March Was Just a Correction – Why We Haven’t Seen the Crash Yet

News

|

Posted 24/08/2020

|

11942

Last week the S&P500 broke not just a new all-time high but also the record for the quickest recovery from a ‘technical’ bear market or 30% decline, doing so in just 110 days. We put technical in inverted commas for a good reason.

Real Investment Advice’s Lance Roberts penned an excellent article over the weekend that puts some important perspective on that so called ‘bear market’. An over simplified but oft adopted definition of what constitutes a bear market is a 20% decline from a multiyear high and so the 35% drop in March ticked the box. In fairness too, it was well and truly due after the longest but most fundamentally tepid bull market in history. It made sense and no one questioned it. However the fact that it reversed in just 110 days amid a recession certainly should raise some questions and Roberts answers them in his usual concise and insightful way. To do so he poses 3 questions that need to be asked, namely:

- What defines a bull and bear market?

- What exactly is a “full-market cycle?”

- How deep will a “bear market” contract?

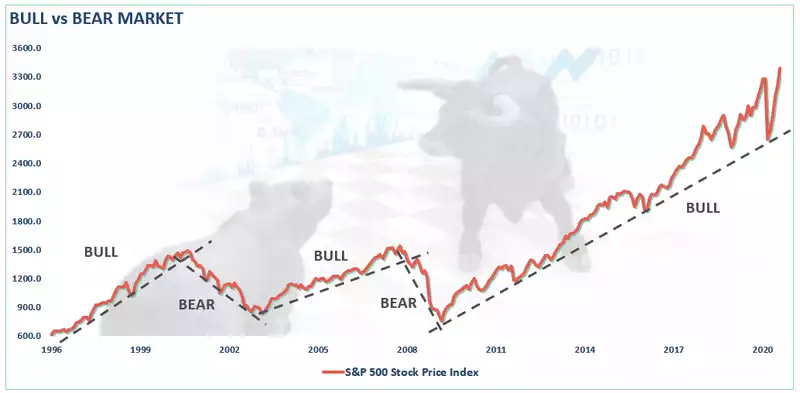

Roberts dismisses the 20% definition as purely arbitrary and to his credit, even back in May, called it as ‘just a big correction’, which has turned out to be true. Spelling out his definitions as follows the chart below paints a very clear picture:

- A bull market is when the price of the market is trending higher over a long-term period.

- A bear market is when the previous advance breaks, and prices begin to trend lower.

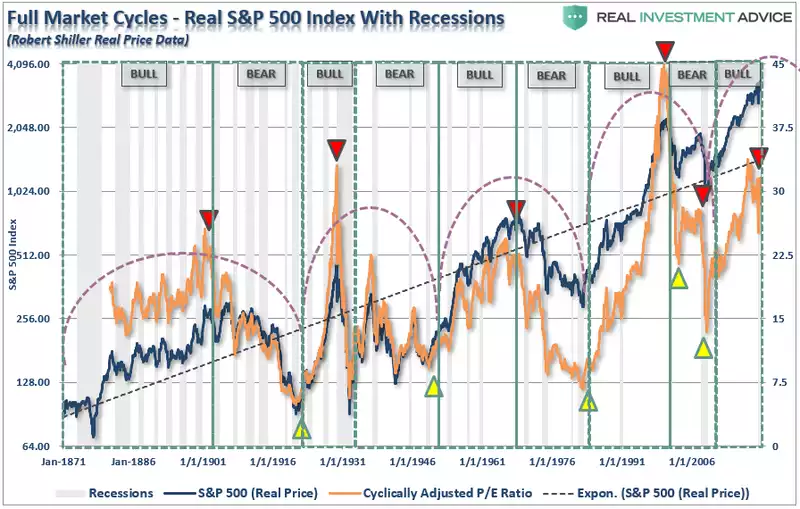

More fundamentally, Roberts talks of the ‘Full Market Cycles’ that have been repeated over a couple of centuries. The same human emotion and behaviour is repeated over and again. “This time is different” probably figuring dominantly in the market psyche each time. But history shows it never is. The chart below shows bull and bear markets consistently follow each other and share pretty much equal time in history.

And so the question arises, what will the crash look like to end this bull market?

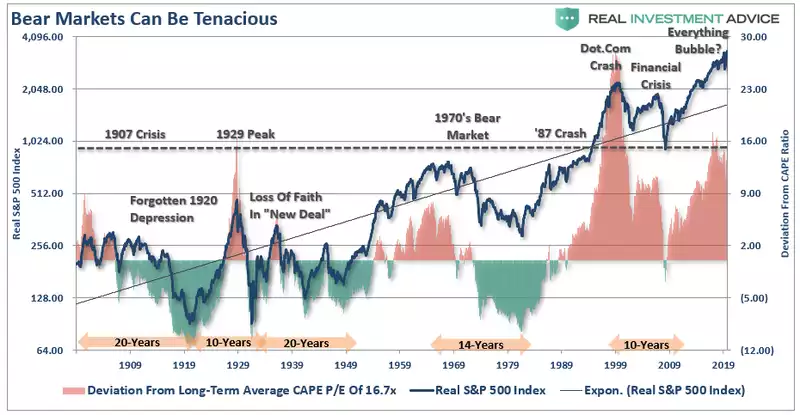

“Over the last two bear market cycles, ending valuations were higher than the previous “bear market cycle” lows. Given changes to market environments over time, we can reasonably assume the next valuation low will be closer to the long-term CAPE average of 16.7x earnings. However, given markets are currently pushing 30x trailing earnings, completion of the mean reversion process will not be mild.”

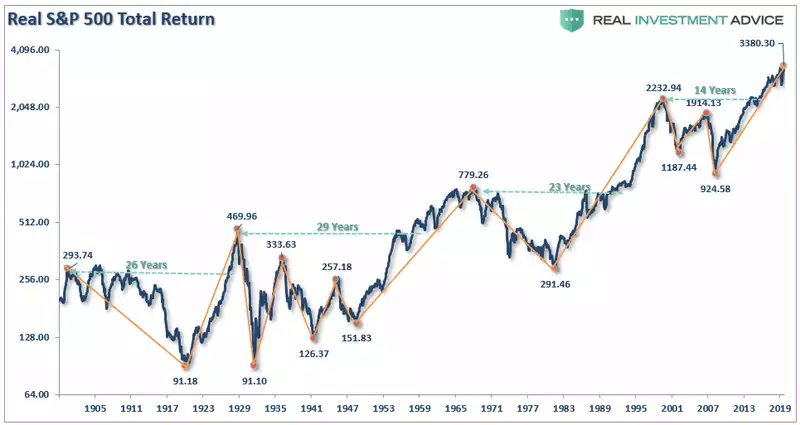

To get to that 16.7x earnings you are looking at close to a 60% correction from here. Such a correction would take you back to 1999 levels and certainly is not without precedent. It is only slightly worse than the GFC and not nearly as much as the 80% seen in the dot.com bubble bursting. Such losses take many years to recover from. The chart below is an inflation adjusted total return S&P500 journey through the years it took from each bear market to regain your money:

Roberts concludes:

“Bear market cycles rarely end in a month. While there is a lot of “hope” the Fed’s flood of liquidity can arrest the market decline, there is still a tremendous amount of economic damage to contend with over the months to come.

In the end, it does not matter IF you are “bullish” or “bearish.” What matters, in terms of achieving long-term investment success, is not necessarily being “right” during the first half of the cycle, but by not being “wrong” during the second half.”

Different people buy gold and silver for different reasons. Some see it as a play on expected capital gains as the price goes up on all the fundamentals we write of daily. Some see it more as a return OF capital rather than a return ON capital. i.e. insurance when everything else looks to have large downside risk. The latter group couldn’t care less about gains, they are looking at preventing the losses Roberts warns of and the years it takes to get back to where you already are with your gold. The difference is that you could have sold your gold and bought all those bargain shares with your ‘insurance payout’….

Then of course you may be thinking this time is indeed different and headlines such as Tesla breaching 1,000 P/E (yep, that’s not a typo) are a sign of good times ahead. The longest bull market in history has heaps left in it and I don’t need gold…. Good luck with that.

Luck has never been a sound investment strategy.