Major Protests in Belgium against the rising cost of living

News

|

Posted 04/07/2022

|

14721

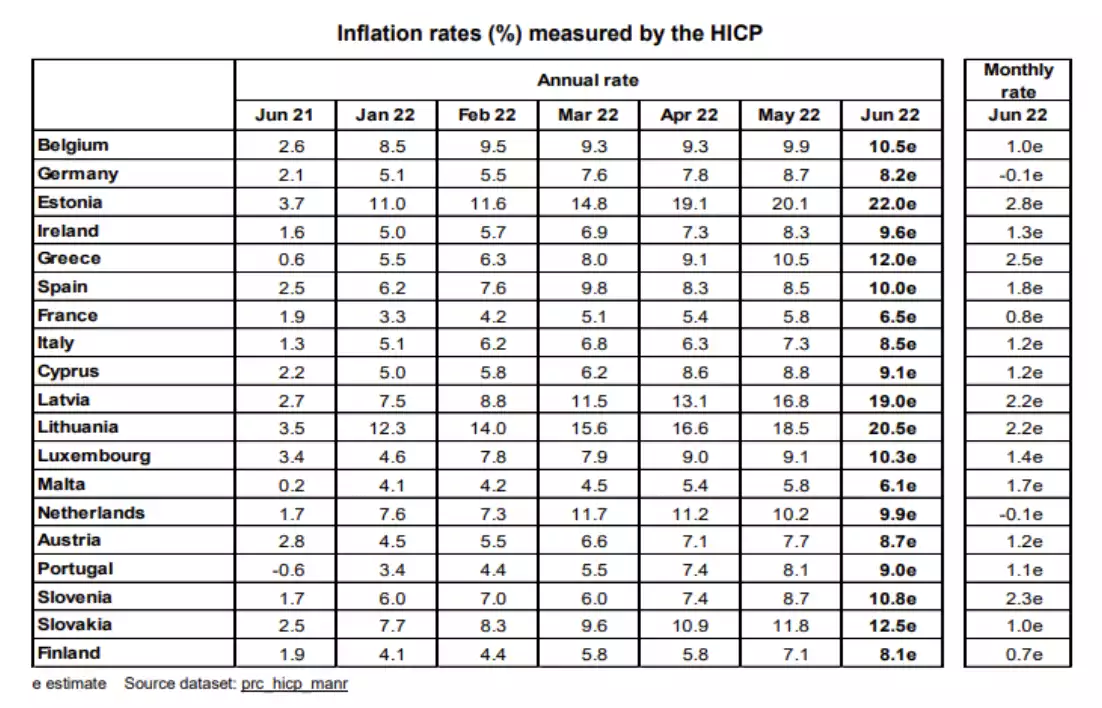

Dramatic images of almost a hundred thousand protestors have broken out in Belgium as inflation has now crossed 10% in June. These civil uprisings have been mirrored worldwide this month as supply chains reach breaking point and the purchasing power of government issued fiat currencies continue to weaken.

Credit: Rueters/ Yves Herman

In Belgium, the Brussels airport has been closed down as staff refuse to work on existing wages, and public transport is operating partly to help protestors make their way to the capital. Belgians are struggling to make ends meet as rising grain prices have pushed up prices in supermarkets and reduced access to oil and gas have led the cost of energy to spike. Across Europe, energy inflation has reached an average of 42% according to Eurostat with all items excluding energy only at 5% year-on-year. Food alcohol and tabacco came in at 8.9% in June, with services and non-energy industrial goods the laggards at 3.4% and 4.3% respectively.

This is mirrored by similar protests in Ireland, Italy, France, Turkey, Iran, Argentina and more violent daily protests in Ecuador. As citizens see everyday goods and petrol slip out of reach, the search for a solution to rapidly devaluing fiat currency rages on. Inflation is a form of theft, one which disproportionately affects those who spend a greater percentage of their earnings and savings on commodities like petrol, electricity, food, rent and daily necessities.

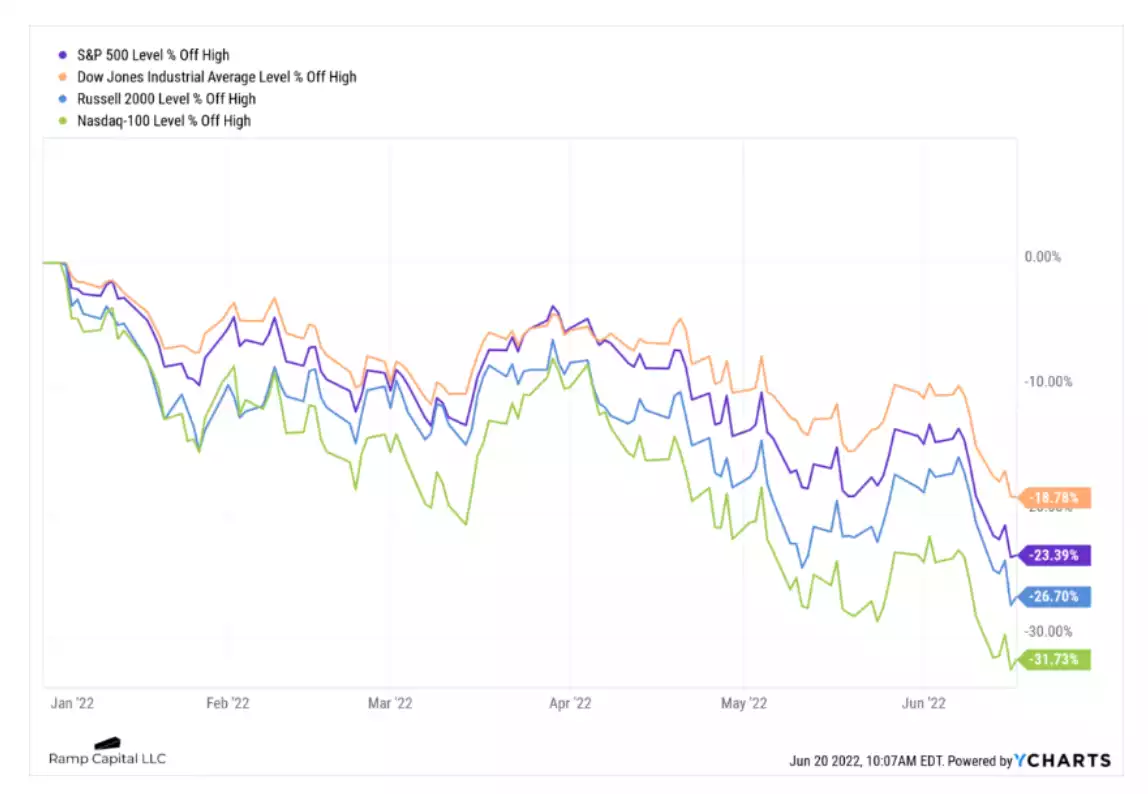

In Iran, working age citizens and pensioners alike have been protesting to demand that their wages and pensions be adjusted for inflation. Taxi drivers have gone on strike as their ability to make ends is reaching breaking point. Soaring inflation is leading to reduced access to food, all the while, President Ebrahim Raisi insists on plans to stop subsidising basic commodities. Ultimately, as everyday people struggle to make ends meet, focus turns towards securing real assets as opposed to paper ones. We can see in major markets that tech is down and commodities are holding their own or rising.

We can see below that the Nasdaq has underperformed all of the other indices YTD.

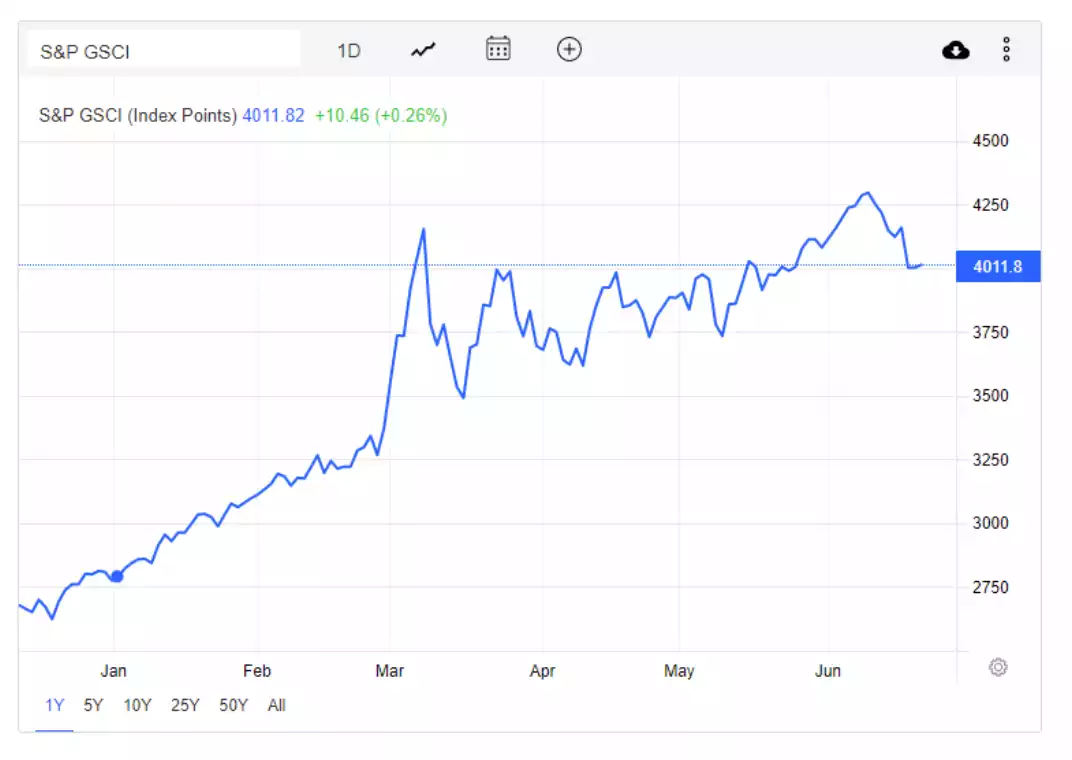

In the same period, the S&P GSCI is up 44% from 2687 points to 4011 points. The S&P GSCI is the benchmark commodities index that covers 24 futures contracts that track global commodities including energy (54%), grains (15%), agriculture (12%), industrial metals (12%), and precious metals (7%).

We have also seen Sri Lanka devolve into chaos, food shortages, supply chain collapse and the reports of mysterious destruction of major food producing facilities continue to be seen across the globe. In Sri Lanka, food has become so much harder to get that four out of five Sri Lankans have started skipping meals according to the United Nations and that the country is facing a “dire humanitarian crisis” in the short to medium term. This food crisis isn’t limited to Sri Lanka, as we covered the struggles of the UK in the news earlier this month.

The Netherlands may be the next shoe to drop, with Farmers all over the country protesting over the weekend and converging on the capital in protest to new laws reducing nitrogen use. Nitrogen emissions are critical to raising livestock and would effectively force farmers off their lands.

Governments struggle to reduce spending and largess. They inflate the currency to bring future revenue forward, and now we are rapidly reaching the precipice where Central Banks and governments need to decide if they will kill the economy or the currency. Amidst devaluation and uncertainty, holding precious metals protects individuals from the chaos of fiat purchasing power.