered to be unreliable indications of the direction the market is ultimately headed. Melt ups often precede melt downs.”

And what a melt up it’s been! Just looking at a couple of valuation metrics gives you the gravity of this. Firstly, On a Price to Sales ratio the S&P500 has now surpassed even the previously unprecedented dot com bubble (and indeed is closer to 2.5 now):

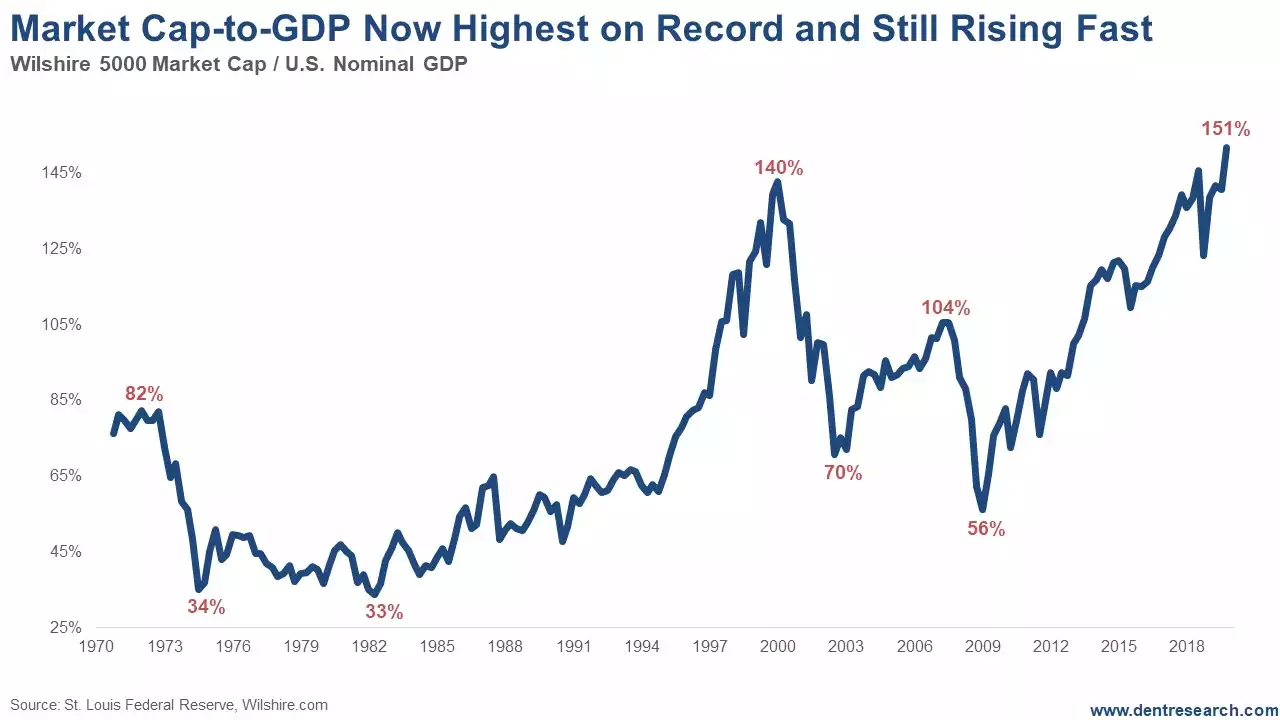

Or Warren Buffet’s favourite, the Market Cap to GDP is also now at unprecedented levels. Remember too though, that as we discussed Monday, traditional GDP is arguably understating the issue making this even more distorted on a smaller denominator. Regardless this chart says it all:

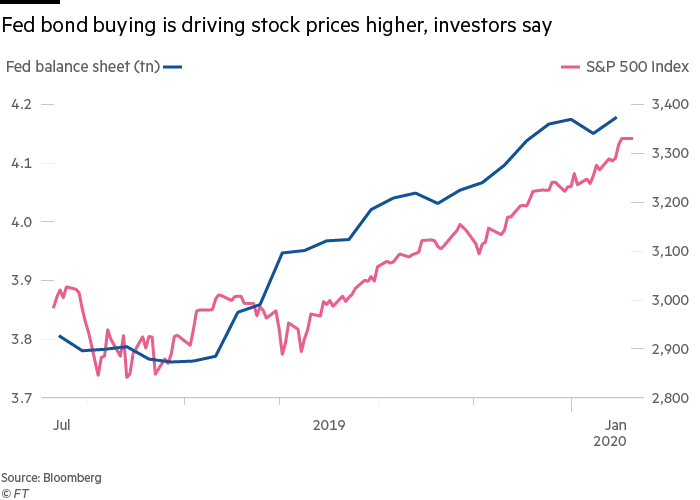

Is this all because of unbelievably strong fundamentals and earnings growth? No of course not. How’s this for another unprecedented distortion:

Indeed the IMF just yet again slashed global growth forecasts, its 6th consecutive downgrade and earnings are declining.

There remains one clear factor behind the rally and we shan’t call it QE…

From the Financial Times:

“Intention is one thing, but how a policy plays out in the market is another. Some analysts and investors say regardless of the Fed’s stated rationale, the purchase of Treasury bills is pushing asset prices higher as investors flood into corporate bonds and equities.

Since October 11, when the Fed announced it would begin buying Treasury bills, the S&P 500 has risen about 12 per cent, investment-grade corporate bonds have returned 2.4 per cent and high-yield bonds have returned 3.5 per cent.

This might not be because of any effect on interest rates. In fact, 10-year Treasury yields have risen since October. It could simply be that the Fed is removing Treasuries from the market at the same time as adding cash, said Matt King, a strategist at Citigroup. Investors have to put this cash somewhere and if there are fewer Treasuries in circulation, it is more likely to go into stocks and corporate bonds.

“Central bankers sometimes like to think of the theory first and then look for market impact later,” said Mr King. “I prefer to do it the other way around and the impact on asset prices appears to be very QE-like.”

Dallas Fed president Robert Kaplan admits there may be some unintended consequences to the central bank’s repo fix.

“On the one hand this is not QE, but I think it is having some QE-like effects,” he told the Financial Times last week.”

And herein lies the problem. Should the Fed try and pull back on notQE what happens? We saw the SP500 drop 20% when the Fed just tried raising rates a little in 2018. What happens if they try and ease off on this notQE in 2020?

Speaking to CNBC whilst at the World Economic Forum in Davos this week, Ray Dalio, head of the world’s largest hedge fund said “cash is trash” and:

“"You have to have balance ... and I think you have to have a certain amount of gold in your portfolio," Dalio said, adding that gold will be a top asset to own in the years ahead as central banks will fail to normalize in the next downturn, which could've already started.”