Italy On The Cusp

News

|

Posted 10/10/2016

|

7109

So it looks like Trump has finally done his dash. It will be interesting to see if this affects gold today just as the non-release of Clinton docs by WikiLeaks was said to play on the Tuesday night smack down last week.

So, and discounting the unknown of the escalating Syrian conflict, the next date of importance for gold could well be 4 December. This is the day the Italians go to the polls for a referendum on a structural overhaul to their constitution and governmental process. Anyone who knows Italy would say that is fundamentally a good thing as they have an incredibly cumbersome and archaic system that has frustrated successive governments. So what’s the big deal? In essence the current and unelected Prime Minister Matteo Renzi has bet his premiership on it, and so it has taken on a popular vote component that could de-rail not just the necessary referendum but the Eurozone itself.

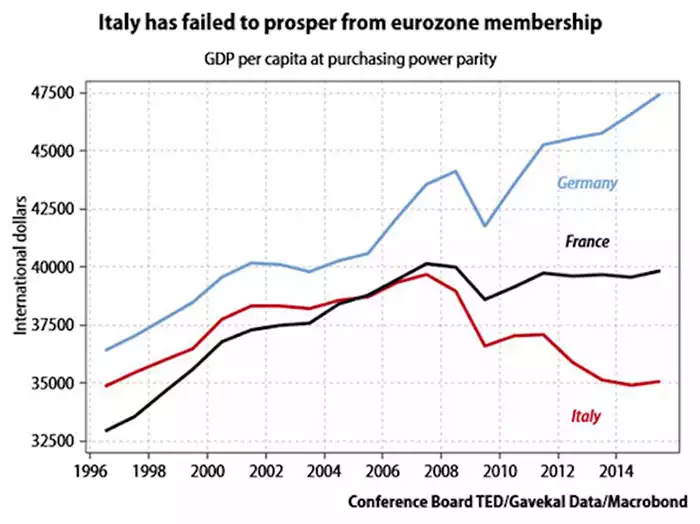

The anti-euro, anti globalisation, anti establishment party Five Star Movement (M5S) is set to capitalise on this as their popularity is surging and they have a fundamental platform policy of taking Italy to a referendum on leaving the EU. This is no Britain or Greece. Italy leaving the EU would be disastrous. Keeping in mind too we are not talking about a particularly stable economy on its own as we wrote about most recently here. Of the big 3, Italy has not gone well under the EU, as you can see from the following graph, and their people know and fell this through sky high unemployment, banks on the cusp of failure and a general and protracted economic slump.

The Financial Times recently put it bluntly:

“An Italian exit from the single currency would trigger the total collapse of the eurozone within a very short period. It would probably lead to the most violent economic shock in history, dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash.”