Lessons from Top 10 GDP Journey

News

|

Posted 12/11/2018

|

7731

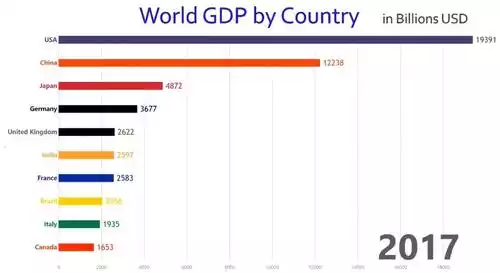

The latest work from our friends at Visual Capitalist shows the changes in the top 10 global economies from 1960 to 2017. This is how it ends:

Probably no surprises in the above chart. However the journey from 1960 is a fascinating one. There are a few things to keep an eye on.

Australia used to frequently take out the 9th or 10th position from 1960 to 1970 before disappearing off the list altogether.

China fell off the list altogether around 1979 but through economic reforms (and a mountain of debt) went on to move up the list to finish at #2. Notable, though not noted in this presentation, is that all of these are based in USD. On a PPP (purchasing power parity) basis which takes out exchange rate differences, China has been #1 since 2015.

As fascinating as China is, Japan is equally incredible. Watch from 1968 where it jumps from 4th to 2nd, a position it held from 1972 until 2010. In the late 80’s and early 90’s it hovered between around 2/3 to 3/4 the size of the US economy with a population less than half. However Japan was ploughing all these trade surplus funds speculatively into property and shares until it reached bubble proportions and inevitably popped. What ensued is the so called ‘Lost Decade’ of deflation with the now famous attempts of their central bank to reflate the economy with rampant quantitative easing and even negative interest rates. The result is one of the highest debt to GDP rates in the world.

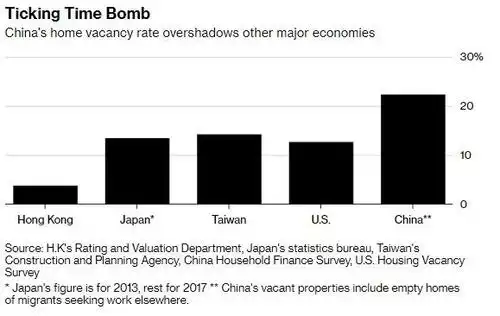

So it is somewhat instructive maybe to look at China right now. Speculative money courtesy of similar trade surpluses has been ploughed into property and shares. The sharemarket has had a terrible year as it appears valuations are normalising. And now there are fears of a severe popping of the property bubble. So speculative has been the property buying frenzy that China now has over 50 million empty homes, or 22% vacancy rate!

From the same Bloomberg article:

"There’s no other single country with such a high vacancy rate,” said Gan, of Chengdu’s Southwestern University of Finance and Economics. “Should any crack emerge in the property market, the homes to be offloaded will hit China like a flood.”

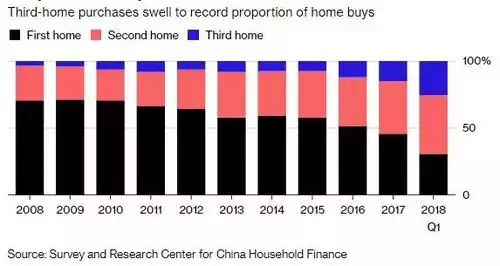

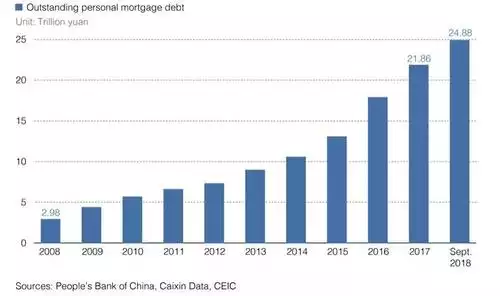

Such is the fervour that people are buying a 3rd home at unprecedented levels and as the prices rise taking on unprecedented amounts of debt (8 fold in just 10 years) to do so per the following 2 charts:

The other thing to note is that these figures only reflect private purchases. The Chinese government has been a big buyer of surplus stock to keep the illusion positive. That of course is courtesy of more debt from the world’s most indebted country.

Whilst this may well see changes similar to Japan, the implications for investors around the world cannot be ignored. Right now the top 3 biggest economies in the world are central bank inflated Ponzi schemes hurtling toward their day of reckoning.

You can watch the video here.